The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, an actual reduction in the fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used.

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax.

Section 179 of the United States Internal Revenue Code, allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. This property is generally limited to tangible, depreciable, personal property which is acquired by purchase for use in the active conduct of a trade or business. Buildings were not eligible for section 179 deductions prior to the passage of the Small Business Jobs Act of 2010; however, qualified real property may be deducted now.

For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings, before any deductions or taxes. It is opposed to net income, defined as the gross income minus taxes and other deductions.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced basis is referred to as the adjusted tax basis. Adjusted tax basis is used in determining gain or loss from disposition of the asset. Tax basis may be relevant in other tax computations.

Depletion is an accounting and tax concept used most often in the mining, timber, and petroleum industries. It is similar to depreciation in that it is a cost recovery system for accounting and tax reporting: "The depletion deduction" allows an owner or operator to account for the reduction of a product's reserves.

Under United States tax laws and accounting rules, cost segregation is the process of identifying personal property assets that are grouped with real property assets, and separating out personal assets for tax reporting purposes. According to the American Society of Cost Segregation Professionals, a cost segregation is "the process of identifying property components that are considered "personal property" or "land improvements" under the federal tax code."

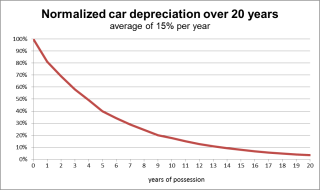

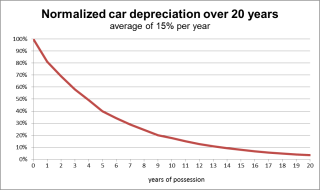

Accelerated depreciation refers to any one of several methods by which a company, for 'financial accounting' or tax purposes, depreciates a fixed asset in such a way that the amount of depreciation taken each year is higher during the earlier years of an asset's life. For financial accounting purposes, accelerated depreciation is expected to be much more productive during its early years, so that depreciation expense will more accurately represent how much of an asset's usefulness is being used up each year. For tax purposes, accelerated depreciation provides a way of deferring corporate income taxes by reducing taxable income in current years, in exchange for increased taxable income in future years. This is a valuable tax incentive that encourages businesses to purchase new assets.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction. The credit generally applies only to taxes of a nature similar to the tax being reduced by the credit and is often limited to the amount of tax attributable to foreign source income. The limitation may be computed by country, class of income, overall, and/or another manner.

Depreciation recapture is the USA Internal Revenue Service (IRS) procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciation. In other words, because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayer's ordinary income, the taxpayer has to report any gain from the disposal of the asset as ordinary income, not as a capital gain.

Commissioner v. Idaho Power Co., 418 U.S. 1 (1974), was a United States Supreme Court case.

In tax law, amortization refers to the cost recovery system for intangible property. Although the theory behind cost recovery deductions of amortization is to deduct from basis in a systematic manner over an asset's estimated useful economic life so as to reflect its consumption, expiration, obsolescence or other decline in value as a result of use or the passage of time, many times a perfect match of income and deductions does not occur for policy reasons.

Simon v. Commissioner, 68 F.3d 41, was a decision by the Second Circuit of the United States Court of Appeals relating to the deductibility of expensive items or tools that may increase in value as a collectible but decrease in value if used in the course of a business or trade.

For tax accounting, Half-year convention is a principle of United States taxation law.

For taxation in the United States, the Limits on Depreciation Deduction was enacted to limit certain deductions on depreciable assets. Section 280F is a policy that makes the Internal Revenue Code more accurate by allowing a taxpayer to report their business use on an asset they may also need for some personal reasons.

An applicable convention, as presented in 26 U.S.C. § 168(d) of the United States Internal Revenue Code, is an assumption about when property is placed into service. It is used to determine when property depreciation begins. The purpose of applicable conventions is to simplify depreciation because they do not require a taxpayer to prove to the IRS when every piece of depreciable property was placed into service.

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges.