In addition, the Commission stated its belief that the amendments would bring increased uniformity to short sale regulation, level the playing field for market participants, and remove an opportunity for regulatory arbitrage. [5] [8]

Calls for reinstatement

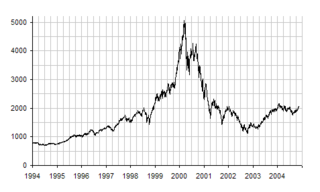

On August 27, 2007, the New York Times published an article on Muriel Siebert, former state banking superintendent of New York, "Wall Street veteran and financial sage", and, in 1967, the first woman to become a member of the New York Stock Exchange. In this article she expressed severe concerns about market volatility: "We've never seen volatility like this. We're watching history being made." Siebert pointed to the uptick rule, saying, "The S.E.C. took away the short-sale rule and when the markets were falling, institutional investors just pounded stocks because they didn't need an uptick." [13]

On March 28, 2008 Jim Cramer of CNBC offered the opinion that the absence of the uptick rule harms the stock market today. He claimed that reintroducing the uptick rule would help stabilize the banking sector. [14]

On July 3, 2008 Wachtell, Lipton, Rosen & Katz, an adviser on mergers and acquisitions, said short-selling was at record levels and asked the SEC to take urgent action and reinstate the 70-year-old uptick rule. [15] On November 20, 2008, they renewed their call stating "Decisive action cannot await ... a new S.E.C. Chairman. ... There is no tomorrow. The failure to reinstate the Uptick Rule is not acceptable." [16]

On July 16, 2008, Congressman Gary Ackerman (D-NY), Congresswoman Carolyn Maloney (D-NY) and Congressman Mike Capuano (D-MA) introduced H.R. 6517, "A bill to require the Securities and Exchange Commission to reinstate the uptick rule on short sales of securities." [17]

On September 18, 2008, presidential candidate and Senator John McCain (R-AZ) said that the SEC allowed short-selling to turn "our markets into a casino." McCain criticized the SEC and its Chairman for eliminating the uptick rule. [18]

On October 6, 2008, Erik Sirri, director of the Securities and Exchange Commission's Division of Trading and Markets, said that the SEC is considering bringing back the uptick rule, stating, "It's something we have talked about and it may be something that we in fact do." [19]

On October 17, 2008, the New York Stock Exchange reported a survey with 85% of its members being in favor of reinstating the uptick rule with the dominant reason to "help instill market confidence". [20]

On November 18, 2008, The Wall Street Journal published an opinion editorial by Robert Pozen and Yaneer Bar-Yam describing an analysis of the difference between regulated and unregulated stocks during the SEC pilot program. By using an analysis they claimed to be more comprehensive than the SEC's original study, they showed that unregulated stocks have lower returns, with a difference that is both statistically and economically significant. They also reported that twice as many stocks had greater than 40% drops in corresponding 12 month periods before and after the repeal. [21] [22]

On January 20, 2009, Ackerman received a letter from Chairman Cox—written the day he left the SEC—in which Cox said he supports the reinstatement of an uptick rule. The letter reads, "I have been interested in proposing an updated uptick rule. However, as you know, the SEC is a commission of five members. Throughout 2008 there was not a majority interested in reconsidering the 2007 decision to repeal the uptick rule, or in proposing some modernized variant of it. I sincerely hope that the commission, in the year ahead, continues to reassess this issue in light of the extraordinary market events of the last several months, with a view to implementing a modernized version of the uptick rule." [23]

On February 25, 2009, Chairman of the Federal Reserve, Ben Bernanke in testimony before the House Financial Services Committee stated he favored the SEC examining restoring the uptick-rule. [24]

On March 10, 2009, the SEC and Congressman Barney Frank (D-MA), Chairman of the Financial Services Committee announced plans to restore the uptick rule. Frank said he was hopeful that it would be restored within a month. [25] [26]