Project management is the process of supervising the work of a team to achieve all project goals within the given constraints. This information is usually described in project documentation, created at the beginning of the development process. The primary constraints are scope, time, and budget. The secondary challenge is to optimize the allocation of necessary inputs and apply them to meet pre-defined objectives.

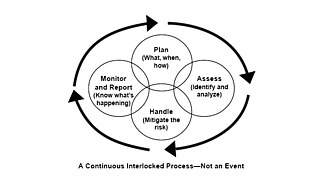

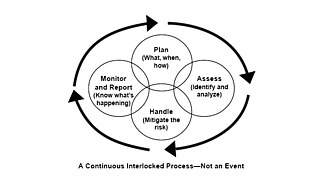

Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring.

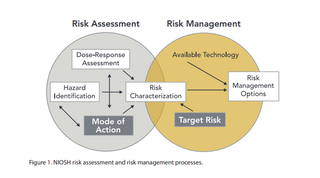

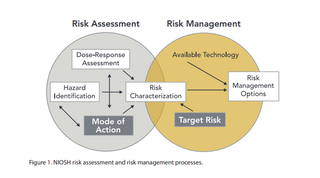

Risk assessment determines possible mishaps, their likelihood and consequences, and the tolerances for such events. The results of this process may be expressed in a quantitative or qualitative fashion. Risk assessment is an inherent part of a broader risk management strategy to help reduce any potential risk-related consequences.

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) is an organization that develops guidelines for businesses to evaluate internal controls, risk management, and fraud deterrence. In 1992, COSO published the Internal Control – Integrated Framework, commonly used by businesses in the United States to design, implement, and conduct systems of internal control over financial reporting and assessing their effectiveness.

Enterprise risk management (ERM) in business includes the methods and processes used by organizations to manage risks and seize opportunities related to the achievement of their objectives. ERM provides a framework for risk management, which typically involves identifying particular events or circumstances relevant to the organization's objectives, assessing them in terms of likelihood and magnitude of impact, determining a response strategy, and monitoring process. By identifying and proactively addressing risks and opportunities, business enterprises protect and create value for their stakeholders, including owners, employees, customers, regulators, and society overall.

Data governance is a term used on both a macro and a micro level. The former is a political concept and forms part of international relations and Internet governance; the latter is a data management concept and forms part of corporate data governance.

Governance, risk management and compliance (GRC) is the term covering an organization's approach across these three practices: governance, risk management, and compliance.

A job safety analysis (JSA) is a procedure that helps integrate accepted safety and health principles and practices into a particular task or job operation. The goal of a JSA is to identify potential hazards of a specific role and recommend procedures to control or prevent these hazards.

A key risk indicator (KRI) is a measure used in management to indicate how risky an activity is. Key risk indicators are metrics used by organizations to provide an early signal of increasing risk exposures in various areas of the enterprise. It differs from a key performance indicator (KPI) in that the latter is meant as a measure of how well something is being done while the former is an indicator of the possibility of future adverse impact. KRI give an early warning to identify potential events that may harm continuity of the activity/project.

ISO/IEC 27005 "Information technology — Security techniques — Information security risk management" is an international standard published by the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) providing good practice guidance on managing risks to information. It is a core part of the ISO/IEC 27000-series of standards, commonly known as ISO27k.

A Risk Breakdown Structure (RBS) within risk management is a hierarchically organised depiction of the identified project risks arranged by category.

ISO 31000 is a family of international standards relating to risk management codified by the International Organization for Standardization. The standard is intended to provide a consistent vocabulary and methodology for assessing and managing risk, resolving the historic ambiguities and differences in the ways risk are described.

Fuel price risk management, a specialization of both financial risk management and oil price analysis and similar to conventional risk management practice, is a continual cyclic process that includes risk assessment, risk decision making and the implementation of risk controls. It focuses primarily on when and how an organization can best hedge against exposure to fuel price volatility. It is generally referred to as "bunker hedging" in marine and shipping contexts and "fuel hedging" in aviation and trucking contexts.

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value, often focusing on negative, undesirable consequences. Many different definitions have been proposed. One international standard definition of risk is the "effect of uncertainty on objectives".

ISO 26262, titled "Road vehicles – Functional safety", is an international standard for functional safety of electrical and/or electronic systems that are installed in serial production road vehicles, defined by the International Organization for Standardization (ISO) in 2011, and revised in 2018.

Risk IT Framework, published in 2009 by ISACA, provides an end-to-end, comprehensive view of all risks related to the use of information technology (IT) and a similarly thorough treatment of risk management, from the tone and culture at the top to operational issues. It is the result of a work group composed of industry experts and academics from different nations, from organizations such as Ernst & Young, IBM, PricewaterhouseCoopers, Risk Management Insight, Swiss Life, and KPMG.

IT risk management is the application of risk management methods to information technology in order to manage IT risk. Various methodologies exist to manage IT risks, each involving specific processes and steps.

Within project management, risk management refers to activities for minimizing project risks, and thereby ensuring that a project is completed within time and budget, as well as fulfilling its goals.

Risk-based internal audit (RBIA) is an internal methodology which is primarily focused on the inherent risk involved in the activities or system and provide assurance that risk is being managed by the management within the defined risk appetite level. It is the risk management framework of the management and seeks at every stage to reinforce the responsibility of management and BOD for managing risk.

ISO 22300:2021, Security and resilience – Vocabulary, is an international standard developed by ISO/TC 292 Security and resilience. This document defines terms used in security and resilience standards and includes 360 terms and definitions. This edition was published in the beginning of 2021 and replaces the second edition from 2018.