Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring.

Security management is the identification of an organization's assets i.e. including people, buildings, machines, systems and information assets, followed by the development, documentation, and implementation of policies and procedures for protecting assets.

Delegation is the process of distributing and entrusting work to another person. In management or leadership within an organisation, it involves a manager aiming to efficiently distribute work, decision-making and responsibility to subordinate workers in an organization. Delegation may result in creation of an accountable chain of authority where authority and responsibility moves down in an organisational structure. Inefficient delegation may lead to micromanagement.

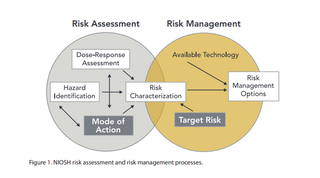

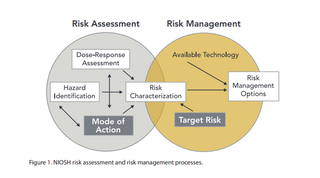

Risk assessment determines possible mishaps, their likelihood and consequences, and the tolerances for such events. The results of this process may be expressed in a quantitative or qualitative fashion. Risk assessment is an inherent part of a broader risk management strategy to help reduce any potential risk-related consequences.

An audit is an "independent examination of financial information of any entity, whether profit oriented or not, irrespective of its size or legal form when such an examination is conducted with a view to express an opinion thereon." Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. Auditors consider the propositions before them, obtain evidence, roll forward prior year working papers, and evaluate the propositions in their auditing report.

Operational risk is the risk of losses caused by flawed or failed processes, policies, systems or events that disrupt business operations. Employee errors, criminal activity such as fraud, and physical events are among the factors that can trigger operational risk. The process to manage operational risk is known as operational risk management. The definition of operational risk, adopted by the European Solvency II Directive for insurers, is a variation adopted from the Basel II regulations for banks: "The risk of a change in value caused by the fact that actual losses, incurred for inadequate or failed internal processes, people and systems, or from external events, differ from the expected losses". The scope of operational risk is then broad, and can also include other classes of risks, such as fraud, security, privacy protection, legal risks, physical or environmental risks. Operational risks similarly may impact broadly, in that they can affect client satisfaction, reputation and shareholder value, all while increasing business volatility.

An information technology audit, or information systems audit, is an examination of the management controls within an Information technology (IT) infrastructure and business applications. The evaluation of evidence obtained determines if the information systems are safeguarding assets, maintaining data integrity, and operating effectively to achieve the organization's goals or objectives. These reviews may be performed in conjunction with a financial statement audit, internal audit, or other form of attestation engagement.

The chief risk officer (CRO), chief risk management officer (CRMO), or chief risk and compliance officer (CRCO) of a firm or corporation is the executive accountable for enabling the efficient and effective governance of significant risks, and related opportunities, to a business and its various segments. Risks are commonly categorized as strategic, reputational, operational, financial, or compliance-related. CROs are accountable to the Executive Committee and The Board for enabling the business to balance risk and reward. In more complex organizations, they are generally responsible for coordinating the organization's Enterprise Risk Management (ERM) approach. The CRO is responsible for assessing and mitigating significant competitive, regulatory, and technological threats to a firm's capital and earnings. The CRO roles and responsibilities vary depending on the size of the organization and industry. The CRO works to ensure that the firm is compliant with government regulations, such as Sarbanes–Oxley, and reviews factors that could negatively affect investments. Typically, the CRO is responsible for the firm's risk management operations, including managing, identifying, evaluating, reporting and overseeing the firm's risks externally and internally to the organization and works diligently with senior management such as chief executive officer and chief financial officer.

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) is an organization that develops guidelines for businesses to evaluate internal controls, risk management, and fraud deterrence. In 1992, COSO published the Internal Control – Integrated Framework, commonly used by businesses in the United States to design, implement, and conduct systems of internal control over financial reporting and assessing their effectiveness.

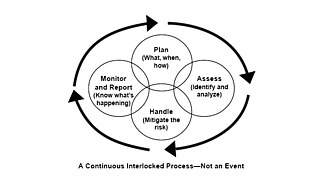

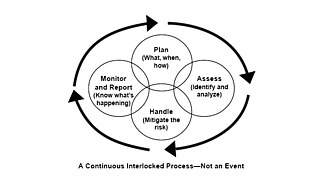

Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives. ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization's objectives, assessing them in terms of likelihood and magnitude of impact, determining a response strategy, and monitoring process. By identifying and proactively addressing risks and opportunities, business enterprises protect and create value for their stakeholders, including owners, employees, customers, regulators, and society overall.

Financial risk is any of various types of risk associated with financing, including financial transactions that include company loans in risk of default. Often it is understood to include only downside risk, meaning the potential for financial loss and uncertainty about its extent.

Internal auditing is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes. Internal auditing might achieve this goal by providing insight and recommendations based on analyses and assessments of data and business processes. With commitment to integrity and accountability, internal auditing provides value to governing bodies and senior management as an objective source of independent advice. Professionals called internal auditors are employed by organizations to perform the internal auditing activity.

Governance, risk management and compliance (GRC) is the term covering an organization's approach across these three practices: governance, risk management, and compliance.

Internal control, as defined by accounting and auditing, is a process for assuring of an organization's objectives in operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. A broad concept, internal control involves everything that controls risks to an organization.

Information security management (ISM) defines and manages controls that an organization needs to implement to ensure that it is sensibly protecting the confidentiality, availability, and integrity of assets from threats and vulnerabilities. The core of ISM includes information risk management, a process that involves the assessment of the risks an organization must deal with in the management and protection of assets, as well as the dissemination of the risks to all appropriate stakeholders. This requires proper asset identification and valuation steps, including evaluating the value of confidentiality, integrity, availability, and replacement of assets. As part of information security management, an organization may implement an information security management system and other best practices found in the ISO/IEC 27001, ISO/IEC 27002, and ISO/IEC 27035 standards on information security.

The CAMELS rating is a supervisory rating system originally developed in the U.S. to classify a bank's overall condition. It is applied to every bank and credit union in the U.S. and is also implemented outside the U.S. by various banking supervisory regulators.

IT risk management is the application of risk management methods to information technology in order to manage IT risk. Various methodologies exist to manage IT risks, each involving specific processes and steps.

Pilot decision making, also known as aeronautical decision making (ADM), is a process that aviators perform to effectively handle troublesome situations that are encountered. Pilot decision-making is applied in almost every stage of the flight as it considers weather, air spaces, airport conditions, estimated time of arrival and so forth. During the flight, employers pressure pilots regarding time and fuel restrictions since a pilots’ performance directly affects the company’s revenue and brand image. This pressure often hinders a pilot's decision-making process leading to dangerous situations as 50% to 90% of aviation accidents are the result of pilot error.

Strategic risk is the risk that failed business decisions may pose to a company. Strategic risk is often a major factor in determining a company's worth, particularly observable if the company experiences a sharp decline in a short period of time. Due to this and its influence on compliance risk, it is a leading factor in modern risk management.

The risk-based approach is an enhanced system of the regulation and standardization of Electromagnetic compatibility (EMC) in electronic devices before their commercialization. EMC is essential for ensuring the safety, performance, and quality of electronic devices. However, achieving and maintaining EMC presents a significant challenge due to the rapid development of new products with evolving technologies and features.