The Weekly Planet: A New Idea for Fighting Climate Change: Retirement Plans!

If you’re retiring in the 2060s, you should make sure you can enjoy the 2060s.

Every Tuesday, our lead climate reporter brings you the big ideas, expert analysis, and vital guidance that will help you flourish on a changing planet. Sign up to get The Weekly Planet, our guide to living through climate change, in your inbox.

In January 2020, Boris Khentov attended a climate protest in Washington, D.C., led by Jane Fonda. (She was, at its climax, arrested.) Its theme was the role of financial institutions in the climate crisis, and the speakers—who included Joaquin Phoenix, Martin Sheen, and the environmental author Bill McKibben—stressed one idea over and over again: divestment.

Financial institutions needed to stop investing in fossil-fuel companies, they said, for society to have a shot at fighting climate change. For the past decade, divestment has been the climate movement’s biggest demand of banks, pension funds, and university endowments, an echo of earlier campaigns against apartheid and Big Tobacco.

“As we marched together towards the Capitol, one phrase ran through my mind,” Khentov later told me in an email: “‘If only it were that simple.’”

Khentov is not an expert in climate change, but he does know something about finance. He is the senior vice president of operations at Betterment, a software company that advises people on how best to manage their money.

Betterment is what’s called a robo-adviser: It offers consumers a few portfolios of stocks and bonds, then automatically shifts how assets in a portfolio are “weighted” for each customer’s goals, so that a 30-year-old, say, has more stocks in her retirement fund than a 60-year-old. It has about half a million customers and $22 billion under management.

Divestment wasn’t wrong, Khentov thought, but it was inadequate. The fight against climate change requires transforming the physical stuff of the world—its engines, refineries, foundries, everything we call economic infrastructure—in the next 30 years. That would require more than just an oil change, so to speak. It would require changing every company—including Betterment.

The protest led him to create something that, as far as I know, is unique among major 401(k) providers and robo-advisers: a specifically climate-focused portfolio. (This week he published a blog post explaining what went into making it.) Any American can invest in it, including with a retirement account such as a Roth IRA. (Before we get any further, I should specify: Nothing in this column constitutes financial advice.)

Even if you don’t have any retirement savings, the new Betterment climate portfolio is worthy of your attention, I think. Unlike many would-be pro-climate investment products, it represents a sincere attempt to think through what will actually change the economy.

To very quickly catch you up, there are two big trends in investing circa 2021. The first is that investors are choosing broad, low-fee, diversified funds that track the overall market rather than searching for the very few companies that do disproportionately well. The second is the laudable but frankly kind of nebulous idea that people want to invest in line with their values. This is usually called investing for “environmental, social, and governance,” or ESG, funds. Over the past few years, hundreds of billions have poured into ESG funds.

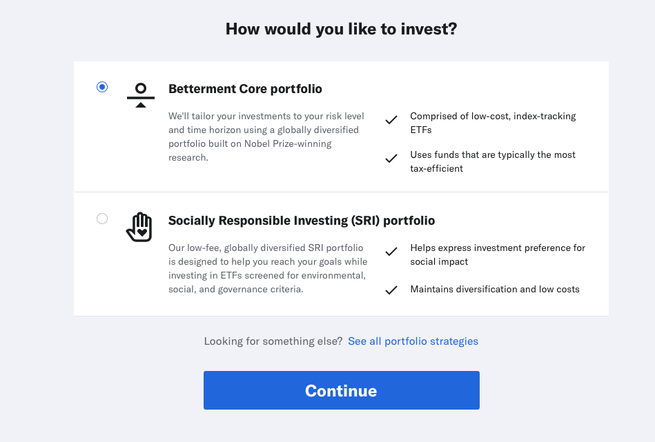

Betterment has promoted and boosted these two trends. Its “core” portfolio tracks major indices, and, in 2017, it launched an ESG-inspired portfolio.

ESG funds are seen as inherently climate-friendly, but they’re really not—or, at least, they usually have a broader ambit than climate alone. Many ESG funds track companies based on how well they perform on a scorecard, which might look at a firm’s carbon footprint alongside questions of “good corporate governance” that climate-focused investors don’t necessarily care about. Some ESG funds invest more in companies if they have a woman on the board of directors—which is a worthwhile idea, except that ExxonMobil’s board has three.

The basic idea of ESG is good, though—and, I would add, goes to the heart of what retirement means in the first place. Perhaps for older readers—and I mean this with no slight—the middle decades of the 21st century remain notional. But I, God willing, would like to celebrate my 59th birthday in 2050, and under current law, I have to start taking money from my 401(k) in 2063.

That’s about the same time that 90 percent of the world’s coral reefs will be at risk of destruction, and when much of California’s forestland will be giving way to scrub, grassland, and desert. The premise of retirement is that I will one day get to enjoy the 2060s, but it will take some societal work to make the 2060s enjoyable. I would like my (for now, meager) retirement savings to enable such work.

I am, apparently, not alone. In October, Betterment split its new climate-focused portfolio from its main ESG offering. Within three weeks of launch, it passed $100 million in total assets—“far faster than any brand-new portfolio in Betterment’s 10-year history,” Khentov wrote. The median investor in the climate portfolio is three years younger than the median Betterment customer.

What are those investors getting? After he came home from the protest, Khentov began a months-long research effort to improve Betterment’s climate portfolio.

“Literally every single sector, every single business, has a CO2 emissions profile,” he said in an interview. “How do we incorporate the fact that these oil and gas companies are pumping, and these utilities are burning, to serve [other] companies? Every business has a carbon profile and very few have fossil-fuel reserves.”

What was needed was another approach—call it divestment-plus. He and his colleagues decided to divide the new Betterment portfolio into three parts.

The first is divestment. Betterment devotes about half of its stock portfolio to exchange-traded funds that track large-cap companies that have no oil, gas, or coal reserves. So Microsoft is here, but no Exxon. Google, but no Chevron. Yet pipeline manufacturers are here too, because even though they trade in fossil fuels, they don’t own underground reserves.

The second approach is what he calls “optimization.” Betterment commits the other half of its stock portfolio to a fund called CRBN, which elevates companies that have the smallest ratio of carbon emissions per dollar in their respective sector. That is, it finds the cleanest companies in each industry, and “votes” for them with dollars.

The final approach is to invest in “green bonds,” through a fund called BGRN. These bonds directly finance climate-friendly investments, such as new renewable projects.

None of these strategies is perfect. The divestment stocks “clearly represent that energy and emotion that I saw when I was protesting,” Khentov said, but because most companies raise money by issuing bonds, divestment from shares may not significantly raise the cost they pay for capital. The optimization approach isn’t ideal either, because these index funds pick the lowest-carbon companies in every sector, including the energy sector. And the green-bond industry remains hopelessly unregulated, so it’s hard to know whether your dollars are funding truly pro-climate projects. (Although the U.S. Securities and Exchange Commission could step in soon.)

The optimization problem in particular troubles Justin Guay, a climate-finance activist and the director of global climate strategy at the Sunrise Project. Companies solely devoted to fossil fuels should have no place in a climate portfolio, he told me. “Some companies need to die as part of the energy transition, while others need to evolve into birds,” he said.

Khentov argues that a “best in class” index, such as CRBN, could open up a new age of what he calls “index activism.” Companies are desperate to get on crucial stock-market indexes—when Tesla made the S&P 500 earlier this year, it was interpreted as a coronation—because they raise the share price, and because they act as a de facto vote of confidence for management. If CRBN attracted enough investor money, he said, then simply wanting to remain on its index could become a pressure point for a company’s executives. They might undertake more ambitious decarbonization plans to stay ahead of their competitors, driving what the political scientist Sarah Manina Kelsey calls a “green spiral”of positive behavior.

Or maybe not: Either way, the Betterment portfolio is, Khentov admits, an experiment. It wouldn’t have been possible to put together this climate portfolio a year ago, he said, and it’s possible that next year, even better climate-focused funds will be available for his team to add to its portfolio. The next frontier, for instance, may be investing in a fund that promises to get involved in disputes between investors and management over climate plans. But right now, no such fund exists.

When I talked to Guay, the activist, he homed in on—and complimented—an aspect of Betterment’s design that I hadn’t noticed. When an investor opens a fund on Betterment’s website, the user interface puts its “core” portfolio on the same tier as its socially responsible portfolios, including its climate portfolio.

“That is different. That is fundamentally different than most retirement advisers,” he said. Fidelity, for instance, provides no divested portfolio options for its 401(k) customers.

The next step, he said, was for the climate-friendly portfolio to become the default. “Options are all well and good … but you’ll never get there by consumer choice alone,” he said, citing research that organ-donation programs are more successful when they’re opt-out. “The problem can’t fall on the shoulders of consumers.”

Thanks for reading. Did someone forward you this newsletter? Sign up here.