The world’s 50 biggest miners are now worth $1.5 trillion, up $76 billion during Q3 as gold miners climb the rankings and Chinese mining stocks get a late boost.

At the end of the third quarter of 2024, the MINING.COM TOP 50* ranking of the world’s most valuable miners had a combined market capitalization of $1.51 trillion, up just under $76 billion from end-June, largely on the back of gold and royalty stocks.

The total stock market valuation of the world’s biggest mining companies is up a fairly modest 8% year to end-September and despite the good run is still $240 billion below the peak hit in the second quarter of 2022.

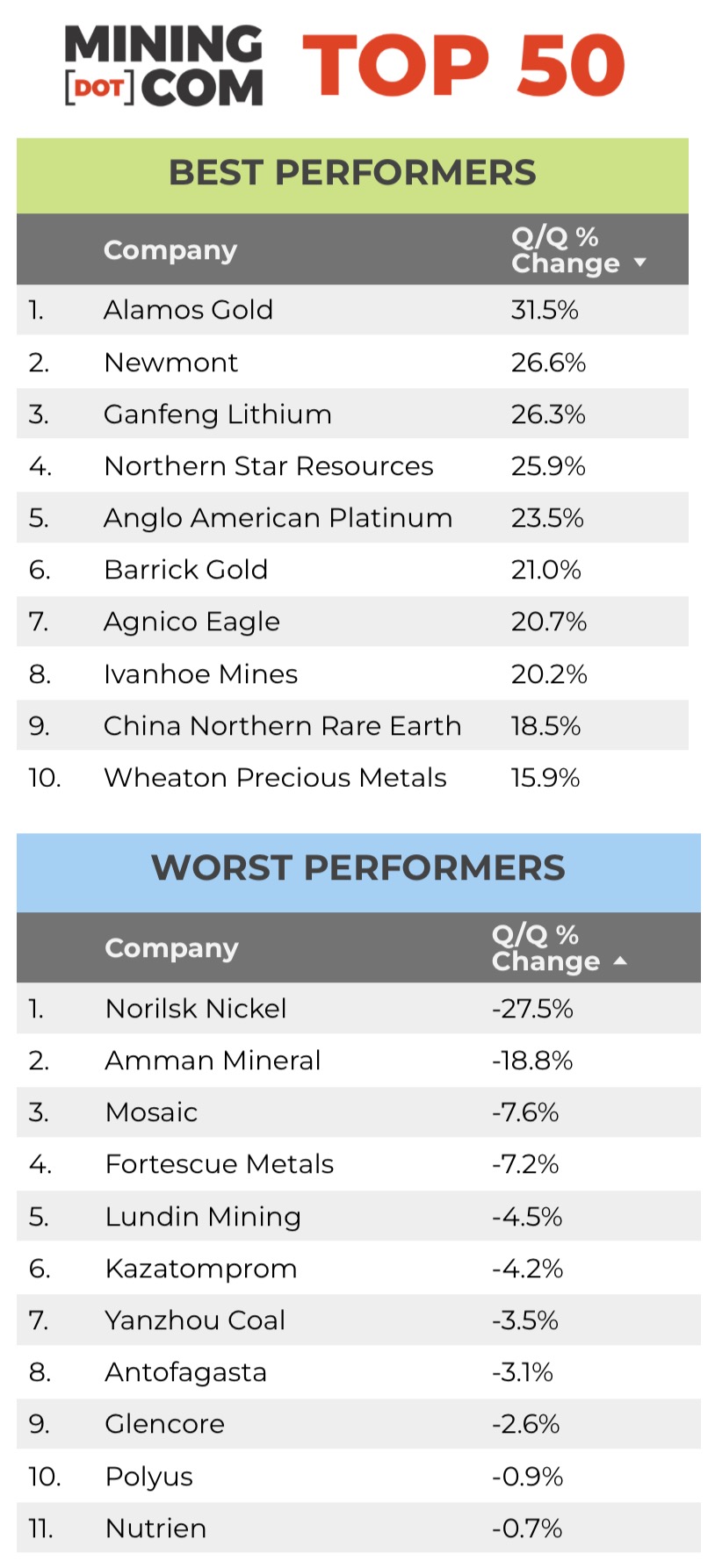

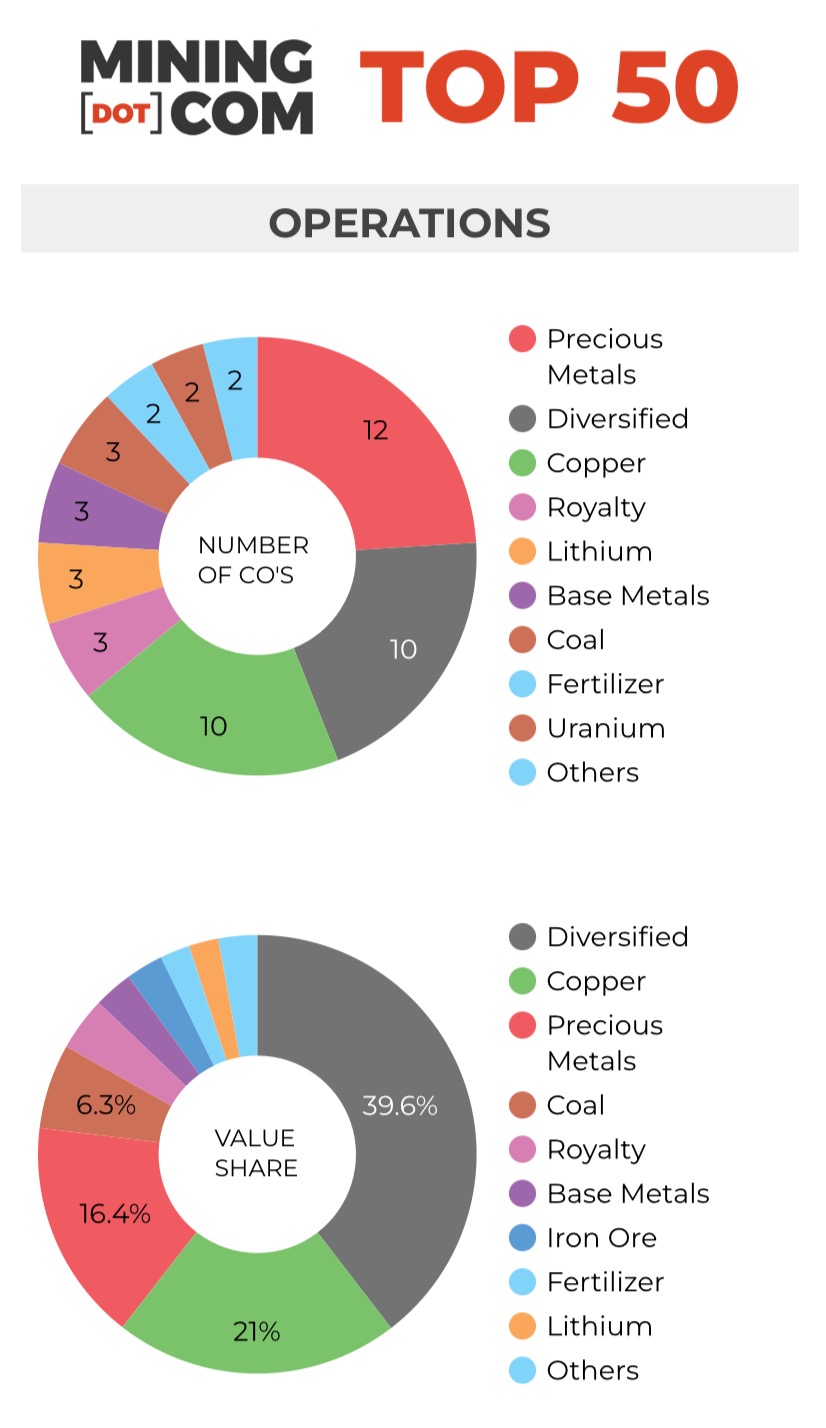

The value of precious metals and royalty companies climbed by a combined $42 billion or 16% during the quarter and gold counters dominate the best performing ranks.

Were it not for the limited tradability of stock in Russia’s Polyus, which lost some ground over the three months despite gold’s stellar performance, bullion’s effect on the Top 50 would have been even more pronounced.

Canada’s Alamos Gold joins the top 50 for the first time with a more than 31% jump in value lifting it six places to number 48 with a valuation of $8.2 billion at the end of the quarter while the second quarter’s newcomer Pan American Silver (following its absorption of Yamana Gold) hangs on at no 50.

Alamos Gold last month raised its production guidance by over 20% for 2025-2026 with the inclusion of the Magino mine and its integration with its Island Gold operation in Ontario. The Toronto based miner has long term ambitions to grow its production base to 900,000 ounces per year.

Uzbekistan is readying an IPO for Navoi Mining and Metallurgy Combinat – the world’s fourth largest gold mining company and significant uranium producer in 2025. NMMC debuted a $1 billion bond offering last week, marking the first global debt market issuance from a gold mining company since June 2023.

Navoi should easily join the ranks of gold producers in the top 50 thanks to ownership of the world’s largest gold mine, Muruntau, and annual production of 2.9 million ounces at grades and per ounce extraction costs the envy of the sector.

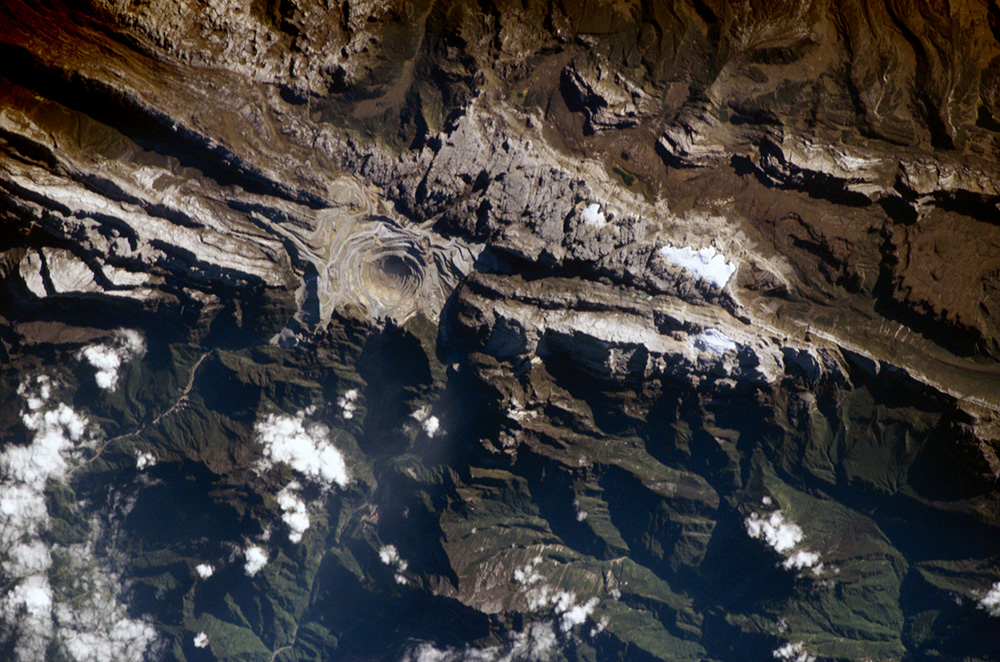

The Muruntau open pit mine southwest of the Kyzylkum desert, originally developed during the Soviet era as a source of uranium, has estimated reserves of around 130 million ounces of gold.

Copper specialists, and those with fat gold credits, have gained a combined 36% year to date as the copper price continues to flirt with the $10,000 a tonne level but momentum slowed dramatically during Q3 with the group contributing only $7.2 billion in added market worth during the quarter.

Amman Mineral’s fierce rally also came to an abrupt halt during the quarter with the counter losing 18% over the three months and coming close to falling out of the top 10.

Investors who bought Amman, owner of the world’s third largest mine worldwide in terms of copper equivalent, at the IPO price in Jakarta a year ago, are still enjoying 400% gains since then however.

Southern Copper’s position as the world’s third most valuable mining stock seems entrenched after a double digit percentage gain in Q3 compared to a much more sedate performance by Freeport-McMoRan which now has to gain a full $20 billion in market cap to haul in its Mexico City-based rival.

Rio Tinto’s vote of confidence in the long term future of the lithium sector (and its own ability to make M&A work) dominated the news at the start of the December-quarter but it’s worth noting that Arcadium’s more than 90% surge since the all-cash offer was first announced are not enough for the stock to enter the rankings.

Three lithium counters exited the rankings this year, Australia’s Pilbara Minerals and Mineral Resources and China’s Tianqi Lithium as the deep slump in prices for the battery metal continues to take its toll.

Last quarter’s no 50, Ganfeng Lithium jumps six places after being swept up in the stimulus-induced rally on Chinese stock markets at the end of the quarter while Tianqi’s performance so far in October should see it reenter the Top 50 in due course.

Ganfeng was barely holding on at position 50 at end-June and with gold price momentum continuing and two gold mining companies waiting in the winds – Yintai and Alamos – only three lithium counters in the top 50 may be a reality for some time to come.

After peaking in the second quarter of 2022 with a combined value of nearly $120 billion, the remaining lithium stocks’ market value has now shrunk to $34 billion.

Despite a modest improvement during the quarter, the mining industry’s traditional big 5 – BHP, Rio Tinto, Glencore, Vale and Anglo American – remain in the red for 2024, losing $24 billion since the start of the year.

The big 5 diversifieds now make up 29% of the total index, down from a height of 38% at the end of 2022.

Iron ore’s less than rosy outlook – the late boost China’s recent stimulus package notwithstanding – saw Fortescue once again feature on the biggest losers list and Cleveland Cliffs exit the ranking with the US iron ore miner’s 37% decline this year exacerbated by its inability to capitalize on the blocking of the Nippon-US Steel tie up.

Iron ore’s representation in the top 50 have diminished in the last couple of years – Brazil’s CSN Mineração dropped out during Q1 this year while Anglo-controlled and separately-listed Kumba Iron Ore has lost touch with the top tier after a 40% fall year to date.

Click on image for full size table.

NOTES:

Source: MINING.COM, stock exchange data, company reports. Share data from primary-listed exchange at close Oct 4, 2024 close of trading converted to US$ where applicable. Percentage change based on US$ market cap difference, not share price change in local currency.

As with any ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining (the gold and uranium giant may list later this year), Eurochem, a major potash firm, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals on the basis of their deep involvement in the industry.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy or Bayan Resources where power, ports and railways make up a large portion of revenues pose a problem. The revenue mix also tends to change alongside volatile coal prices. Same goes for battery makers like China’s CATL which is increasingly moving upstream, but where mining will continue to represent a small portion of its valuation.

Another consideration is diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting. Similarly we excluded Hindustan Zinc which is listed separately but majority owned by Vedanta.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.

2 Comments

Robert

Interesting, is it not that the top 50 mining stocks’ capitalisation only amounts to 1/4 of the $USD created from thin air in one year.(or for that matter, that none of the men toiling to dig it from the bowels of the art demand to be paid in specie, as was the norm, for example as recently as during the excavation of the Panama Canal)

Stanley Slawski

It would be nice if the list of mining stocks only contained mining stocks. Cleveland Cliffs (ranked as the 2nd worst performing stock) hasn’t been an iron ore company for some two years now. They are a vertically integrated steel company, that happens to mine ore, solely for their own mills.