Consolidated statement of financial position

- 1. Corporate Financial Accounting (2201) Consolidated statement of financial position Mathematical problems and solutions 2016 Sakib AhmedAnik On behalf of the Group 3 (Dynamic) 4/18/2016 Submitted To : Mohammad Salah Uddin Lecturer Department of AIS Jagannath University

- 2. LETTER OF SUBMISSION April 18, 2016 Mohammad Salah Uddin Lecturer Department of Accounting & Information Systems Jagannath University, Dhaka, Bangladesh Subject: Letter of Submission. Sir, It is an enormous pleasure to submit my assignment titled “Consolidated Statement of Financial Position” assigned as a requirement of our course related. In preparing this assignment we have acquired much knowledge about corporate financial statement. We have tried our best to furnish the assignment with the mathematical problems and solutions which we’ve gathered by group study. We hope this assignment will help the corporate sector to gather some insights on the consolidated statement of financial position and to do further studies in this aspect. We would like to convey our tributes to you and thank you for giving us the opportunity to work on this topic. Your queries in this aspect will highly be expected. Thank you Sincerely yours Sakib Ahmed Anik On behalf of the group 3 (Dynamic) Section: A Session: 2013-2014 Department of AIS Jagannath University, Dhaka,Bangladesh

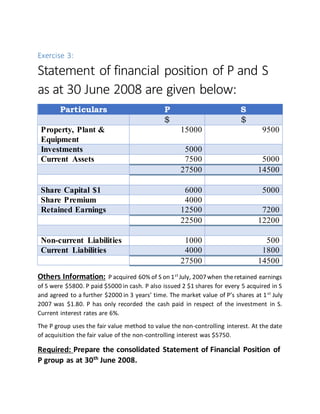

- 4. Exercise 3: Statement of financial position of P and S as at 30 June 2008 are given below: Particulars P S $ $ Property, Plant & Equipment 15000 9500 Investments 5000 Current Assets 7500 5000 27500 14500 Share Capital $1 6000 5000 Share Premium 4000 Retained Earnings 12500 7200 22500 12200 Non-current Liabilities 1000 500 Current Liabilities 4000 1800 27500 14500 Others Information: P acquired 60% of S on 1st July, 2007when theretained earnings of S were $5800. P paid $5000 in cash. P also issued 2 $1 shares for every 5 acquired in S and agreed to a further $2000 in 3 years’ time. The market value of P’s shares at 1st July 2007 was $1.80. P has only recorded the cash paid in respect of the investment in S. Current interest rates are 6%. The P group uses the fair value method to value the non-controlling interest. At the date of acquisition the fair value of the non-controlling interest was $5750. Required: Prepare the consolidated Statement of Financial Position of P group as at 30th June 2008.

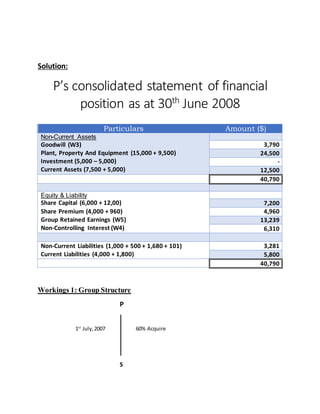

- 5. Solution: P’s consolidated statement of financial position as at 30th June 2008 Particulars Amount ($) Non-Current Assets Goodwill (W3) Plant, Property And Equipment (15,000 + 9,500) Investment (5,000 – 5,000) Current Assets (7,500 + 5,000) 3,790 24,500 - 12,500 40,790 Equity & Liability Share Capital (6,000 + 12,00) Share Premium (4,000 + 960) Group Retained Earnings (W5) Non-Controlling Interest (W4) 7,200 4,960 13,239 6,310 Non-Current Liabilities (1,000 + 500 + 1,680 + 101) Current Liabilities (4,000 + 1,800) 3,281 5,800 40,790 Workings 1: Group Structure P 1st July,2007 60% Acquire S

- 6. Workings 2: NetAssets of S (Subsidiary) Particulars @ Acquisition @ Reporting Share Capital 5,000 5,000 Retained Earnings 5,800 7,200 10,800 12,200 Workings 3: Goodwill Particulars Amount ($) Parents Holding at fair value: Cash Paid Share Exchange (60% × 5,000 × 2/5 × 1.80) Deferred Consideration (2,000 × 1/𝟏. 𝟎𝟔 𝟑 ) 5,000 2,160 1,680 8,840 NCI value at Acquisition 5,750 14,590 Less: Fair Value of net assets at acquisition (W2) (10,800) Goodwill on Acquisition 3,790 Workings 4: Non-controlling Interest Particulars Amount ($) NCI value at acquisition (W3) 5,750 NCI share of post-acquisition reserves (W2) (40% × (7,200 – 5,800)) 560 6,310 Workings 5: RetainedEarnings Particulars Amount ($) P’s Retained earnings 12,500 Deferred consideration finance cost (101) S’s Retained earnings (60% × (12200 – 10800)) (W2) 840 13,239

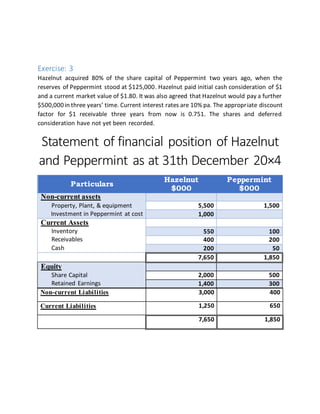

- 7. Exercise: 3 Hazelnut acquired 80% of the share capital of Peppermint two years ago, when the reserves of Peppermint stood at $125,000. Hazelnut paid initial cash consideration of $1 and a current market value of $1.80. It was also agreed that Hazelnut would pay a further $500,000in three years’ time. Current interest rates are 10% pa. The appropriate discount factor for $1 receivable three years from now is 0.751. The shares and deferred consideration have not yet been recorded. Statement of financial position of Hazelnut and Peppermint as at 31th December 20×4 Particulars Hazelnut $000 Peppermint $000 Non-current assets Property, Plant, & equipment Investment in Peppermint at cost 5,500 1,500 1,000 Current Assets Inventory Receivables Cash 550 100 400 200 200 50 7,650 1,850 Equity Share Capital Retained Earnings 2,000 500 1,400 300 Non-current Liabilities 3,000 400 Current Liabilities 1,250 650 7,650 1,850

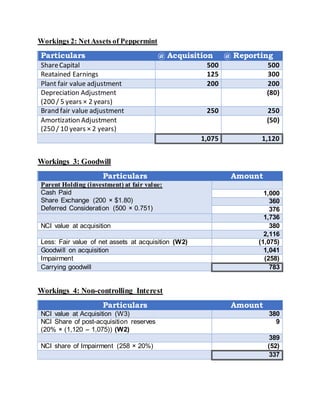

- 8. Further Information: 1) At acquisition the fair values of Peppermint’s plant exceeded its book value by $200,000. The plan had a remaining useful life of five years at this date. 2) For many years Peppermint has been selling some of its products under the brand name of “Spearmint”. At the date of acquisition the direcors of Hazelnut valued this brand at $250,000 with a remaining life of 10 years. The brand is ot included in Peppermint’s statement of financial position. 3) The consolidated goodwill has been impaired by $258,000. 4) The Hazelnut Group values the non-controlling interest using the fair value method. At the date of acquisition the fair value of the 20% non-controlling interest was $380,000. Prepare the consolidatedstatementof financialposition as at 31st December 20×4.

- 9. Solution: Hazelnut Consolidated statement of financial position at 31st December 20×4 Particulars Amount $000 Non-Current Assets: Goodwill (W3) Brand Name (W2) PPE 783 200 7,120 Current Assets: Inventory (550 + 100) Receivables (400 + 200) Cash (200 + 50) 650 600 250 9603 Equity & Liability: Share Capital (2,000 + 200) Share Premium (0 + 160) Retained Earnings (W5) Non-Controlling Interest 2,200 160 1,151 337 3,848 Non-Current Liabilities (3,000 + 400) 3,400 Current Liabilities (1,250 + 650) 1,900 Deferred Consideration (376 + 79) 455 9603 Workings 1: Group Structure Hazelnut 2 years ago 80% acquire Peppermint

- 10. Workings 2: NetAssets of Peppermint Particulars @ Acquisition @ Reporting ShareCapital 500 500 Reatained Earnings 125 300 Plant fair value adjustment 200 200 Depreciation Adjustment (200 / 5 years × 2 years) (80) Brand fair value adjustment 250 250 Amortization Adjustment (250 / 10 years × 2 years) (50) 1,075 1,120 Workings 3: Goodwill Particulars Amount Parent Holding (investment) at fair value: Cash Paid Share Exchange (200 × $1.80) Deferred Consideration (500 × 0.751) 1,000 360 376 1,736 NCI value at acquisition 380 2,116 Less: Fair value of net assets at acquisition (W2) (1,075) Goodwill on acquisition 1,041 Impairment (258) Carrying goodwill 783 Workings 4: Non-controlling Interest Particulars Amount NCI value at Acquisition (W3) 380 NCI Share of post-acquisition reserves (20% × (1,120 – 1,075)) (W2) 9 389 NCI share of Impairment (258 × 20%) (52) 337

- 11. Workings 5: Group Retained Earnings Particulars Amount Hazelnut Retained Earnings 1,400 Unwind discount (W6) (79) Peppermint (80% × (1,120 – 1,075)) 36 Impairment of goodwill (80% × 258) (W3) (206) 1,151 Workings 6: Unwinding of discount Present value of deferred consideration at acquisition 376 Present value of deferred consideration at reporting date 455 79