Related Research Articles

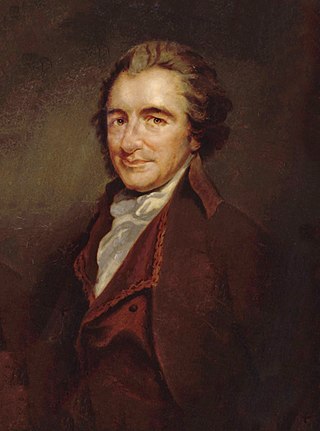

Citizen's dividend is a proposed policy based upon the Georgist principle that the natural world is the common property of all people. It is proposed that all citizens receive regular payments (dividends) from revenue raised by leasing or taxing the monopoly of valuable land and other natural resources.

The Alaska Permanent Fund (APF) is a constitutionally established permanent fund managed by a state-owned corporation, the Alaska Permanent Fund Corporation (APFC). It was established in Alaska in 1976 by Article 9, Section 15 of the Alaska State Constitution under Governor Jay Hammond and Attorney General Avrum Gross. From February 1976 until April 1980, the Department of Revenue Treasury Division managed the state's Permanent Fund assets, until, in 1980, the Alaska State Legislature created the APFC.

Guaranteed minimum income (GMI), also called minimum income, is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship and that the person in question does not already receive a minimum level of income to live on.

Philippe Van Parijs is a Belgian political philosopher and political economist, best known as a proponent and main defender of the concept of an unconditional basic income and for the first systematic treatment of linguistic justice.

The Basic Income Earth Network is a network of academics and activists interested in the idea of basic income. It serves as a link between individuals and groups committed to or interested in basic income, and fosters informed discussion on this topic throughout the world. BIEN's website defines a basic income as "a periodic cash payment unconditionally delivered to all on an individual basis, without means-test or work requirement."

Eduardo Matarazzo Suplicy is a Brazilian left-wing politician, economist and professor. He is one of the founders and main political figures on the Workers Party of Brazil (PT). In the municipal elections of São Paulo in 2016 was consecrated as the most voted city councilor in the history of Brazil.

In economics, a negative income tax (NIT) is a system which reverses the direction in which tax is paid for incomes below a certain level; in other words, earners above that level pay money to the state while earners below it receive money, as shown by the blue arrows in the diagram. NIT was proposed by Juliet Rhys-Williams while working on the Beveridge Report in the early 1940s and popularized by Milton Friedman in the 1960s as a system in which the state makes payments to the poor when their income falls below a threshold, while taxing them on income above that threshold. Together with Friedman, supporters of NIT also included James Tobin, Joseph A. Pechman, and Peter M. Mieszkowski, Jim Gray and even then-President Richard Nixon, who suggested implementation of modified NIT in his Family Assistance Plan. After the increase in popularity of NIT, an experiment sponsored by the US government was conducted between 1968 and 1982 on effects of NIT on labour supply, income, and substitution effects.

Peter Barnes is an American entrepreneur, environmentalist, and journalist.

The social dividend is the return on the natural resources and capital assets owned by society in a socialist economy. The concept notably appears as a key characteristic of market socialism, where it takes the form of a dividend payment to each citizen derived from the property income generated by publicly owned enterprises, representing the individual's share of the capital and natural resources owned by society.

Universal basic income (UBI) is a social welfare proposal in which all citizens of a given population regularly receive a minimum income in the form of an unconditional transfer payment, i.e., without a means test or need to work. In contrast a guaranteed minimum income is paid only to those who do not already receive an income that is enough to live on. A UBI would be received independently of any other income. If the level is sufficient to meet a person's basic needs, it is sometimes called a full basic income; if it is less than that amount, it may be called a partial basic income. As of 2024, no country has implemented a full UBI system, but two countries—Mongolia and Iran—have had a partial UBI in the past. There have been numerous pilot projects, and the idea is discussed in many countries. Some have labelled UBI as utopian due to its historical origin.

Guy Standing is a British labour economist. He is a professor of development studies at the School of Oriental and African Studies, University of London, and a co-founder of the Basic Income Earth Network (BIEN). Standing has written widely in the areas of labour economics, labour market policy, unemployment, labour market flexibility, structural adjustment policies and social protection. He created the term precariat to describe an emerging class of workers who are harmed by low wages and poor job security as a consequence of globalisation. Since the 2011 publication of his book The Precariat: The New Dangerous Class, his work has focused on the precariat, unconditional basic income, deliberative democracy, and the commons.

Universal basic income is a subject of much interest in the United Kingdom. There is a long history of discussion yet it has not been implemented to date. Interest in and support for universal basic income has increased substantially amongst the public and politicians in recent years.

Global basic income or world basic income is the concept of giving everyone in the world a guaranteed minimum income of money on a regular basis. The proposal usually suggests that the basic income be unconditional. Global basic income is part of the wider discussion on basic income, which typically implemented or proposed at the national level. Pilot schemes are also run at city/region levels.

Universal basic income refers to a social welfare system where all citizens or residents of a country receive an unconditional lump sum income, meaning an income that is not based on need. The proposal has been debated in a number of countries in recent years, including Japan.

Universal basic income in Germany has been discussed since the 1970s, with emphasis placed on its unconditional dimension by 2003. The universal basic income concept has many definitions, such as Philippe Van Parijs', which described it as the income paid by the government, at a uniform level and regular intervals to each adult citizen and permanent residents of the country. The Basic Income Earth Network's criteria constitute one of the most popular proposals and they include: 1) income must be paid to individuals instead of households; 2) income should be paid irrespective of income from other sources; and, 3) it must be paid without requiring performance of any work.

Universal basic income (UBI) is discussed in many countries. This article summarizes the national and regional debates, where it takes place, and is a complement to the main article on the subject: universal basic income.

Universal basic income pilots are smaller-scale preliminary experiments which are carried out on selected members of the relevant population to assess the feasibility, costs and effects of the full-scale implementation of universal basic income, or the related concept of negative income tax (NIT), including partial universal basic income and similar programs. The following list provides an overview of the most famous universal basic income pilots, including projects which have not been launched yet but have been already approved by the respective political bodies or for the negotiations are in process.

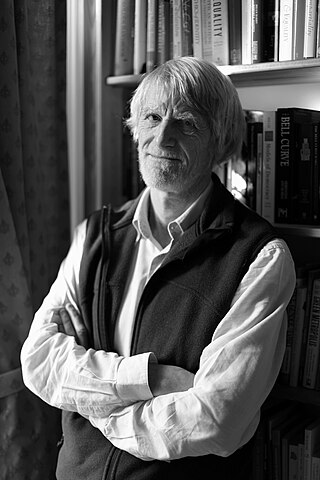

Karl Widerquist is an American political philosopher and economist at Georgetown University on its campus in Qatar. He is best known as an advocate of basic income, but is also an interdisciplinary academic writer who has published in journals in fields as diverse as economics, politics, philosophy, and anthropology. He is a consistent critic of propertarianism, right-libertarianism, social contract theory, and the belief that modern societies fulfill the Lockean proviso.

Universal basic income and negative income tax, which is a related system, has been debated in the United States since the 1960s, and to a smaller extent also before that. During the 1960s and 1970s a number of experiments with negative income tax were conducted in United States and Canada. In the 1970s another and somewhat related welfare system was introduced instead, the Earned Income Tax Credit. The next big development in the history of basic income in the United States came in 1982, when the Alaska Permanent Fund was established. It has delivered some kind of basic income, financed from the state's oil and gas revenues, ever since.

References

- ↑ "Improving Social Security in Canada Guaranteed Annual Income: A Supplementary Paper". Minister of Human Resource Development Canada. 1994. Retrieved 30 November 2013.

- ↑ "History of Basic Income". Basic Income Earth Network (BIEN). Archived from the original on 21 June 2008.

- ↑ Universal Basic Income: A Review Social Science Research Network (SSRN). Accessed August 6, 2017.

- ↑ "About Basic Income | BIEN — Basic Income Earth Network" . Retrieved 2020-08-28.

- ↑ Widerquist, Karl (7 March 2013). Independence, Propertylessness, and Basic Income. Springer. ISBN 978-1-137-31309-6.

- ↑ "Description at U.S. Basic Income Guarantee Network". Archived from the original on 2011-07-24. Retrieved 2017-11-30.

- ↑ "Description at U.S. Basic Income Guarantee Network". Archived from the original on 2011-07-24. Retrieved 2017-11-30.

- ↑ Widerquist, Karl (14 February 2012). Alaska's Permanent Fund Dividend. Springer. ISBN 978-1-137-01502-0.

- ↑ Widerquist, Karl (14 February 2012). Alaska's Permanent Fund Dividend. Springer. ISBN 978-1-137-01502-0.

- ↑ Widerquist, Karl (19 February 2016). Exporting the Alaska Model. Springer. ISBN 978-1-137-03165-5.

- ↑ Widerquist, Karl (7 March 2013). Independence, Propertylessness, and Basic Income. Springer. ISBN 978-1-137-31309-6.

- ↑ Varoufakis, Yanis (31 October 2016). "The Universal Right to Capital Income". Project Syndicate. Retrieved 6 December 2021.

- ↑ "The New Physiocratic Platform". The New Physiocratic League. 2018. Retrieved 26 November 2018.