Inside the legal drama embroiling a Pasadena startup that grossed billions selling COVID tests

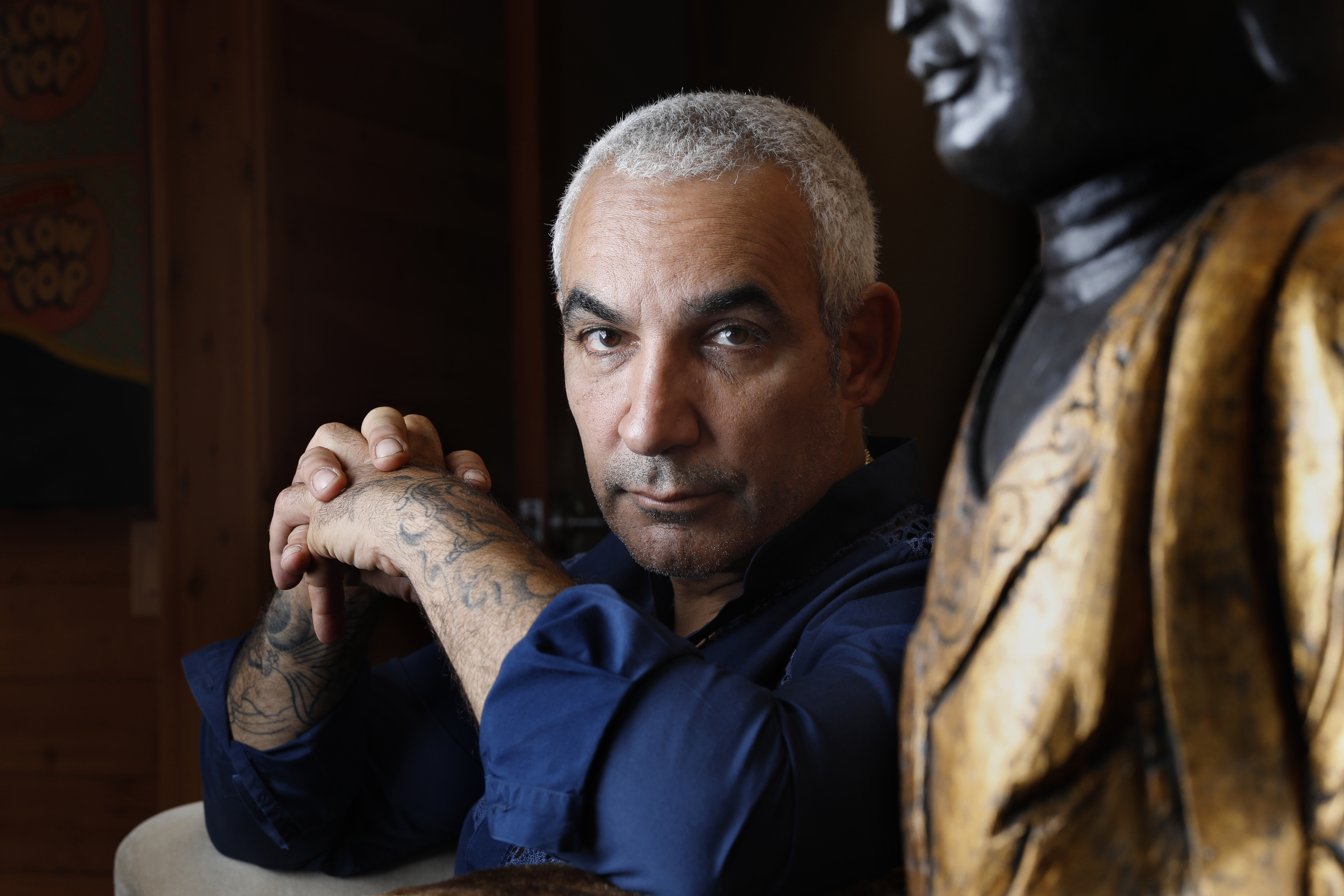

A script for a biopic called “Overnight Billionaire” recounts the extraordinary life of Charles Huang, a Chinese villager who overcomes long odds to educate himself and become a Hong Kong corporate analyst.

After immigrating to Los Angeles, Huang builds a COVID-testing company that is key to the United Kingdom weathering the pandemic.

The draft concludes on a high note, with a TV host acknowledging to the now-fabulously wealthy Huang that his story is “one in a billion.”

Reality has been less rosy for the real-life Huang.

After securing a lucrative testing deal with the British government, Huang and his partners have become embroiled in multiple legal disputes over at least $2 billion Pasadena-based Innova Medical Group earned in profits during the pandemic.

Innova Medical Group in Pasadena secured contracts worth at least $2.7 billion selling Chinese-made antigen tests to the U.K. government despite questions over their accuracy.

Huang has alleged in civil lawsuits that two former executives defrauded Innova of more than $100 million, which they have denied. One of those executives accused Huang of squandering company funds to finance “a lavish lifestyle, half-cocked business gambles and luxuries for his friends and girlfriends,” according to a Los Angeles County Superior Court lawsuit filed last year by Robert Kasprzak. “Huang is a high-end con artist who claims he can see the future,” the lawsuit says.

Another lawsuit, filed by Kening Xu, one of Huang’s former business associates, accuses Huang of treating Innova’s private equity parent as his “personal property,” awarding himself and others more than half its shares while making “numerous reckless investments.” Huang has denied the claims.

The unusually contentious litigation includes at least 10 state and federal lawsuits, among them a sexual battery complaint filed against Huang by a former employee, which he has denied. Huang also alleges he was the victim of an extortion plot being prosecuted in Pasadena that involves a purported sex tape.

Huang did not respond to a detailed list of questions, but in a statement Innova disputed the claims.

“These baseless accusations come from people who have either engaged in unlawful or improper activity, vastly overstated their contributions to the company, or claim to be entitled to millions of dollars they neither earned nor deserve. The companies and Dr. Huang choose to litigate these matters in the proper venue, a court of law, when they expect to be completely vindicated and to see justice served,” the statement said.

The controversy — a familiar tale of what can happen to a startup suddenly flush with success and money — has renewed scrutiny of Innova and its antigen test. In 2021, the Food and Drug Administration said the tests lacked adequate trial data and “could present a serious risk to the public health.” The company later resolved those issues with the agency.

The British government stuck by Innova, citing its own studies, but questions have lingered about the test’s efficacy and how the business was able to win such large contracts. An independent inquiry into that country’s pandemic response is expected to include the contracts with Innova.

“This was an enormous sum of money that was spent, and we still don’t understand how Innova came to be chosen,” said barrister Jo Maugham, founder of the Good Law Project, a U.K. legal advocacy group.

Humble beginnings in rural China

Huang, 60, grew up in a poor village outside Wuhan, China. The oldest son of a large family, he managed to gain entrance to Wuhan University and go on to receive an MBA and a doctorate in marketing at the University of Strathclyde in Scotland, according to a translated interview he gave to ODK Media, an Asian streaming service.

He headed to Hong Kong, where he worked on and off for more than a decade as an analyst, including covering the automotive and pharmaceutical industries. He boasts on the website of his Pasaca Capital private equity firm that he predicted the Asian financial crisis in 1997.

Huang also partnered with Yang Rong, the billionaire founder of Brilliance Group, a Chinese vehicle maker. Yang, also known as Benjamin Yeung, fled China in 2002 after getting into a dispute with a Communist Party leader, settling in the upscale San Gabriel Valley community of Bradbury.

Huang eventually settled with his family nearby in Arcadia. In 2009, the two men proposed building a $4-billion hybrid vehicle plant in Baldwin County, Ala., but the project fizzled.

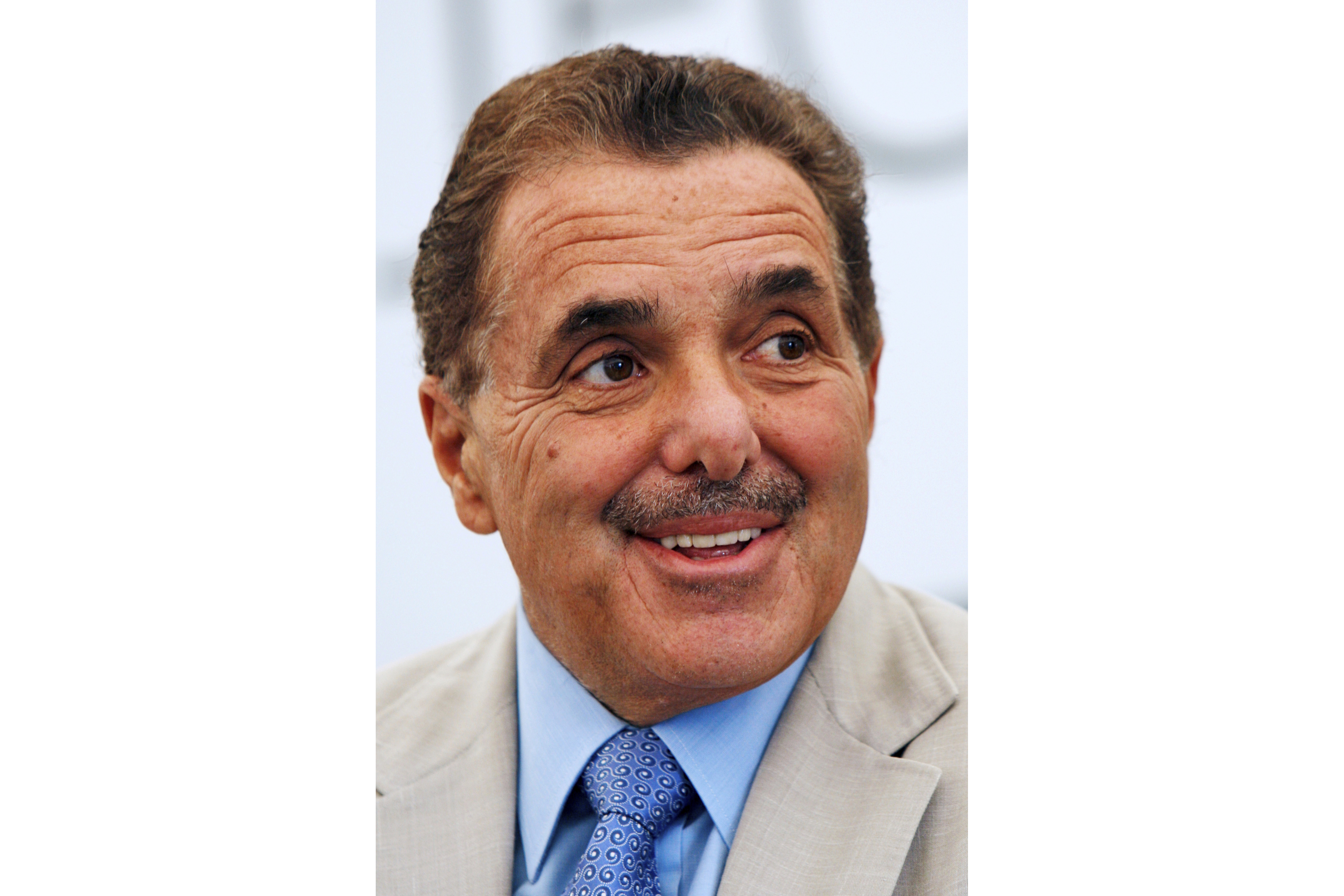

In 2016, Huang formed Pasaca Capital Inc. to look for acquisitions, and later reconnected with an old business associate: Daniel Elliott, an entrepreneur and engineer who also had ambitions to make it big.

Elliott, who grew up in Rancho Dominguez in L.A. County, forged a career in battery technology and electric vehicles. In 2007, he was invited to the White House, where he advised President George W. Bush on electrifying the transportation sector.

Later, he was the chief executive of a company that proposed building a $372-million battery plant in eastern Kentucky, but the project ended up in bankruptcy.

Elliott, 52, said Pasaca was in negotiations to buy Sandoz, the generic pharmaceutical business of the Swiss drug company Novartis, when the pandemic struck and Huang pitched another idea.

“Charles called me in January [2020], and said, ‘Hey, do you want to get into the COVID-testing business?’ and I was like, ‘What the hell do I know about COVID testing?’” Elliott recalled.

Soon convinced, Elliott called on an old friend for help: Kasprzak, an attorney he had worked with on past ventures.

A promising antigen test

Huang incorporated Innova Medical Group as a subsidiary of Pasaca in March 2020.

The partners first tried to sell off-the-shelf tests that detect antibodies created by the SARS-CoV-2 virus that causes COVID-19.

When that didn’t work, Elliott said, he called Dr. Deborah Birx, President Trump’s coronavirus response coordinator. She told him what were needed were tests that could detect antigen proteins produced by the immune response to COVID that could be done at home.

Birx said that she doesn’t recall the conversation but that at a White House meeting on March 4, 2020, she told a group of pharmaceutical executives that they needed to make the tests, with Abbott Laboratories producing its BinaxNow test by June.

Innova scoured Asia for test makers, settling on Xiamen Biotime Biotechnology in Xiamen, China. A deal was reached for the company to make 1 billion tests, Elliott said.

Elliott said he called governments around the world and made headway in Britain, with Innova submitting tests for evaluation by Operation Moonshot, a program in then-Prime Minister Boris Johnson’s administration that involved mailing millions of antigen tests to households.

Innova needed a U.K. company to submit its application and hand-deliver tests to a government laboratory evaluating drug company submissions, Elliott said. Innova reached a deal with Disruptive Nanotechnology Ltd. “I probably was sleeping two hours a night,” recalled Elliott, who said he was constantly on the phone with government officials and the prime minister’s offices at 10 Downing St.

Dr. Tim Peto, an Oxford University scientist who led the initial government study, said Innova was chosen after its test “passed the threshold of performance” and the company showed it could supply large quantities. “It wasn’t taken forward because it was clearly the best of the bunch,” he said.

On Sept. 17, 2020, the government placed an initial $138-million order for tests, with Innova delivering 18 million in 15 days, Elliott said. The British military flew to China to receive them from Biotime.

In the ODK YouTube video, Huang called it his “proudest moment.” “Despite numerous challenges, we conquered them all,” he said.

In all, Innova would deliver about 2 billion tests to the British government, Elliott said, with the company signing additional contracts.

The total revenue from the contracts was at least $5 billion, according to a U.K. government website, with Xu claiming in his lawsuit that profits from the government contract topped $2 billion. Elliott said 178 improvements were made to the test, with the company selling them in smaller quantities in about 20 countries, including France, Brazil and Qatar.

The incredible success was liberating after all the struggles to raise funds, Huang told ODK Media: “We no longer have to seek money from investors, as we are investors ourselves.”

A financial windfall

One of Innova’s early acquisitions, Elliott said, was MPS Medical, an Orange County company it wanted to employ for making antigen tests for the U.S. market, which it didn’t pursue. Former British Prime Minister Tony Blair was hired as a consultant to assist in expanding business internationally.

“I thought we were there to build a legacy company that my kids could work in,” Elliott said. “We were buying other technologies and other companies.”

Huang leads multiple businesses, according to a spokesperson, including drug distributor Mullan Pharmaceutical and Nanojet Technologies, a high-tech disinfectant company. Pasaca also operates a jet charter service.

With his newfound wealth, Huang displayed remarkable generosity, buying Elliott a $110,715 Patek Philippe watch and giving Kasprzak a $163,705 Breguet watch, according to lawsuits filed last year against the two men in Nevada by Pasaca and Innova.

His philanthropic aspirations were even larger. In September 2021, he gave $70 million to the University of Strathclyde. An additional $40 million was donated to Wuhan University. He was recognized as Philanthropreneur of the Year in 2021 by the California Assembly.

But Elliott said he was becoming frustrated with how the company was being run and in April 2021 sent a memo, reviewed by The Times, to board members expressing his concerns.

Elliott resigned May 1, 2022, after negotiating a severance package that included $62.5 million in cash for his Pasaca stock, a Gulfstream jet and the forgiveness of $19.5 million in company loans, according to the Nevada lawsuit filed against him. He had previously received $63 million in dividends and additional compensation, the lawsuit said.

Kasprzak, Innova’s chief legal officer, was named the company’s chief executive, and it seemed like a good fit. In the ODK YouTube video, he praised Huang as a “visionary.”

The honeymoon didn’t last long.

Kasprzak in his lawsuit says he reached an agreement with Huang to buy out his Pasaca shares for at least $75 million as part of his exit agreement. However, he alleges he was terminated in September and defamed by Huang, who said he was taking over as interim chief executive in an companywide email that stated: “I have zero tolerance for internal and external corruption, racial discrimination, sexual harassment and all other bad behaviors.”

An Innova representative denied the email was defamatory, saying Huang was making only a “statement of principles” and that section of the email was not “directed to any person in particular.”

Allegations of stolen funds

Huang alleged he had learned that commissions he believed were going to Disruptive Nanotechnology and Nano LiquiTec, another Innova intermediary, were actually stolen by Elliott and Kasprzak, according to the Nevada lawsuits filed against the men.

The lawsuits accused the men of setting up a company in October 2020 called Nano Holdings — a name they assert was intended to confuse Huang — to skim 2% of commissions from the U.K. test sales.

A total of $106 million is alleged to have been stolen, largely through that scheme.

The lawsuit against Elliott cites messages between the two men allegedly discussing the “scheme,” including a WhatsApp message Elliott sent to Kasprzak on the day he asked Huang to sign the Nano Holdings commission agreement: “You and I will make $10m EACH! In our side business this year.”

The messages are presented out of context, said Elliott’s attorney, Mark Holscher. Elliott alleges that Huang knew and agreed to the creation of Nano Holdings as a way to increase the two men’s compensation without other Innova and Pasaca employees finding out and demanding additional compensation.

Two Pasaca business associates have signed sworn declarations viewed by The Times stating that Huang told them he knew the Nano commission payments were going to Elliott and Kasprzak, Holscher said. Huang has denied such knowledge.

Kasprzak also states in a declaration in response to the Nevada lawsuit filed against him that Huang knew the details of the Nano Holdings venture. He is alleged to have made $77 million in compensation and other benefits in addition to the stolen commissions. Kasprzak then filed his own L.A. County lawsuit in April 2023 accusing Huang of misappropriating funds from the company.

The lawsuit said the allegations of wrongdoing against him were a pretext to fire him without paying him the $75 million for his shares — despite his allegations that Innova’s success was largely due to his and Elliott’s efforts. The lawsuit cites a letter sent by Boris Johnson’s secretary of state for health and social care to the two men, applauding their “hard work” and “diligence” in securing the antigen tests. It does not mention Huang.

The lawsuit further states that Huang took advantage of his control over Pasaca and Innova to divvy up ownership shares to his benefit, transfer $200 million to bank accounts in Hong Kong and Singapore and make more than $200 million in bad investments.

Huang also is accused of spending funds on private jets, an $18-million Bradbury mansion dubbed the “CEO house,” to hire mistresses and to produce the “fictionalized and idealized” “Overnight Billionaire” movie project. All in all, it says that more than $1 billion was transferred out of Innova to Pasaca.

An Innova representative said all the allegations against Huang are false.

The Elliott and Kasprzak disputes are now being heard in separate arbitration cases. Kasprzak declined an interview through his attorney, Chris Casamassima, who said his client “did not receive any improper compensation from Pasaca or anyone else, and to the contrary, he is still owed a substantial sum of money.”

Also in arbitration is the lawsuit by Xu, 61, who is the nephew of Yang, Huang’s former business partner. He is demanding $400 million, or about a fifth of the alleged profits, as one of the five “co-venturers” of the enterprise. Huang denies he owes the money.

Last week, two former Pasaca executives filed a federal lawsuit in L.A. against Huang citing accusations in Kasprzak’s complaint and seeking hundreds of millions of dollars in restitution. Huang denied any wrongdoing.

Disruptive Nanotechnology has sued Elliott, Kasprzak and Huang, as well as Pasaca and Innova, alleging it was defrauded out of $500 million when its commissions were reduced. Elliott, Kasprzak and Huang deny any wrongdoing.

Amid the legal wrangling, Huang found himself the target of an alleged extortion plot. In May 2023, the Los Angeles County district attorney’s office filed felony extortion charges against a married couple and Sunny Sun, a former Pasaca employee.

The alleged plot involved a purported video of Huang having sex with Sun surreptitiously recorded at a company condo, according to a Los Angeles County Sheriff’s Department investigative report reviewed by The Times. Huang told investigators he had sex with Sun and had been threatened that the video would be posted online unless he paid $20 million, the report said. All three have pleaded not guilty and posted bail. A preliminary hearing has not yet been held.

Garo Madenlian, Sun’s attorney, said he believed his client would be exonerated. “In fact, I think she is the victim,” he said.

Meanwhile, Huang and another Pasaca executive have been accused of sexual battery and sex trafficking in civil litigation filed in April in Los Angeles County Superior Court. The complaint by a Jane Doe alleges she was hired to lead Pasaca’s public relations in 2022 despite a lack of experience. She asserts in the suit she was actually lured to the company to provide Huang sexual services.

An Innova representative said the allegations are false and part of an extortion attempt.

As for “Overnight Billionaire,” an Innova representative said the film was being delayed because of all the litigation.

It has a new title, “One in a Billion,” according to IMDb, which lists the the film as “in development.”

More to Read

Subscriber Exclusive Alert

If you're an L.A. Times subscriber, you can sign up to get alerts about early or entirely exclusive content.

You may occasionally receive promotional content from the Los Angeles Times.