The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business. The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets.

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends.

A limited liability company (LLC) is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states, businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC).

Controlled foreign corporation (CFC) rules are features of an income tax system designed to limit artificial deferral of tax by using offshore low taxed entities. The rules are needed only with respect to income of an entity that is not currently taxed to the owners of the entity. Generally, certain classes of taxpayers must include in their income currently certain amounts earned by foreign entities they or related persons control.

The retained earnings of a corporation is the accumulated net income of the corporation that is retained by the corporation at a particular point in time, such as at the end of the reporting period. At the end of that period, the net income at that point is transferred from the Profit and Loss Account to the retained earnings account. If the balance of the retained earnings account is negative it may be called accumulated losses, retained losses, accumulated deficit, or similar terminology.

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax.

Eisner v. Macomber, 252 U.S. 189 (1920), was a tax case before the United States Supreme Court that is notable for the following holdings:

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

An S corporation, for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions.

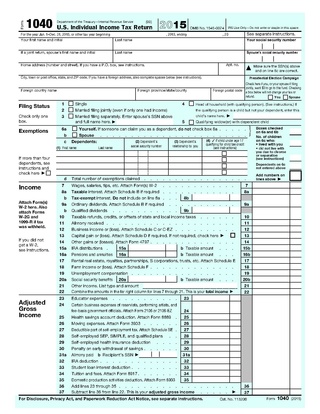

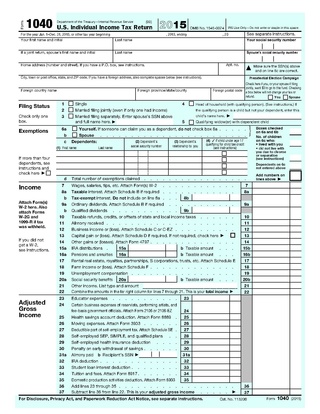

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Tax consolidation, or combined reporting, is a regime adopted in the tax or revenue legislation of a number of countries which treats a group of wholly owned or majority-owned companies and other entities as a single entity for tax purposes. This generally means that the head entity of the group is responsible for all or most of the group's tax obligations. Consolidation is usually an all-or-nothing event: once the decision to consolidate has been made, companies are irrevocably bound. Only by having less than a 100% interest in a subsidiary can that subsidiary be left out of the consolidation.

Section 355 of the Internal Revenue Code allows a corporation to make a tax-free distribution to its shareholders of stock and securities in one or more controlled subsidiaries. If a set of statutory and judicial requirements are met, neither the distributing corporation nor its shareholders recognize gain or loss on the distribution. The three types of corporate divisions are commonly known as spin-offs, split-offs and split-ups.

For purposes of income tax in the United States, U.S. persons owning shares of a passive foreign investment company (PFIC) may choose between (i) current taxation on the income of the PFIC or (ii) deferral of such income subject to a deemed tax and interest regime. The provision was enacted as part of the Tax Reform Act of 1986 as a way of placing owners of offshore investment funds on a similar footing to owners of U.S. investment funds. The original provisions applied for all foreign corporations meeting either an income or an asset test. However, 1997 amendments limited the application in the case of U.S. Shareholders of controlled foreign corporations.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Private equity funds and hedge funds are private investment vehicles used to pool investment capital, usually for a small group of large institutional or wealthy individual investors. They are subject to favorable regulatory treatment in most jurisdictions from which they are managed, which allows them to engage in financial activities that are off-limits for more regulated companies. Both types of fund also take advantage of generally applicable rules in their jurisdictions to minimize the tax burden on their investors, as well as on the fund managers. As media coverage increases regarding the growing influence of hedge funds and private equity, these tax rules are increasingly under scrutiny by legislative bodies. Private equity and hedge funds choose their structure depending on the individual circumstances of the investors the fund is designed to attract.

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), enacted as Subtitle C of Title XI of the Omnibus Reconciliation Act of 1980, Pub. L. No. 96-499, 94 Stat. 2599, 2682, is a United States tax law that imposes income tax on foreign persons disposing of US real property interests. Tax is imposed at regular tax rates for the taxpayer on the amount of gain considered recognized. Purchasers of real property interests are required to withhold tax on payment for the property. Withholding may be reduced from the standard 15% to an amount that will cover the tax liability, upon application in advance of sale to the Internal Revenue Service. FIRPTA overrides most nonrecognition provisions as well as those remaining tax treaties that provide exemption from tax for such gains.

The dividends-received deduction, under U.S. federal income tax law, is a tax deduction received by a corporation on the dividends it receives from other corporations in which it has an ownership stake.

The domestic international sales corporation is a concept unique to tax law in the United States. In 1971, the U.S. Congress voted to use U.S. tax law to subsidize exports of U.S.-made goods. The initial mechanism was through a Domestic International Sales Corporation (DISC), an entity with no substance which received tax benefits. Today, shareholders of a DISC continue to receive reduced income tax rates on qualifying income from exports of U.S.-made goods.