Best car insurance for seniors in 2024

Updated 5:03 a.m. UTC July 1, 2024

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy.

Nationwide is the best car insurance for seniors in 2024. It has competitive rates, a low number of consumer complaints and valuable coverage features, such as vanishing deductibles and accident forgiveness.

USAA and Travelers are also top-scoring companies in our rating of best auto insurance companies for seniors. Getting several car insurance quotes can help you find an affordable auto insurance policy that meets your coverage needs.

Best senior car insurance companies of 2024

- Nationwide: Best car insurance for seniors.

- USAA: Best car insurance for military.

- Travelers: Great car insurance for new car owners.

- Auto-Owners: Great car insurance for low customer complaints.

- Erie: Best car insurance for claims.

- Geico: Best car insurance for bad credit.

- Progressive: Best car insurance for DUI.

Why trust our car insurance experts

Our team of car insurance experts has decades of experience in the auto insurance industry, both as editors and consumers. We approach our car insurance analysis the way we would for ourselves or our family members, focusing on the factors that matter the most: rates, coverage and features available, customer complaints and the collision repair process.

We use a data-driven methodology to evaluate hundreds of insurance products, analyze thousands of data points and rate each insurer to help you find the best car insurance product for your situation. Advertisers never influence our editorial content.

You can read more about our methodology below.

- 260 companies analyzed.

- 347 rates reviewed.

- 5 levels of fact-checking.

Top-rated car insurance companies for seniors

Why it’s the best

Nationwide has the lowest average rates for older drivers and is the best car insurance company for seniors in 2024. Its rates, low number of complaints to state insurance departments and coverage options, like usage-based car insurance, also earn it the title of best car insurance of 2024.

Senior drivers can take advantage of several beneficial coverages and features offered by Nationwide, including usage-based insurance, accident forgiveness and gap insurance.

In addition to cheap car insurance rates for senior drivers, Nationwide has the lowest average rates for drivers with poor credit and parents adding a teen (16 to 19) to their car insurance policy. Good drivers and drivers with a speeding ticket who aren’t eligible for coverage with USAA are also likely to find low rates with Nationwide.

See our full Nationwide car insurance review

Why it’s the best

USAA offers the second lowest car insurance rate for senior drivers, and its commitment to serving members of the U.S. Forces makes it the best car insurance for seniors in the military community. USAA’s rates are particularly competitive for good drivers as well as those who have an accident or speeding ticket on their record. Even drivers with a DUI or poor credit history are likely to find competitive rates with USAA.

While most drivers can unlock lower rates with this insurer, only USAA members are eligible for coverage. USAA was founded specifically to support the military community, and its auto insurance and financial products are available only to active military members, veterans and their eligible family members.

See our full USAA car insurance review

Why it’s the best

Travelers has low gap insurance rates. It also has a robust new car replacement coverage feature that lasts five years, longer than provided by other car insurance companies in our review. That makes it the best car insurance for seniors with a new vehicle.

Travelers has the third-lowest rates for senior drivers among insurers in our analysis and lower-than-average rates for most drivers. Its discount for new vehicles (less than three years old) and hybrid/electric vehicles can further lower the cost of car insurance, especially for new vehicle owners.

See our full Travelers car insurance review

Why it’s the best

Based on National Association of Insurance Commissioners (NAIC) data, Auto-Owners has the lowest customer complaint ratio among the top-scoring car insurance companies in our analysis. It has a 0.49 NAIC complaint ratio, well below the national average of 1.0.

Auto-Owners received above-average scores on the most recent J.D. Power Auto Claims Satisfaction Study and the annual CRASH Network Insurer Report Card.

Auto-Owners doesn’t have the lowest rates in our analysis, but many drivers will still find its rates to be below the national average. However, that’s not the case for drivers with poor credit or a DUI on their record — these drivers should consider other insurers in our rating.

See our full Auto-Owners car insurance review

Why it’s the best

Erie is the best car insurance company if you prioritize a strong collision repair experience. It has the best CRASH Network grade (A-) among the senior car insurance companies we analyzed. This score reflects how an insurer handles collision claims, including their claims handling policies, repair quality, payment process and customer experience. Erie also has the second-highest score on the most recent J.D. Power Auto Claims Satisfaction Study.

In addition to a strong claims process, Erie also has competitive rates for many types of drivers, especially drivers with an accident, DUI or speeding ticket on their record. However, some drivers, especially those with a clean record or poor credit, may find cheaper rates elsewhere.

See our full Erie car insurance review

Why it’s the best

Geico has a below-average rate for senior drivers, and next to USAA and Nationwide, it has the lowest average rate for drivers with poor credit. It also has competitive rates for good drivers and below-average rates for most other types of drivers, except those with a DUI.

Geico offers coverage in all 50 states and provides most major types of car insurance drivers expect, but some coverage options and features are missing. Namely, Geico doesn’t offer rideshare insurance, gap insurance, new car replacement or vanishing deductibles.

Read our full Geico car insurance review

Why it’s the best

Progressive also has the lowest average rates for drivers with a DUI on their record, out of the insurers in our analysis. And, even though Progressive’s rates aren’t the lowest among our best car insurance companies for seniors, they are still below average. Its rates are also generally below average for other types of drivers, but if you have a speeding ticket or accident causing property damage on your record, you’ll want to look elsewhere.

Progressive car insurance is available in all 50 states and offers a wide range of features and coverage options, such as rideshare and gap insurance. However, it doesn’t offer new car replacement coverage.

Compare the best car insurance companies for seniors

| CAR INSURANCE COMPANY | AVERAGE MONTHLY COST FOR SENIORS | AVERAGE ANNUAL SAVINGS COMPARED TO NATIONAL AVERAGE | CONSUMER COMPLAINTS | SENIOR CAR INSURANCE RATING | LEARN MORE | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $117 | $748 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $121 | $695 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $139 | $482 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $151 | $337 | Very Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $153 | $319 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $149 | $357 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $161 | $213 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $167 | $141 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

Westfield Westfield | $189 | -$119 | Very Low | Compare Rates Compare rates offered by participating partners | ||||||||

| ||||||||||||

| $250 | -$846 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

| ||||||||||||

| $267 | -$1,049 | Low | Compare Rates Compare rates offered by participating partners | |||||||||

|

Average annual senior car insurance premium reflects rates for male and female drivers between ages 60 and 80. Complaint scores are based on the most recent data from the National Association of Insurance Commissioners (NAIC).

Methodology

Our car insurance experts evaluated the best car insurance providers in the nation by analyzing several key metrics: cost, coverage options and features, consumer complaints and collision repair scores.

Each car insurance company was eligible for up to 100 points, based on its performance in the following key categories:

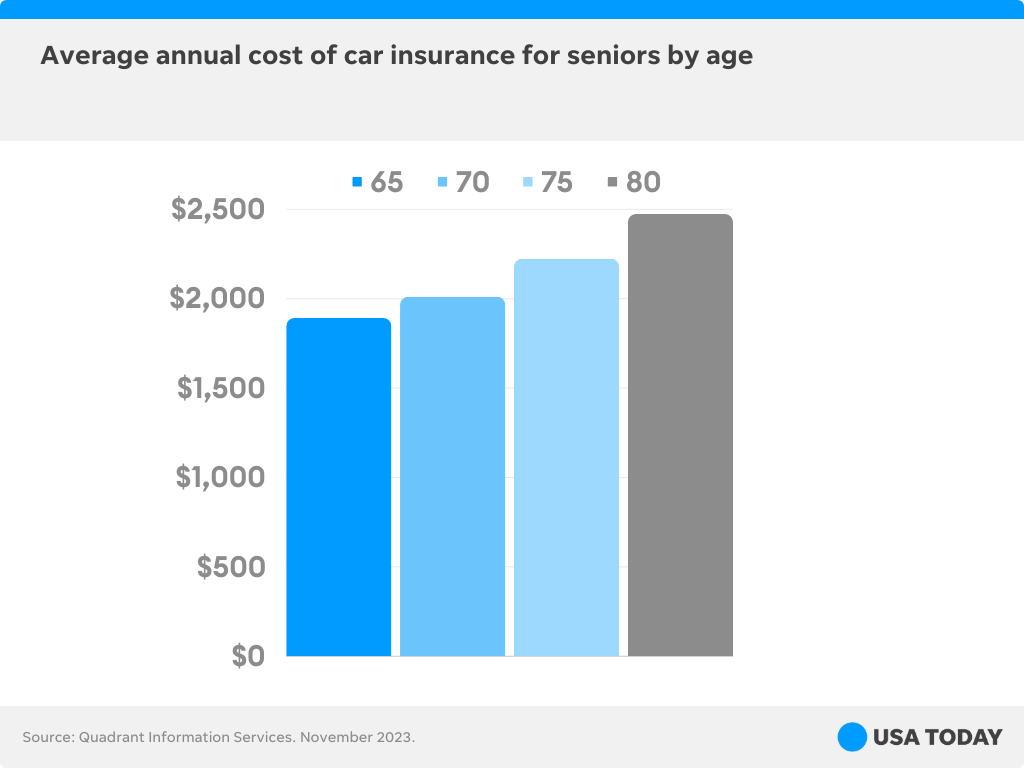

- Cost: 50 points. We analyzed rates from Quadrant Information Services for good drivers at ages 65, 70, 75 and 80 for a policy with 100/300/100 in liability coverage, uninsured motorist coverage and comprehensive and collision coverage.

- Complaints: 20 points. We collected complaint data from the National Association of Insurance Commissioners (NAIC), which shows the volume of car insurance consumer complaints against each company. When a consumer lodges a complaint to their state’s department of insurance — often about an insurance company’s claims process, delays, denials or settlements — these complaints are logged and tracked by the NAIC.

- Car insurance coverage options and features: 20 points. Car insurance policy features can help make coverage more affordable both before and after an accident or covered incident. We evaluated car insurance policies offered by each insurer and awarded points to insurers that offered these valuable benefits:

- Accident forgiveness: 5 points.

- New car replacement: 5 points.

- Diminishing deductible: 5 points.

- Usage-based car insurance: 5 points.

- Collision repair score: 10 points. Every year the CRASH Network surveys collision repair professionals across the nation, evaluating insurers on the quality of their repairs and customer service interactions for motorists. Grades range from A+ to F, and insurers with better grades score higher for this metric.

If you’d like to dig in deeper, head over to our car insurance ratings methodology page.

Average cost of car insurance for seniors

The average cost of car insurance for seniors between 65 and 80 is $2,150 a year, or $179 a month. However, senior car insurance rates vary by age, with drivers in their 60s paying less for coverage than those in their 70s and 80s.

The average cost of car insurance at any age may not be indicative of your rates. How much you pay for coverage will depend on several factors, including:

- Age.

- Car insurance discounts.

- Credit score (in most states).

- Driving record.

- Gender (in most states).

- Location.

- How many miles you drive.

- Make and model vehicles.

- Type and amount of coverage desired.

Who has the cheapest car insurance for seniors?

Nationwide has the cheapest car insurance for seniors between 60 and 80. Its average rate for drivers in this demographic is $1,402, nearly 35% less than the national average of $2,150.

Other insurers with below-average rates for senior citizens include USAA, Travelers, Auto-Owners, Erie, Geico, Progressive and State Farm.

Senior car insurance rates by insurer

| Car insurance company | Average annual rate for seniors | Average monthly rate for seniors | Learn More | |||||

|---|---|---|---|---|---|---|---|---|

| $1,402 | $117 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,455 | $121 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,668 | $139 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,813 | $151 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,831 | $153 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,793 | $149 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $1,937 | $161 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $2,009 | $167 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

Westfield Westfield | $2,269 | $189 | Compare Rates Compare rates offered by participating partners | |||||

| ||||||||

| $2,996 | $250 | Compare Rates Compare rates offered by participating partners | ||||||

| ||||||||

| $3,199 | $267 | Compare Rates Compare rates offered by participating partners | ||||||

|

How to find the best car insurance rates for seniors

If you’re 60 or older and are looking for car insurance, here are some tips for finding the best coverage for the lowest price.

Shop around for a better policy

No matter your age, gender, driving record or location, it’s a good idea to shop around for better car insurance once in a while. Doing so can help you find the cheapest car insurance for your specific coverage needs.

Some drivers shop each time their policy is up for renewal while others wait every few years so they can take advantage of their provider’s loyalty discount.

Either way, experts agree: It never hurts to see how much you can save. It’s best to get and compare at least three car insurance quotes. Just make sure you’re looking at policies with the same level of coverage when comparing prices.

Our rating of the best car insurance for seniors is a good place to start. If you’re looking for the cheapest senior auto insurance, consider options like USAA, Auto-Owners, Geico and Westfield, all of which offer senior car insurance policies that average less than $2,000 a year.

“Multiple companies tie in to the senior market,” said Peter Schumacher, an independent insurance agent with many clients in the senior community. “They effectively tie in with senior member groups, such as AARP or AMAC.”

To get a fuller picture of the options available, you can use an online auto insurance marketplace. Provide some basic info, click a button and review all the insurance offers available.

Alternatively, you can work with an independent car insurance agent, who can generate multiple rates. The benefit of a good agent, according to Schumacher, is that they’ll “take the time to get to know a client to unearth additional savings programs.”

Take a defensive driving course

Showing your insurance provider that you take safe driving seriously, even if you’ve been driving for decades, could result in a discount. Ask your current provider if taking a defensive driving course would lower your rate.

In some states, the government mandates that insurers offer this discount to senior drivers who’ve completed an approved course. The discount is usually between 5% and 10%.

Ask about car insurance discounts for seniors

Some car insurance companies, like Geico, offer car insurance discounts for seniors, or people over the age of 50. Many auto insurers offer discounts — to drivers of all ages — for bundling auto coverage with homeowners insurance or renters insurance, switching to paperless billing and paying the full premium in advance, rather than monthly. Insurance companies may also offer loyalty, safe driving and vehicle safety feature discounts.

Shopping for car and home insurance? Best auto and home insurance bundles

Consider usage-based insurance

Usage-based insurance is a type of coverage that allows insurance to track driving habits, such as your speed, acceleration, braking and even the time of day and how frequently you drive. Oftentimes, insurers reward good driving behavior with lower rates.

Seniors with a good driving record and practice safe driving habits may find this type of care insurance helps them lower their monthly rates. The same is true for seniors who spend less time on the roads.

Adjust your policy

There are a few policy adjustments that can lead to lower car insurance rates:

- Increasing your deductible, or the amount an insurer will subtract from a claims check for certain claims, such as collision or comprehensive claims.

- Decreasing your limits, or the maximum amount your insurer will pay out after a claim.

- Dropping unnecessary coverages, such as gap insurance if you’ve already paid off your vehicle or roadside assistance if you no longer need it or found coverage elsewhere.

Jennifer’s expert take:

Adjusting your policy limits can lead to lower car insurance costs up front, but it’s not always the most cost-effective solution. If you’re at fault for an accident, your insurance company will only cover accident-related costs up to your policy limit. As vehicles become more expensive to repair and medical costs soar, an accident that causes injuries to another driver (or their passengers) and damage to their vehicle can be quite costly.

If you carry a minimum liability insurance policy with say $15,000 in bodily injury liability insurance and $5,000 in property damage coverage, even a relatively minor accident can lead to costs that exceed your limit. You may save a couple hundred dollars a year by reducing coverage, but if the unthinkable happens, you can find yourself in significant debt with potential legal repercussions.

Jennifer Lobb, Deputy Editor of Insurance, USA TODAY Blueprint

Be car conscious

The vehicle you drive can also have an impact on your car insurance premiums. Sporty vehicles like convertibles and coupes fetch higher insurance rates while reliable vehicles equipped with advanced safety features are much more affordable to insure.

Why auto insurance is more expensive for senior drivers

There are several reasons car insurance for seniors is often more expensive than it may be for other groups, with the exception of teens, who typically have some of the highest rates.

- Seniors over 70 have higher fatal crash rates per mile when compared to drivers in other age groups, according to the Insurance Institute for Highway Safety (IIHS).

- Seniors are more likely to suffer from declining vision, memory impairments and mobility issues, all of which can impact driving ability.

- Drivers in their senior years are more likely to take medications with side effects that can impact their reaction time and hand-eye coordination.

But it’s not all gloom and doom: The IIHS reports fatal collisions for seniors are on a decline. Despite there being more senior drivers on the road today than there were in the late ’90s, there are 22% fewer accidents resulting in fatalities for seniors.

That could be due to a number of features, including improvements in vehicle safety technology. But the IIHS points out that seniors are reportedly driving fewer miles, especially at night, which has also contributed to this decline in fatalities.

Best car insurance for seniors FAQs

Based on our analysis of insurance companies, the following insurers have the best care insurance for seniors ages 65 to 80:

- Nationwide

- USAA

- Travelers

Each of these insurers receive 5.0 stars in our best car insurance for seniors rating, which takes into account an insurer’s rates, coverage options and features, customer complaints and collision repair scores.

Before you choose a car insurance company, always get and compare car insurance quotes from at least three different insurers.

Out of the companies we analyzed, Nationwide has the cheapest car insurance for mature senior drivers, costing $1,402 per year. USAA and Travelers are the next cheapest car insurance companies for seniors, respectively.

Many of the best car insurance companies offer discounts, including some specifically for seniors. For example, in many states auto insurance companies are required to offer seniors a discount for successfully completing a defensive driving course.

Seniors may qualify for other car insurance discounts for actions like bundling home and auto insurance, enrolling in paperless billing, paying the full premium in advance and making it through a policy period without any claims.

Usage-based insurance programs can lead to savings for seniors. If you’re a senior driver and don’t drive as frequently as you used to, consider a car insurance company that offers usage-based insurance (UBI) programs.

UBI programs track how safely or frequently you drive, and if you keep your mileage low you may see discounts. For example, with Nationwide’s SmartMiles program, your rate is based on a pay-per-mile basis. If your mileage is low, SmartMiles can lead to a flexible monthly rate.

Bundling your home and auto, or auto and life insurance, paperless billing, and affiliation groups can also all lead to car insurance discounts for seniors.

Yes, based on our analysis, car insurance rates begin to increase in your mid-60s and continue to do so after age 80.

Seniors looking for the cheapest car insurance should consider shopping around, getting multiple quotes and asking about discounts for defensive driving courses, bundling policies and opting into usage-based insurance.

The cheapest car insurance company for people over 60 is USAA or Nationwide. Here’s the average annual cost of car insurance for a 65-year-old good covered by USAA or Nationwide.

According to the Insurance Institute for Highway Safety (IIHS), seniors may pay more for car insurance due to an increased risk of an accident. Seniors can also be more likely to suffer vision impairment and slower reaction time. Age is factored into your car insurance rate, which is why car insurance for teens and seniors tends to be more expensive.

The average cost of senior auto insurance is $2,150 per year, or $179 per month for good drivers, according to our analysis of rates.

You can keep costs down by comparing car insurance quotes from multiple companies to make sure you’re getting the best deal for your needs. You may also qualify for car insurance discounts that can help lower your car insurance premium.

Learn more about car insurance

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy. The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.