Finance refers to monetary resources and to the study and discipline of money, currency and capital assets. As a subject of study, it is related to but distinct from economics, which is the study of the production, distribution, and consumption of goods and services. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance.

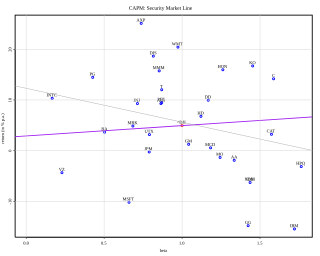

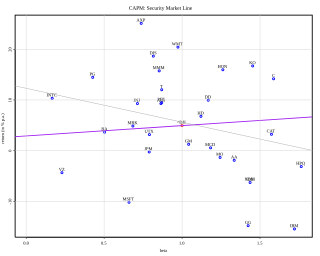

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio.

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky return less the risk-free return, as demonstrated by the formula below.

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of equities over that of government bonds, which has been observed for more than 100 years. There is a significant disparity between returns produced by stocks compared to returns produced by government treasury bills. The equity premium puzzle addresses the difficulty in understanding and explaining this disparity. This disparity is calculated using the equity risk premium:

A market anomaly in a financial market is predictability that seems to be inconsistent with theories of asset prices. Standard theories include the capital asset pricing model and the Fama-French Three Factor Model, but a lack of agreement among academics about the proper theory leads many to refer to anomalies without a reference to a benchmark theory. Indeed, many academics simply refer to anomalies as "return predictors", avoiding the problem of defining a benchmark theory.

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be bullish. On the contrary, if the market sentiment is bearish, most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as permabulls and permabears respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going up more than normal, and vice versa. A bull market refers to a sustained period of either realized or expected price rises, whereas a bear market is used to describe when an index or stock has fallen 20% or more from a recent high for a sustained length of time.

Michael Cole Jensen was an American economist who worked in the field of financial economics. From 1967-1988, he was on the University of Rochester's faculty. Between 2000 and 2009 he worked for the Monitor Company Group, a strategy-consulting firm which became "Monitor Deloitte" in 2013. Until 2000, he held the position of Jesse Isidor Straus Professor of Business Administration at Harvard University.

Frank J. Fabozzi is an American economist, educator, writer, and investor, currently Professor of Practice at The Johns Hopkins University Carey Business School and a Member of Edhec Risk Institute. He was previously a Professor of Finance at EDHEC Business School, Professor in the Practice of Finance and Becton Fellow in the Yale School of Management, and a Visiting Professor of Finance at the Sloan School of Management at the Massachusetts Institute of Technology. He has authored and edited many books, three of which were coauthored with Nobel laureates, Franco Modigliani and Harry Markowitz. He has been the editor of the Journal of Portfolio Management since 1986 and is on the board of directors of the BlackRock complex of closed-end funds.

John R. Graham is an American financial economist, a professor at the Duke University Fuqua School of Business, a research associate for the NBER, and a regular guest commentator on CNBC. A Phi Beta Kappa winner, Graham has accumulated a lengthy list of award winning research papers.

David Arthur Hsieh is a professor of finance at the Duke University Fuqua School of Business. He has done extensive research on hedge funds and alternative beta, which includes dynamics of asset prices and their implications for financial risk management and risk and return in hedge funds and commodity funds.

Corporate finance is the area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to maximize or increase shareholder value.

In investing and finance, the low-volatility anomaly is the observation that low-volatility securities have higher returns than high-volatility securities in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that higher returns can only be achieved by taking more risk.

Söhnke Matthias Bartram is a professor in the Department of Finance at Warwick Business School (WBS). He is also a research fellow in the Financial Economics programme and the International Macroeconomics and Finance programme of the Centre for Economic Policy Research (CEPR), a charter member of Risk Who's Who, and a member of an international think tank for policy advice to the German government. Prior to joining the University of Warwick, he held faculty positions at Lancaster University and Maastricht University and worked for several years in quantitative investment management at State Street Global Advisors as Head of the London Advanced Research Center.

Craig Woodworth Holden was the finance department chair and Gregg T. and Judith A. Summerville Chair of Finance at the Kelley School of Business at Indiana University. His research focused on market microstructure. He was secretary-treasurer of the Society for Financial Studies. He was an associate editor of the Journal of Financial Markets. His M.B.A. and Ph.D. were from the Anderson School of Management at UCLA. He received the Fama-DFA Prize for the second best paper in capital markets published in the Journal of Financial Economics in 2009, the Spangler-IQAM Award for the best investments paper published in the Review of Finance in 2017-2018, and the Philip Brown Prize for the best paper published in 2017 using SIRCA data. His research has been cited more than 4,300 times. He has written two books on financial modeling in Excel: Excel Modeling in Investments and Excel Modeling in Corporate Finance. He has chaired 22 dissertations, been a member or chair of 62 dissertations, and serves on the program committees of the Western Finance Association and European Finance Association.

Factor investing is an investment approach that involves targeting quantifiable firm characteristics or “factors” that can explain differences in stock returns. Security characteristics that may be included in a factor-based approach include size, low-volatility, value, momentum, asset growth, profitability, leverage, term and carry.

Orly Sade is a financial economist based out of the Hebrew University of Jerusalem who has been noted for her research regarding behavioral and experimental finance and crowdfunding platforms. Sade is the Israel Associate Professor of Finance at the Department of Finance, School of Business Administration at the Hebrew University of Jerusalem. She is the first female professor in the field of finance at Hebrew University.

Victor Ricciardi is an American professor of business and author. He was an assistant professor of financial management at Goucher College. He is currently teaching at Ursinus College as a visiting Assistant Professor of Finance.

Jennifer Taub is an American law professor, advocate, and commentator focusing on corporate governance, financial market regulation, and white collar crime.

Manju Puri is an economist who currently works as the J. B. Fuqua Professor of Finance at the Fuqua School of Business at Duke University.

Ravi Bansal is an economist and an academic. He is J.B. Fuqua Professor at the Fuqua School of Business at Duke University and Research Associate at the National Bureau of Economic Research. He is most known for his research work in the fields of financial economics and macroeconomics.