Commodity traders are people or companies who speculate and trade in commodities as diverse as metals and spices.

Commodity traders are people or companies who speculate and trade in commodities as diverse as metals and spices.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodities market for centuries for price risk management.

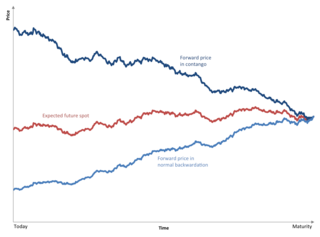

Contango is a situation in which the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market or carrying-cost market.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. For most of its history, the exchange was in the then common form of a non-profit organization, owned by members of the exchange. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

Louis Dreyfus Company B.V. (LDC) is a French merchant firm that is involved in agriculture, food processing, international shipping, and finance. The company owns and manages hedge funds, ocean vessels, develops and operates telecommunications infrastructures, and it is also involved in real estate development, management and ownership. Along with Archer Daniels Midland, Bunge, and Cargill, Louis Dreyfus is one of the four "ABCD" companies that dominate world agricultural commodity trading.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

Trafigura Group Pte. Ltd. is a multinational commodities company domiciled in Singapore with major regional hubs in Geneva, Houston, Montevideo and Mumbai, founded in 1993. The company trades in base metals and energy. It is the world's largest private metals trader and second-largest oil trader having built or purchased stakes in pipelines, mines, smelters, ports and storage terminals.

Multi Commodity Exchange of India (MCX) is a commodity exchange based in India. It was established in 2003 and is currently based in Mumbai. It is India's largest commodity derivatives exchange. The average daily turnover of commodity futures contracts increased by 26% to ₹32,424 crore during FY2019-20, as against ₹25,648 crore in FY2018-19. The total turnover of commodity futures traded on the Exchange stood at ₹83.98 lakh crore in FY2019-20. MCX offers options trading in gold and futures trading in non-ferrous metals, bullions, oil, natural gas, and agricultural commodities.

Olam International is an agri-business company, operating in 60 countries and supplying food and industrial raw materials to over 20,900 customers worldwide, placing them among the world's largest suppliers of cocoa beans, coffee, cotton and rice. Its value chain includes farming, origination, processing and distribution operations, child labor, and allegedly even child slavery.

Phibro is an international physical commodities trading firm. Phibro trades in crude oil, oil products, natural gas, precious and base metals, agricultural products, commodity-related equities, and other products. Phibro’s headquarters are located in Stamford, Connecticut.

Mercuria Energy Group Ltd. is a Cypriot-domiciled Swiss multinational commodity trading company active in a wide spectrum of global energy markets including crude oil and refined petroleum products, natural gas, power, biodiesel, base metals and agricultural products. The company is one of the world's five largest independent energy traders and asset operators and is based in Geneva, Switzerland, with 37 additional offices worldwide. The group operates in 50 different countries.

The Shanghai Futures Exchange is a futures exchange in Shanghai, China formed from the amalgamation of the national level futures exchanges of China, the Shanghai Metal Exchange, Shanghai Foodstuffs Commodity Exchange, and the Shanghai Commodity Exchange in December 1999. It is a non-profit-seeking incorporated body regulated by the China Securities Regulatory Commission.

Gunvor Group Ltd is a multinational energy commodities trading company registered in Cyprus, with its main trading office in Geneva, Switzerland. Gunvor also has trading offices in Singapore, Houston, Stamford, London, Calgary, and Dubai, with a network of representative offices around the globe. The company operates in the trade, transport, storage and optimization of petroleum and other energy products, as well as having investments in oil terminal and port facilities. Its operations consist of securing crude oil and petroleum products upstream and delivering it to market via pipelines and tankers. Gunvor has a separate company, Nyera, set up in 2021 to invest in renewable energy sources. It is run by energy transition director Fredrik Tornqvist.

Vitol is a Swiss-based Dutch multinational energy and commodity trading company that was founded in Rotterdam in 1966 by Henk Viëtor and Jacques Detiger. Though trading, logistics, and distribution are at the core of its business, these are notably complemented by refining, shipping, terminals, exploration and production, power generation, and retail businesses. Vitol has over 40 offices worldwide, with its largest operations in Geneva, Houston, London, and Singapore.

Sucden is a French-based commodity broker of soft commodities and other financial products headquartered in Paris. The firm started as a sugar broker and is now amongst the world leaders with a market share of around 15% in volume, or 9.5 million tonnes. It has offices in a number of countries around the world, including London and Hong Kong.

Minangkabau businesspeople refers to merchants from the Minangkabau Highlands in central Sumatra, Indonesia. Minangkabau are the ethnic majority in West Sumatra and Negeri Sembilan. Minangkabau are also a recognised minority in other parts of Indonesia as well as Malaysia, Singapore and the Netherlands.

Marex is a UK-based financial services company. The company's clients are predominantly commodity producers and consumers, banks, hedge funds, asset managers, broking houses, commodity trading advisors and professional traders. Marex currently has over 1,800 employees and 36 offices across Europe, USA and APAC.

Castleton Commodities International, LLC (CCI) is a privately held global merchant firm that is involved in commodity trading and is active in a wide spectrum of global energy markets. Under the name Louis Dreyfus Energy, the company was formed in 1997 by the Louis Dreyfus Company as a subsidiary to trade energy. By 2006 Louis Dreyfus Energy was ranked as one of the 10 largest natural gas marketers within the United States. The company has worldwide interests covering "the physical delivery of petroleum and natural gas as well as financial interests in energy". Headquartered in Stamford, Connecticut, CCI has offices in Calgary, Canada; Houston, Texas; Geneva, Switzerland; London, United Kingdom; and Singapore.