The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

A tax cut represents a decrease in the amount of money taken from taxpayers to go towards government revenue. Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Tax cuts usually refer to reductions in the percentage of tax paid on income, goods and services. As they leave consumers with more disposable income, tax cuts are an example of an expansionary fiscal policy. Tax cuts also include reduction in tax in other ways, such as tax credit, deductions and loopholes.

The Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner issued a directive that the Bureau be combined with the Financial Management Service to form the Bureau of the Fiscal Service in 2012.

In France, taxation is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

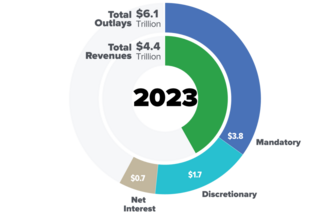

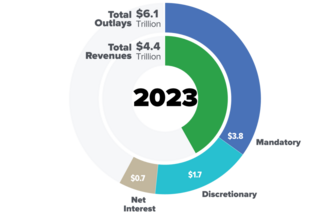

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

Fiscal conservatism or economic conservatism is a political and economic philosophy regarding fiscal policy and fiscal responsibility with an ideological basis in capitalism, individualism, limited government, and laissez-faire economics. Fiscal conservatives advocate tax cuts, reduced government spending, free markets, deregulation, privatization, free trade, and minimal government debt. Fiscal conservatism follows the same philosophical outlook as classical liberalism. This concept is derived from economic liberalism.

The Department of Budget and Management is an executive body under the Office of the President of the Philippines. It is responsible for the sound and efficient use of government resources for national development and also as an instrument for the meeting of national socio-economic and political development goals.

The Department of Finance is the executive department of the Philippine government responsible for the formulation, institutionalization and administration of fiscal policies, management of the financial resources of the government, supervision of the revenue operations of all local government units, the review, approval and management of all public sector debt, and the rationalization, privatization and public accountability of corporations and assets owned, controlled or acquired by the government.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed. Economic performance during the period was adversely affected by two recessions, in 2001 and 2007–2009.

The Bureau of Internal Revenue(Filipino: Kawanihan ng Rentas Internas, or BIR) is a revenue service for the Philippine government, which is responsible for collecting more than half of the total tax revenues of the government. It is an agency of the Department of Finance and it is led by a Commissioner.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

Cesar Antonio Velasquez Purisima is a Filipino accountant and financial expert. He was the Secretary of Finance of the Republic of the Philippines under the administration of President Benigno S. Aquino III. He also served as the chair of the Cabinet Economic Development Cluster and member of the Monetary Board of the Bangko Sentral ng Pilipinas. Purisima is a multi-awarded finance minister, recognized 7 times in 6 consecutive years by various international institutions for turning the Philippine economy around and restoring investor confidence.

The economic history of the Philippines chronicles the long history of economic policies in the nation over the years.

In 2011, ongoing political debate in the United States Congress about the appropriate level of government spending and its effect on the national debt and deficit reached a crisis centered on raising the debt ceiling, leading to the passage of the Budget Control Act of 2011.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

Carlos "Sonny" García Domínguez III is a distinguished Filipino businessman who was appointed as Philippine Cabinet Secretary thrice: as Minister of Natural Resources (1986-1987), Secretary of Agriculture (1987-1989), and as Secretary of Finance (2016-2022).

The Chinese government initiated a fiscal and taxation system reform in 1992, prepared and promulgated in 1993, and finally implemented in 1994. The reform was a large-scale adjustment of the tax distribution system and tax structure between the central and local governments, which was regarded as a milestone in the transition of China's fiscal system from planned economy to market economy. The main purpose of the tax-sharing reform is to alleviate the budget deficit since the end of the 1980s. As the reform achieved indeed remarkable results, it yet evoked problems like heavier financial burden of local governments. In order to make ends meet, governments started to let lands which eventually pushed up the land and housing price. Therefore, the tax-sharing reform is considered to be the reason of China's severe land finance.

Taxation in Sri Lanka mainly includes excise duties, value added tax, income tax and tariffs. Tax revenue is a primary constituent of the government's fiscal policy. The Government of Sri Lanka imposes taxes mainly of two types in the forms of direct taxes and indirect taxes. As of 2018 CBSL report, taxes are the most important revenue source for the government, contributing 89% of the revenue. The tax revenue to GDP ratio is just about 11.6 percent as of 2018, which is one of the lowest rates among the upper-middle income earning countries. At present, the government of Sri Lanka also face major challenges regarding the continuous budget deficits where government expenditures have exceeded the government tax revenue.