Related Research Articles

Proof of work (PoW) is a form of cryptographic proof in which one party proves to others that a certain amount of a specific computational effort has been expended. Verifiers can subsequently confirm this expenditure with minimal effort on their part. The concept was first implemented in Hashcash by Moni Naor and Cynthia Dwork in 1993 as a way to deter denial-of-service attacks and other service abuses such as spam on a network by requiring some work from a service requester, usually meaning processing time by a computer. The term "proof of work" was first coined and formalized in a 1999 paper by Markus Jakobsson and Ari Juels. The concept was adapted to digital tokens by Hal Finney in 2004 through the idea of "reusable proof of work" using the 160-bit secure hash algorithm 1 (SHA-1).

Double-spending is the unauthorized production and spending of money, either digital or conventional. It represents a monetary design problem: a good money is verifiably scarce, and where a unit of value can be spent more than once, the monetary property of scarcity is challenged. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist. Like all increasingly abundant resources, this devalues the currency relative to other monetary units or goods and diminishes user trust as well as the circulation and retention of the currency.

Bitcoin is the first decentralized cryptocurrency. Nodes in the peer-to-peer bitcoin network verify transactions through cryptography and record them in a public distributed ledger, called a blockchain, without central oversight. Consensus between nodes is achieved using a computationally intensive process based on proof of work, called mining, that secures the bitcoin blockchain. Mining consumes large quantities of electricity and has been criticized for its environmental impact.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It has, from a financial point of view, grown to be its own asset class. However, on the contrary to other asset classes like equities or commodities, sectors have not been officially defined as of yet, though abstract versions of them exist.

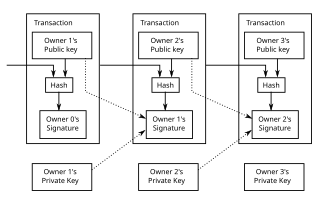

The bitcoin protocol is the set of rules that govern the functioning of bitcoin. Its key components and principles are: a peer-to-peer decentralized network with no central oversight; the blockchain technology, a public ledger that records all bitcoin transactions; mining and proof of work, the process to create new bitcoins and verify transactions; and cryptographic security.

A blockchain is a distributed ledger with growing lists of records (blocks) that are securely linked together via cryptographic hashes. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Since each block contains information about the previous block, they effectively form a chain, with each additional block linking to the ones before it. Consequently, blockchain transactions are irreversible in that, once they are recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

Hyperledger is an umbrella project of open source blockchains and related tools that the Linux Foundation started in December 2015. IBM, Intel, and SAP Ariba have contributed to support the collaborative development of blockchain-based distributed ledgers. It was renamed the Hyperledger Foundation in October 2021.

A decentralised application is an application that can operate autonomously, typically through the use of smart contracts, that run on a decentralized computing, blockchain or other distributed ledger system. Like traditional applications, DApps provide some function or utility to its users. However, unlike traditional applications, DApps operate without human intervention and are not owned by any one entity, rather DApps distribute tokens that represent ownership. These tokens are distributed according to a programmed algorithm to the users of the system, diluting ownership and control of the DApp. Without any one entity controlling the system, the application is therefore decentralised.

A smart bond is a specific type of an automated bond contract that uses the capabilities of blockchain databases that can operate as cryptographically-secure yet open and transparent general ledgers. This is sometimes referred to as Distributed Ledger Technology (DLT). It is one of a class of financial instruments known as a smart contract, "a computerized transaction protocol that executes the terms of a contract."

Ethereum Classic is a blockchain-based distributed computing platform that offers smart contract (scripting) functionality. It is open source and supports a modified version of Nakamoto consensus via transaction-based state transitions executed on a public Ethereum Virtual Machine (EVM).

Proof of space (PoS) is a type of consensus algorithm achieved by demonstrating one's legitimate interest in a service by allocating a non-trivial amount of memory or disk space to solve a challenge presented by the service provider. The concept was formulated in 2013 by Dziembowski et al. and by Ateniese et al.. Proofs of space are very similar to proofs of work (PoW), except that instead of computation, storage is used to earn cryptocurrency. Proof-of-space is different from memory-hard functions in that the bottleneck is not in the number of memory access events, but in the amount of memory required.

A cryptocurrency wallet is a device, physical medium, program or an online service which stores the public and/or private keys for cryptocurrency transactions. In addition to this basic function of storing the keys, a cryptocurrency wallet more often offers the functionality of encrypting and/or signing information. Signing can for example result in executing a smart contract, a cryptocurrency transaction, identification, or legally signing a 'document'.

Proof of authority (PoA) is an algorithm used with blockchains that delivers comparatively fast transactions through a consensus mechanism based on identity as a stake. The most notable platforms using PoA are VeChain, Bitgert, Palm Network and Xodex.

Distributed ledger technology law is not yet defined and recognized but an emerging field of law due to the recent dissemination of distributed ledger technology application in business and governance environment. Those smart contracts which were created through interaction of lawyers and developers and are intended to also be enforceable legal contracts are called smart legal contracts.

IOTA is an open-source distributed ledger and cryptocurrency designed for the Internet of things (IoT). It uses a directed acyclic graph to store transactions on its ledger, motivated by a potentially higher scalability over blockchain based distributed ledgers. IOTA does not use miners to validate transactions, instead, nodes that issue a new transaction on the network must approve two previous transactions. Transactions can therefore be issued without fees, facilitating microtransactions. The network currently achieves consensus through a coordinator node, operated by the IOTA Foundation. As the coordinator is a single point of failure, the network is currently centralized.

Hashgraph is a distributed ledger technology that has been described as an alternative to blockchains. The hashgraph technology is currently patented, is used by the public ledger Hedera, and there is a grant to implement the patent as a result of the Apache 2.0's Grant of Patent License so long as the implementation conforms to the terms of the Apache license. The native cryptocurrency of the Hedera Hashgraph system is HBAR.

A blockchain is a shared database that records transactions between two parties in an immutable ledger. Blockchain documents and confirms pseudonymous ownership of all transactions in a verifiable and sustainable way. After a transaction is validated and cryptographically verified by other participants or nodes in the network, it is made into a "block" on the blockchain. A block contains information about the time the transaction occurred, previous transactions, and details about the transaction. Once recorded as a block, transactions are ordered chronologically and cannot be altered. This technology rose to popularity after the creation of Bitcoin, the first application of blockchain technology, which has since catalyzed other cryptocurrencies and applications.

Nano is a cryptocurrency characterized by a directed acyclic graph data structure and distributed ledger, making it possible for Nano to work without intermediaries. To agree on what transactions to commit, it uses a voting system with weight based on the amount of currency an account holds.

Algorand is a proof-of-stake blockchain and cryptocurrency. Algorand's native cryptocurrency is called ALGO.

References

- ↑ Distributed Ledger Technology: beyond block chain (PDF) (Report). Government Office for Science (UK). January 2016. Archived (PDF) from the original on 16 March 2018. Retrieved 29 August 2016.

- 1 2 3 Scardovi, Claudio (2016). Restructuring and Innovation in Banking. Springer. p. 36. ISBN 978-331940204-8. Archived from the original on 22 September 2022. Retrieved 21 November 2016.

- ↑ "Distributed Ledgers". Investopedia. Archived from the original on 2022-08-01. Retrieved 2022-08-09.

- ↑ Sadeghi, Mahsa; Mahmoudi, Amin; Deng, Xiaopeng (2022-02-01). "Adopting distributed ledger technology for the sustainable construction industry: evaluating the barriers using Ordinal Priority Approach". Environmental Science and Pollution Research. 29 (7): 10495–10520. Bibcode:2022ESPR...2910495S. doi:10.1007/s11356-021-16376-y. ISSN 1614-7499. PMC 8443118 . PMID 34528198.

- ↑ Maull, Roger; Godsiff, Phil; Mulligan, Catherine; Brown, Alan; Kewell, Beth (21 Sep 2017). "Distributed ledger technology: Applications and implications". FINRA. 26 (5): 481–89. doi:10.1002/jsc.2148. Archived from the original on 9 February 2022. Retrieved 9 February 2022.

- ↑ "Distributed Ledger Technology: beyond block chain" (Press release). Government Office for Science (UK). 19 January 2016. Archived from the original on 15 May 2022. Retrieved 25 September 2018.

- ↑ Brakeville, Sloane; Perepa, Bhargav (18 Mar 2018). "Blockchain basics: Introduction to distributed ledgers". Developer works. IBM. Archived from the original on 26 September 2018. Retrieved 25 Sep 2018.

- ↑ Rutland, Emily. "Blockchain Byte" (PDF). FINRA. R3 Research. p. 2. Archived (PDF) from the original on 23 January 2021. Retrieved 25 September 2018.

- ↑ "Central banks look to the future of money with blockchain technology trial". Australian Financial Review. Fairfax Media Publications. 21 November 2016. Archived from the original on 4 December 2016. Retrieved 7 December 2016.

- ↑ "Citi and Goldman Sachs go live with blockchain equity swaps platform - The TRADE". www.thetradenews.com. Retrieved 2022-05-20.

- ↑ "BlackRock Joins Blockchain Platform Axoni for Equity Swap Trades". Bloomberg.com. 2021-09-07. Retrieved 2022-05-20.

- ↑ "MAS in DeFi landmark trade". Euromoney. 2022-11-03. Archived from the original on 2023-02-04. Retrieved 2023-02-04.

- ↑ "First Industry Pilot for Digital Asset and Decentralised Finance Goes Live". www.mas.gov.sg. Archived from the original on 2023-02-04. Retrieved 2023-02-04.

- ↑ Nevil, S., Distributed Ledger Technology (DLT): Definition and How It Works, Investopedia, updated on 14 June 2024, accessed on 22 June 2024

- ↑ "Blockchains & Distributed Ledger Technologies". Blockchainhub Berlin. Archived from the original on 2018-01-19. Retrieved 2022-07-28.

- ↑ Pervez, H. (2018). "A Comparative Analysis of DAG-Based Blockchain Architectures". ICOSST 2018.

{{cite journal}}: Cite journal requires|journal=(help)CS1 maint: location (link)