Introduction

The pandemic-accelerated rise of mobile, coupled with an exploding volume of gaming options and demand from users — has driven gaming marketers to invest heavily in creative user acquisition and an engaging and delightful user experience.

The mobile game vertical continues to grow at an astonishing pace, setting standards for every other vertical on mobile. According to our recent study, the number of total gaming apps installed on Android increased by 22% in 2021 compared to the previous year, proving the pandemic played a key role in introducing gaming to the masses.

Gaming apps are channeling more of their budgets into user acquisition (UA). $14.5B were spent on UA by gaming apps in 2021 (excluding China), with the US taking up half of global budgets. At the same time, privacy changes led to a 13% YoY drop in iOS compared to a 35% jump in Android, leading to an overall rise of 18%.

The trailblazing nature of gaming apps is rooted in the savviness of their marketing teams. Working in tandem with development, many have cracked the code of stickiness in the face of high uninstall rates and low retention. The competitive nature of the gaming space has led them to embrace data, with a laser-focused mindset on profitability.

That said, limited user level data in the age of privacy has challenged gaming apps to perform in an aggregate data reality.

Since data is the fuel that powers the gaming performance engine, a deep-dive into the key ingredients of mobile measurement and marketing analytics as it applies specifically to gaming is in order, and that’s what this guide is all about.

Let’s jump in!

Getting started with mobile measurement? Read our intro guide here

Top 5 challenges

The gaming ecosystem has changed rapidly over the course of the last decade, with new genres, UA strategies, monetization methods, and prediction models.

We’ve all seen it over and over again — someone devises a new type of game or pushes the envelope in terms of what’s possible with app marketing, and before you know it, developers and marketers across all genres have followed suit.

This evolution has brought continued growth to the gaming vertical, but also created a long list of challenges, among which:

1 – Fierce competition

The rapidly growing number of mobile games has created a hyper competitive landscape. On one hand, it forces developers to go the extra mile and create new games, new features, and new strategies, which is the primary reason why gaming is the most productive vertical.

But on the other hand, it leads to a hyper state of consolidation where mega studios acquire smaller ones, stymied app store discovery, and UA strategies that are downright aggressive.

2 – High user expectations

The evolution of the mobile gaming ecosystem not only resulted in more games being developed, but also increased the number of actual users who switch between one game to the next and do so relatively quickly.

Typically, mobile players are less tolerant of games that fail to deliver the experience they’re looking for. As our data shows, today’s players uninstall more gaming apps than any other app (mostly on Day 1), while their retention rates are not favorable to say the least.

3 – Data complexity

An increase in the number of games and users calls for a robust variety of segments, campaign types, creatives, and in-app events.

The result: a massive amount of data.

Big data analysis that aims to optimize performance — whether in real time, on an ongoing basis, or for the purpose of building predictive models — is therefore a significant challenge.

Gaming app marketers deal with this challenge either by using external tools or, if they have the resources, develop in-house solutions and hire data talent to deliver on their KPIs.

4 – Mobile measurement in the age of privacy

Over the past few years, privacy has taken center stage in mobile app marketing, and particularly for iOS (Android’s changes are at least two years away).

Apple’s introduction of the ATT prompt, which severely limited the usability of its unique identifier, the IDFA. As a result, user-level data has become much less readily available.

App owners can now turn to a host of new and not so new solutions to be able to regain granular, actionable insights. These include:

- SKAdNetwork – Apple’s deterministic aggregated attribution solution. Within this framework, SKAN conversion values allow marketers to to grade user value after the install.

- User-level deterministic attribution – ATT opt-in rates are around 47% for many shopping apps, which not only enable full data granularity for these users, but also the ability to segment towards non-consenting audiences.

- Aggregated probabilistic modeling – a statistical technique that leverages machine learning to estimate campaign performance with a high level of accuracy.

- Predictive analytics – allows marketers to make data driven decisions about users’ future value with a high level of confidence, while relying on very limited data points early in the funnel.

- Top-down measurement – holistic methodologies such as Incrementality (identifying incremental revenue drivers in order to optimize budget allocation), and media mix modeling or MMM (measuring the impact of campaigns to help determine how various elements contribute to the bottom line).

- Data Clean Rooms – enabling privacy-compliant measurement and optimization in a highly secure, permission-only environment where advertisers can leverage user level data insights without access to user level data.

These privacy-centered changes have a direct effect on marketers’ ability to measure LTV, remarketing campaigns, and segment audiences. Luckily — innovation is continuing to lead the measurement front with confidence, as data shows it has been largely restored to pre-ATT levels.

5 – Fraud

Among all verticals, the gaming sector is the least impacted when it comes to fraudulent install rates, which is primarily because gaming businesses are savvy and know how to protect themselves from fraud, but also because their CPI payouts are low compared to shopping or finance apps.

According to AppsFlyer data, the average fraudulent install rate stands at 2% across gaming apps (as in 2% of gaming app installs are in fact fake). In-app fraud, however, is a different story, and stands at an average of 5% across all gaming apps, with in-app fraud rate of 11% in Android and 13% in iOS.

For more information about how AppsFlyer uses both machine learning and big data to combat fraud, read here.

The solution – Granular measurement as the foundation for everything

So, what does it take to overcome these challenges? The short answer is a variety of data tools (internal, external or both), staying current with constant industry changes and trends, and maintaining an innovative always-be-testing kind of mindset.

Success boils down to making the right decisions that drive a positive return on ad spend, while meeting constant demand for growth.

Not an easy task when there are hundreds of thousands of competitors, but this guide is here to help.

Chapter 1

What to measure

What exactly should you measure, configure and set-up to gather the right data to inform actionable marketing analytics for your game? Chapter 1 has the answers.

Key Performance Indicators

There’s a wide range of KPIs to measure within mobile gaming, but only a several are invaluable when it comes to measuring metrics against the most important goal of a gaming app marketer — acquiring new and profitable users at scale.

Here’s the lowdown on which metrics to measure when you’re focusing on UA:

| KPI/Term | Definition | Why it’s important |

| eCPM (Effective Cost Per Mille = 1000 impressions) | The revenue generated per 1,000 impressions. To calculate eCPM, divide the total earnings from advertising by the total number of impressions and multiple by 1,000 | Offers a basic approach to evaluating the quality of your traffic and determines your CPM. CPM: Rate advertiser is willing to pay for 1,000 impressions; eCPM is the publisher earnings per 1,000 impressions |

| CPI (Cost Per Install) | The cost of generating one new install | Affected by many variables, such as geography, platform, and device, and is used to determine the price of acquiring a new user |

| IPM (Install Per Mille) | The number of installs generated for every 1,000 impressions. Calculated as (installs/impressions)*1,000 | Helps evaluate the performance of a campaign. The higher the IPM, the more effective it is. A low IPM can indicate low user engagement with your creative, which means you should better optimize your targeting or change the creative itself (read more) |

| RPM (Revenue Per Mille) | The amount of ad revenue an app earns from serving 1,000 impressions in its media properties. Calculated as (Ad Revenue/impressions)*1000 | Unlike RPC (Revenue Per Click), RPM is ideal for campaigns with a goal of increasing exposure and brand awareness, rather than specific user action goals, like installing an app or registering for a service |

| Share of NOIs (Non-Organic Installs) | The percentage of app downloads that happened as the result of a paid or owned marketing activity | Because of the massive competition, most games rely heavily on driving demand through paid / owned channels, and share of NOIs allows you to measure their success rates more efficiently |

| Organic conversion rate | The percentage of conversions driven by non-paid channels, such as organic search, social media, press mentions etc. | Informs your non-paid distribution power and how to drive new users to your app without spending on UA |

| K-Factor | The ratio between paid users to non-paid users who were introduced to the app by paid users (e.g. invitations to your multiplayer game are sent by players to other users) | A high K-Factor indicates a successful app and enables you to reduce your average UA spend per user. If, for example, you paid $3 for one install, and that one install triggered two more installs, you actually paid only $1 dollar for each one (read more) |

| Retention rate | The percentage of players that return to your app during a defined period of time after the install (typically measured at 1, 3, 7, 14, and 30 days after install) | A key indicator of your app’s performance over time. A high retention rate proves your game offers real value to users, which is demonstrated by repeat usage. It’s also the basis of monetization and a key factor in prediction models |

| Churn / Uninstall rate | The rate at which users uninstall your app within X days of an install | Games suffer from the highest uninstall rates. Analyzing this KPI allows you to drill down to factors that lead to app removal, such as poor segmentation or user experience, and calculate your losses for churn (read more) |

| DAU (Daily Active Users) | The number of unique users who use your app at least once per day (note that a single unique user who launches the game 3 times a day is still counted as 1 daily active user) | Helps evaluate the game’s potential once engagement and retention has been increased. Cohorting the number of DAUs can also help evaluate the success of a new feature within your game or in an app store (read more) |

| MAU (Monthly Active Users) | The number of unique users who engage with your app over the course of 30 days (note that a user who engages with a game for 5 days within a 30 days period still counts as 1 monthly active user | Indicates the size of your user base |

| Stickiness | Presents the number of days users visit your app within a 30 days period. Stickiness = (DAU/MAU)*30 | Indicates how relevant and addictive your game is. High stickiness rate derives from users coming back to your app consistently and on a daily basis |

| ARPU (Average Revenue Per User | Calculated by dividing the total revenue generated by the total number of users for a given cohort over a given time frame (e.g. Day 30 ARPU is the average revenue generated by a user within 30 days of an install) | Used to evaluate players’ value and plan UA budgets. ARPU includes all revenue-generating in-app events, such as purchases, ads, subscriptions, and paid-for apps |

| ARPPU (Average Revenue Per Paying User) | Measures only players who made an in-app purchase. The formula is therefore total revenue divided by total number of users who generated revenue | Used to evaluate the efficiency and success rates of existing IAP events, as well as the effect of other events on IAP revenue (e.g. the option to see an ad rather than pay) |

| LTV (Lifetime Value) | The revenue a user generates over the course of the entire time they play the game (calculated as the number of days of engagement * average spend per day) | Together with ARPU, LTV helps evaluate the total value of a game or a user, and is the strongest indication of how much can be spent on UA to meet the goal of LTV > Cost |

| Time to first purchase | The time it takes a user to make the first in-app purchase after installing a game | Helps plan IAP placements and timing during the game flow, and may suggest the need to mix in another monetization model to improve performance |

| Share of paying users | The percentage of installers who ended up making an in-app purchase within a given time frame since installing | This is an indication of the quality of users coming from various media sources, as well as a way to measure the performance of your monetization model |

| ROAS | The metric of profitability. It’s calculated as the money spent on marketing divided by the revenue generated by users in a given time frame (e.g. a Day 7 ROAS of 50% means that a player generated revenue worth 50% of the budget spent to acquire that user) | As a measure of profit, ROAS is the most important metric that UA managers are measured on |

In-app event measurement

In a world of free to play (F2P) games, post-install measurement is key to optimizing user flow. When you create and strategically place in-app events (wrapping up a game tutorial, completing a certain level, engaging with an ad, making a purchase, etc.), you can dive deeply into user activity within the game flow and determine how each action affects revenue.

Armed with this knowledge, you can make better marketing decisions that maximize revenue thanks to optimized UA and re-engagement campaigns.

For example, if you know that users who complete level 10 within a 2 days time frame are predicted to have a high LTV, you can shift budgets to media sources that deliver the highest volume of these users.

What to measure

The following are the most popular events marketing leaders are measuring, sliced by app size (based on number of non-organic installs). This will help to establish your performance goals and guide your marketing strategy, and can also serve as a proof point for developers to configure these events in the SDK.

In addition to measuring certain events frequently, you should also measure the event funnel conversion rate when choosing and designing your in-app events.

Why? Two reasons:

- The intelligence you gather from events within the game flow helps inform UA campaigns. It pinpoints the channels and sources that are more or less likely to drive high-value users, which allows you to better understand the problematic areas in your funnel and re-engage users when it matters.

- This level of intelligence informs product upgrades by monitoring event activity data, which lays the foundation for subsequent engagement goals.

How much to measure?

The number of events to measure is largely determined by the app size and game genre. The larger the game, the higher the number of events that are often mapped and measured.

In addition, in some sub-genres such as Social Casino — where IAP is the primary monetization model — a greater number of events can optimize game flow and performance.

In general, the larger apps typically have:

- Large teams and a robust infrastructure with a BI stack, data analysts, and data scientists to handle the data and extract insights that matter.

- Teams with the knowledge and expertise to understand the importance of granular measurement when working with a massive volume of data.

- A product with depth — which calls for more events to measure.

In-app event data is a must-have for app marketers, and usually — the more the merrier. As we can see, apps that measure a wide range of events perform better, but be sure to have the resources and know-how to be able to crunch large quantities of data!

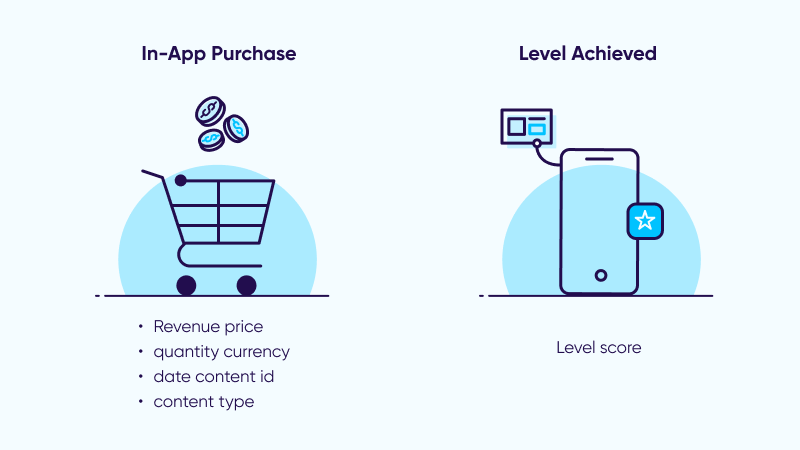

How in-depth should you go when you measure?

The ability to measure user behavior on a granular level and then view aggregated analytics — is the basis of making smart marketing decisions across all acquisition and engagement channels.

Diving deeper into the data involves one more crucial step: defining the right parameters of each in-app event — or turning it into a “rich” in-app event, which can take your optimization and segmentation to a whole new level.

For example:

Imagine knowing that users not only completed a level, but that they completed a crucial one and landed a high score. This data can then be used to engage these users by letting them know they’ve been upgraded to the All Stars membership club — which could be a huge loyalty driver!

Also, if one of your goals is to get users to complete level 5 within a week of installing the app because you’ve found out that it’s a strong indication of high LTV, you can measure the level achieved event “enriched” with the date parameter.

If you want to increase the number of players who have made at least two significant in-app purchases, you’ll want to measure the purchase event “enriched” with the revenue and quantity parameters.

Ultimately, by measuring these rich in-app events, you’ll be able to:

- Understand your players better through deep analytics.

- Set the path towards granular segmentation with networks that are at the forefront of mobile marketing capabilities, creating advanced audiences-based campaigns based on your and your MMP’s real time data.

Uninstall measurement

Our study has shown that Day 30 retention rates in gaming apps witnessed a 10% drop in 2021, and in the competitive app marketing space, it’s no wonder that apps have a hard time retaining users. And in a freemium-dominated space, ongoing usage is absolutely vital to success. Without it, monetization becomes all but impossible.

With too many competitors to count, and increasingly growing user expectations, an app that doesn’t deliver on all fronts — and fast — will simply not stand the test of time.

Uninstalling an app from a device clearly signals that something went wrong as far as the user was concerned. Understanding why, when, and which kind of users uninstall — is nothing short of crucial in the fight against churn, especially in Gaming.

Unsurprisingly, with shorter shelf lives and endless competition, games suffer from the highest rates of uninstalls:

As the data shows, the bulk of uninstallers do so on Day 1, most likely because of unmet expectations or false promises. Clearly, creating a superior onboarding experience and avoiding over-promising advertisement is essential.

As to the setup process for uninstall measurement, this varies greatly between Android and iOS. To help you navigate the differences in each platform, we’ve laid out the basic steps for you here.

Ad revenue measurement

While ad monetization has taken different forms since the rise of mobile, in-app purchasing (IAP) and especially in-app advertising (IAA) have become dominant drivers of revenue in recent years — mainly for casual mobile games.

With the rise of Hyper Casual games, ad monetization at scale was made possible, proving to game developers and marketers across genres that IAA was a legitimate revenue stream: it doesn’t harm user experience when applied correctly and even generates incremental income.

Today, IAA is an integral part of most monetization models adopted by gaming apps, creating a new source of revenue for developers who were previously focused exclusively on IAP. With IAA, they can monetize their non-paying users, which are typically around 95% of their overall user base.

The importance of user-level ad revenue data

Though IAA could potentially be a major source of revenue, without granular data — advertisers are limited in their ability to optimize.

The main challenge is that different mediation platforms have different data points about how users interact with these in-app ads, making it hard to decipher user level data.

Further complicating things, some networks pass revenue data in an averaged and aggregated form, which in essence is the total revenue generated on a specific ad placement divided by the number of users that clicked or saw that ad. With that being the case, the true LTV or ARPU can be calculated only to a certain extent.

Because measuring granular revenue is now more important than ever, some mediation platforms provide accurate user-level data down to the device ID (e.g. ironSource and MAX by AppLovin) and impression-level revenue data (e.g. MoPub and MAX by AppLovin).

Passing this data to MMPs helps to standardize it, allowing marketers to accurately tie revenue data back to the actual attributed source of each user.

As a result, they’re able to determine an accurate and holistic LTV figure to pinpoint acquisition budgets, and allow for more effective re-engagement campaigns (e.g. showing ads to whales, rather than to users who make IAPs).

Re-engagement measurement

When you work in mobile gaming marketing, your job is to fight an ongoing battle against churn, and re-engage existing and lapsed users through owned and paid channels, in addition to investing in acquiring new users.

Remarketing drives users back to your app and is most commonly used in IAP-based verticals such as Shopping & Travel. However, it can also be a game changer when blended correctly with gaming UA strategies.

That said, and despite the significant potential of remarketing, gaming marketers are still slow when it comes to implementing re-engagement strategies. Why is that? Often it’s because they lack sufficient measurement tools that can help analyze their remarketing performance and identify their true incremental value (see below for more on that).

In the meantime, gaming app marketers mostly use owned media to re-engage existing users. Push notifications are often perceived as intrusive and need to be deployed with care, and cross-promotion is typically easier to execute, but is only relevant for companies with large gaming portfolios.

When applicable, cross-promotion helps keep users under a single umbrella, enabling you to direct an already engaged traffic toward new or under-performing games. Some ad networks provide dedicated tools to run cross-promotion campaigns and maximize results in a similar way to standard UA.

To read more on the effects of M&As on cross-promotion tactics in the gaming sector – check out our blog.

4 reasons why gaming apps should invest in remarketing

1 – User acquisition costs are on the rise

The reality is that the cost to acquire a new user is 5-10x higher than the cost to re-engage an existing one.

In fact, back in 2021, $14.5B was spent by gaming apps on UA (excluding China), with the US taking up half of global budgets. Privacy changes led to a 13% YoY drop in iOS compared to a 35% jump in Android, leading to an 18% rise overall.

2 – Availability of robust segmentation tools

With increasingly advanced segmentation tools at their disposal, marketers can drill down into their app’s unique audience segments to see which users deliver the most revenue and which are most likely to churn.

3 – Performance

As the data below illustrates, remarketing significantly boosts revenue from your paying users, particularly in gaming apps.

4 – Leveraging control groups for measurement

Always keep control groups to measure your lift. Your game has a level of re-engagement that takes place naturally, so using a control group to measure your remarketing efforts against it — is invaluable.

For more winning tips on how to boost your re-engagement strategies – check out our guide. Or visit here how to set up your remarketing campaigns the right way.

SKAN measurement

StoreKit Ad Network, or SKAdNetwork or SKAN, is a privacy-centric API operated by Apple that helps ad networks and advertisers measure their ad activity (such as impressions, clicks, and app installs) on an aggregated level. In other words, it’s the not-so-new sheriff in town.

With most iOS users denying access to their user-level data in versions 14.5+, SKAN is what you rely on for non-Android campaign measurement.

Introducing completely new mechanisms to balance between data privacy and marketing measurement, SKAN employs sophisticated timer mechanisms, elusive privacy thresholds, and a unique conversion value system to grade the success of your iOS campaign.

Conversion values – making them work for you

Conversion values are configured by app developers to measure post-install activity, and tie it back to the install. A single conversion value is included in the one-time postback that Apple sends to the ad network and advertiser.

As a result, the information in this conversion value is all the information you can get on a user’s post-install activity (assuming they didn’t consent to “tracking”), making it extremely important. After all, in a freemium world, optimization is driven by post-install data.

A conversion value is defined by 6 bits, which are binary measures, meaning they can be turned on or off (0 or 1). This opens up the potential for 64 measurement combinations within those 6 bits – from 0 to 63.

Although 64 options can be considered limited, there are still plenty of options to work with to measure revenue, engagement, funnel progress and more.

As long as you properly map your conversion values based on your internal logic, these values can be used in any way you want. They’re yours to control and assign to the KPIs that are most valuable to you.

The 64 values, each with their own unique decoding configured by the app developer/advertiser, are then attributed to the source of the install, enabling campaign measurement and optimization.

How are marketers in different verticals mapping their conversion value schemes?

What we can learn by analyzing data from AppsFlyer’s Conversion Studio is that Gaming apps are laser-focused on revenue, and as such – it’s a model that’s being involved in most conversion value schemes. On the non-gaming side, in-app activity is the most configured option.

For more on how to make the most of conversion values, including benchmarks on activity window timer, and optimal usage of the 64 combination capacity, click here.

What to measure in SKAN?

Gaming apps are driven by revenue

In fact, according to our recent report with TikTok, 84% of games utilize revenue configurations. This is because games have a lower time to first purchase compared to other sectors — particularly among the highly popular casual games.

Unsurprisingly, 93% of Hardcore games are particularly laser-focused on revenue, as these games heavily rely on in-app purchases and not in-app advertising.

23% of Social Casino apps configure funnel events and revenue

As one of the highest-grossing app verticals with an excellent ability to identify early patterns of high-value behavioral signals, more than a fifth of social casino apps measure this combination.

Hardcore & Casual gaming apps sing a slightly different tune

From our experience, Hardcore gaming apps prefer to dedicate the majority of their SKAN bits to event measurement.

This is primarily because these types of apps entail a more complex gaming experience, longer retention cycles, and attract heavy-weight players that bring in more in-app revenue compared to other gaming categories, in which case event measurement can help with predicting their LTV.

Casual apps, on the other hand, which tend to showcase shorter user lifecycles, usually focus on a combination of event and revenue measurement, simply because they rely more on revenue streams coming in from in-app events and IAA.

How much to measure in SKAN?

When there are only 64 options to measure post-install activity, it’s highly recommended to use them all. Thankfully, gaming app marketers are well known for their level of data-driven expertise and ability to rapidly react to change.

The sheer competitiveness of this vertical dictates that, with 63% already utilizing practically all options, compared to only about 40% of non-gaming apps (with Food & Drink apps being the exception with no less than 80%).

In addition, we can see that 74% of Hardcore and 76% of Midcore games utilize 60-64 conversion values due to their more complex funnels.

When do gaming apps send the SKAN postback?

The majority of apps across all verticals are utilizing the default 24-hour activity windows to collect data, but we expect this to change as SKAdNetwork usage matures more.

Beyond the fact that 24h-hour window is the default, it’s important to remember that data can only be collected once, so there is an intentional tradeoff. Shorter activity windows enable faster data collection, but leave you with limited information.

Alternatively, longer windows provide richer data, but access to it will be delayed.

Also, bear in mind that the timer cannot be extended for all users — so even if it’s extended, it will only apply to a portion of them. And, the only way to extend it is by updating the conversion value, which can only occur once the app is opened.

10 ways to ensure you make the most of SKAN

Here are a few steps to ensure your business is SKAdNetwork-ready:

1 – Data aggregation

Be sure to collect all SKAN information from each ad network.

2 – Data validation

Ensure all postbacks are signed by Apple and aren’t manipulated in transit. Working with a trusted MMP can help you address this with ease.

3 – Data enrichment

Match SKAN information with other data points, such as impressions, clicks, cost, organic traffic and more, for complete ROI analysis.

4 – Data enablement

Facilitate SKAN data for convenient consumption by the advertiser through dedicated dashboards and APIs.

5 – Seamless integration

Make sure your mobile measurement solution offers full encapsulation, which requires close to zero effort from the advertiser, especially when it comes to future changes in the SKAN protocol.

6 – Conversion events

Be sure to measure server side, dynamic, and flexible in-app events. Leverage easy to use tools to map/constantly update your conversion value schema to make the most of the 64 options instead of wasting time on development.

True, having 64 options in SKAN campaigns might sound limiting, but it still offers plenty of value if bits are properly allocated and utilized. Make the most of ranges and combinations and focus on the post-install actions that matter most.

Test, test, and test again until you find the right mapping (having a UI certainly makes it easier).

7 – Funnel measurement

We’re still in the early days of SKAN, so most advertisers are under-utilizing funnel configurations, which can be a more efficient way to allocate your bits. Instead of dedicating 3 bits to measure three separate events, a funnel configuration can measure sequential behavior using only a single bit.

8 – Predictive analytics

Use them to overcome time limitations and leverage early signs of engagement to predict long-term campaign performance. Put mobile attribution in SKAN on “autopilot”, removing measurement and timing barriers, so you can maintain and strengthen your competitive edge in this new reality.

Also, bear in mind that the postback timer limits the amount of data you can collect to predict LTV for your users. Leveraging predictive modeling will allow you to identify the most effective metrics and behaviors that can best identify your most profitable users.

You can employ a predictive benefit score that uses all 6 bits to communicate any score, while a specific combo will indicate a valuable user cluster (presented in aggregate form when coming back from SKAN).

9 – Fraud

Keep your data safe from all types of fraud in the new iOS 14 ecosystem. An MMP can offer protection from SKAN fraud, by ensuring that you’re getting accurate data on your campaign performance.

It protects your ad spend before, during and after installs, with end-to-end coverage against infrastructure weaknesses, data limitations and reporting loopholes.

10 – Dedupe your data

According to our data, advertisers with primarily non-SRN campaigns find that around 62% of their SKAN installs are duplicates, while advertisers with primarily SRN campaigns find that around 18% of their SKAN installs are duplicates. Deduplication is therefore nothing short of critical for iOS data.

To read more about a single source of truth and how it can transform your data and cost analysis, see here.

Chapter 3

What to make sure is in place

Creatives

Performance marketing is becoming increasingly automated and machine-driven, which is why creatives are at the very core of marketing in 2022, and their importance cannot be overlooked.

Creatives will have a distinct effect on your performance and play an important role in optimizing spend, but most importantly — creatives affect user experience.

When users are bombarded with an increasing variety of mobile games and aggressive ad campaigns, they can become overwhelmed, particularly by video interstitials and rewarded videos.

A high bid will most likely buy you a quality ad slot, but that won’t guarantee installs. This is where your creatives can move the needle.

In many cases, your ad has between 5 seconds (interstitial) to 30 seconds (rewarded video) to engage a user, which means the creative and its placement is crucial when it comes to winning that engagement.

Creative formats for gaming

Banners

Typically placed at the bottom of the game screen, banners are probably the most common placement across the mobile advertising ecosystem. They can present static ads and low-quality video ads, which tend to generate a significant number of views but a poor engagement rate. That said, while these inexpensive ads might not be valuable in terms of engagement, they can boost the visibility of a brand.

Interstitial ads

A more intrusive option, interstitial ads appear in different stages during a game and can interrupt the game flow. To maintain an enjoyable user experience and avoid high churn rates, developers and marketers should place and time interstitial ads wisely.

Before rewarded videos became common, interstitials used to provide the best monetization via ads. They offer a 5-second timer that allows users to skip the ad, which puts advertisers in a bit of a bind — as they need to match their creative to that 5-second window.

The combination of disrupting the game flow and nailing precise timing contributed to lower CPI and relatively low engagement rates — compared to their more contemporary counterparts: rewarded videos.

Rewarded videos

Known to offer strong returns, rewarded ads offer users to watch a ~30-second video in exchange for in-game rewards. They don’t block the user’s journey and don’t catch the gamer’s off guard, which improves UX and leads to higher install and engagement rates.

Naturally, given these returns, advertisers are willing to pay a higher CPI for rewarded video campaigns.

Playable ads

This new genre of ads has become more commonly used in the last few years, and is delivering very promising results. Playables do well when it comes to demonstrating the game’s experience and engaging quality users that are less likely to churn down the funnel.

On the other hand, creating a playable ad requires wider resource allocation, which resembles the creation of a mini-game — involving designers, developers, and QA. The investment is therefore much higher, and success is not guaranteed. But, when a playable ad does perform well — it can explode.

Offerwall ads

The most complicated format, offerwalls can help retain users up to a point within a game flow where monetization is viable.

That said, offerwall can also lead to high churn rates and bring marketers to struggle with maintaining a healthy LTV/CPI balance, which is why many advertisers choose to deploy an additional channel of CPA (Cost Per Action) campaigns.

This complexity has also led to the creation of another layer of pricing, as different actions need to be priced differently (e.g. installing a game and watching a tutorial are not priced the same way as installing a game or reaching level 10).

Naming conventions

Within your campaigns, naming conventions can help unlock additional information that is otherwise not available via APIs.

Most UA managers know this and build an internal naming conventions system that meshes with their BI infrastructure. They then digest all the metadata that’s separated with “_”s and place it into data dimensions and insightful data visualization reports.

For example:

- Campaign type_platform_pricingmodel

- Geo_Media source_campaignstartdate

As a result, when using their MMP’s dashboards, Excel or BI platform, marketers can quickly pull a report, filter and analyze the performance of a specific segment, geo, or placement — across various campaigns.

The main focus with naming conventions is to consider all factors when building your campaign, and think one step ahead to be able to run drill down analysis whenever needed.

Nowadays, it’s considered a common practice to attach this sort of performance metric to creatives. What used to be a cumbersome process is now much easier, to the point where analyzing creative themes, orientation, dimensions, video length, user fatigue, and “freshness” is relatively simple.

The best use case to measure creatives is to add characterization such as ad type, ad size, ad length, and button color to the campaign naming — as follows:

geo_media source_campaign start date_rewarded_video_30seconds

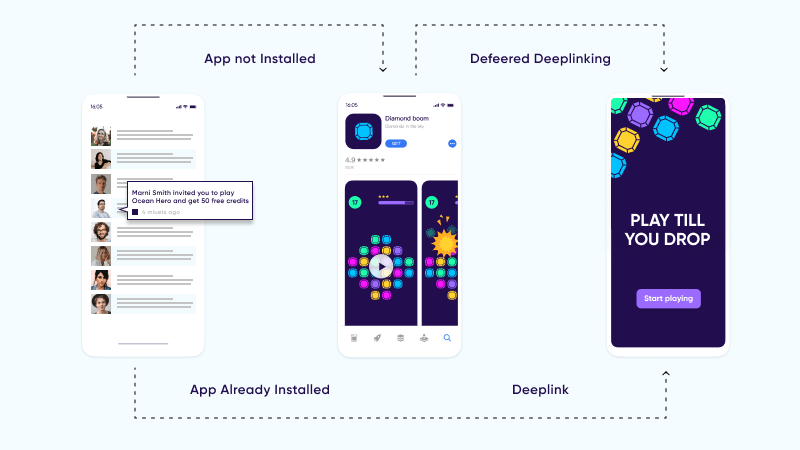

Deep linking

One of the most powerful tools in the app marketing tech stack is deep linking, creating a contextually-relevant user experience across channels, platforms, and devices.

In gaming, user invites are a key method to drive acquisition and boost engagement, which is powered by deep linking.

Another common use case is when existing players wish to “share their achievement” or “invite a friend” to a game. They can select the channel for spreading the word through social, SMS or email, after which a deep link will be automatically generated for easy sharing.

Once the invite is sent, marketers are able to measure user behavior and optimize their future marketing efforts, by understanding which users are most likely to invite friends, their preferred channels, and more.

To get started, you must first configure deep linking. Luckily, this can be done easily by implementing code in your app, or through enabling associated domains, depending on the method used.

The destination to which a user is brought is primarily dependent on:

- The deep linking campaign goals

- The consenting user information previously gathered (i.e. content viewed, purchase history, location, etc.), which must be decided and understood ahead of time.

Smart banners – Advanced deep linking strategy

Through the deep links placed in smart banners, marketers can bring users to install a new app, redeem a special offer, share an invite with a friend, or place their order in the checkout page.

When a user clicks on a smart banner popup and follows it to the relevant location within your app, you can receive data on the user’s subsequent in-app activities, the IDs of levels and category pages visited, and even, retroactively, the attribution data from their user journey.

Beyond the valuable data gathered, however, smart banners also contribute to an improved user experience, increasing the potential of greater brand loyalty and engagement overall.

When choosing a deep linking solution, make sure that it not only supports your growth needs, but is also in sync with the latest privacy and security guidelines, and that your campaigns comply with the most up-to-date user privacy and security regulations.

For more info on deep linking and its ability to catapult your CX to a whole new level, read our guide.

Owned media

Owned media is any marketing asset directly controlled by a company and which requires little to no additional cost to access and use. Most relevant to mobile re-engagement are push notifications, emails, and SMS messages, but also webinars and tweets.

Owned media is your way of creating free, contextual content designed to increase engagement on your active, idle or lapsed users’ side — and create a more personal, long-lasting connection. In the age of user privacy, where user-level data is harder to come by, this connection is nothing short of critical.

Interestingly, despite their widespread use, many marketers are still not fully aware of the long term value owned media channels inevitably provide.

Why leverage owned media?

- Utilizing the marketing “hierarchy” – Given the little to no cost of owned media channels, especially compared to paid campaigns, re-engaging users via these channels should be the focus and priority as much as is possible and appropriate.

- Full control over every aspect of your content.

- It’s free – aside from the internal resources you’ve put in to create it.

- Low risk – with paid media you could find you’ve wasted your budget if a campaign proves to be unsuccessful, and with earned media (the equivalent to digital word of mouth) you lack control over comments or potential inaccuracies. Owned media avoids both completely.

- Contextuality – owned media allows you to build content strategy that addresses each stage of your user journey, including your uninstallers or dormant users.

Audience segmentation

In any mobile vertical, it’s crucial to understand your audience so you can segment it and deliver effective ads that prompt engagement, without wasting money serving ads to users who will likely not engage.

Prices vary among segments and will also vary depending on how you combine segments. As is the case with every economic system, price is determined by supply and demand, and advertisers will pay more for quality users who generate profit that exceeds ad spend (LTV>CPI) later in the funnel.

Here are the most common ways to segment an audience in Gaming (note that in the case of iOS 14+ users, these segments only apply to consenting ones):

- Geographic

Country, state, city, and sometimes even down to a specific zip code — You can’t do geo-based marketing without it.

- Demographic

Gender, age, income, e.g. male users aged 50 and over with an income of over $200,000.

- Psychographic

Values and interests, e.g. users who routinely install and engage with news apps or content.

- Technographic

The pint-sized tech stack in every mobile device, e.g. an iOS 12+ user with a device that has at least 6GB RAM.

- Platform

iOS or Android. These two platforms act differently in terms of KPIs and pricing.

- Behavioral

What users actually do on their phones, for how long and to which extent, e.g. mobile gamers who tend to engage with games for 20 minutes or more in a session and routinely place IAPs. The variety of behavioral segments is massive, and can be by a mix of multiple activities.

- Ad placement & creatives

Prices also fluctuate in between ad placements, as each placement has its own engagement advantages and unique opportunities.

Media source selection

Choosing your media sources across all channels, including ad networks, is a major decision that shouldn’t be taken lightly.

While many will offer a dream-level scale at a minimum price, the fact is that one media source can’t provide everything. So be cautious of being over-promised by vendors in a hyper-competitive space! Your job is to find the right mix of media sources that delivers the very best results.

Relying on multiple media sources allows you to judge your UA performance by business model, and comparison will help you to zero in on media sources that deliver on your KPIs, at the right price and volume.

Moreover, fewer networks may prevent you from reaching new audience segments, and cause you to miss out on available technologies that can help your marketing strategies meet their full potential.

In essence, the more networks you choose, the more exposure you get. That said — more exposure doesn’t necessarily mean more scale.

At the end of the day, the number of potential users is limited, and sometimes more scale doesn’t match up to the effort and expenses involved, it exposes you to more fraud risks, and might even create an operational distraction.

So it’s important to keep your finger on the quality and performance pulse of your media sources at all times — a task your MMP should be able to lead with minimal hassle on your end.

Looking at gaming specifically, we see the trend is in fact opposite, with the bigger apps using fewer media sources. This is because gaming marketers for large apps know exactly which media sources work best for them, and are able to cleverly divide budgets while pinpointing their quality-quantity balance.

To see how networks rank per region and gaming genre, check out our Performance Index

Increasing ATT opt-in rates

After a year of ATT, we can see that month after month — almost 1 in 2 instances result in a user tapping on the ‘Allow’ button, among users who have been shown the prompt (Apple prevents users who enabled Limit Ad Tracking and those with restricted status from seeing the prompt).

So although the IDFA rate — which takes into account all ATT statuses — and the ID matching rate — which require dual consent on both advertiser and publisher sides — are lower, IDFA is clearly still around.

In fact, the IDFA cohort is still of value to marketers for benchmarking, modeling, and extrapolations against the non-consenting audiences.

The data is showing that the vast majority of gaming apps understand the importance of creating a substantial segment of consenting users.

Despite the potential UX risk in showing users a prompt that includes potentially concerning language for some users, 4 in 5 apps have decided to show users the ATT prompt, and the current opt-in rate stands at 46% for gaming apps.

Clearly, the reality is that the benefits of showing the prompt far outweigh those of not showing it.

To ensure your app stays ahead of the curve, here are two proven strategies to improve your ATT opt-in rates:

1 – Timing is everything – Showing the prompt on the 1st launch

Our data clearly shows that consent is highest when users launch an app for the 1st time — likely with other in-app notifications shown to users upon launch. Overall, there’s a 30% drop between the 1st and 120th minute, and when looking at hours and days since install, the consent rates drop even lower.

Among the only categories with higher rates after the 1st minute are and Hardcore gaming (50-100 minutes), and the reason behind this gap is likely to be unsynchronized timing between the IDFA collection and the attribution process.

If the latter occurs before the IDFA is collected, a ‘Not Determined’ ATT status will be recorded. Since app owners can configure when the SDK will collect the IDFA, they should ensure this configuration matches their consent flow.

Lastly, when attribution occurs using IDFA, it’s important to collect it during the 1st launch. The MMP’s SDK can “wait”, which allows marketers to configure how long the SDK should defer for the ATT status, before the data is sent to the MMP’s servers.

2 – Showing a post-ATT in-app notification to engaged, non-consenting users

It doesn’t need to be the end of the road for users who did not consent when shown the ATT prompt, as they can still enable tracking at any time in their device’s Settings.

That said, your users probably don’t know this, so — this is your chance to give them a reminder. As with the pre-ATT prompt, show engaged users a post-ATT notification that includes the user benefits of opting in, which will take them directly to their Settings for app opt-in.

True, the data shows only 17% of gaming apps have a higher Day 7 rate, but at the very least, it’s still worthwhile to test the tactic of showing a post-ATT in-app notification to engaged, non-consenting users.

For more on the most recent ATT-related trends – visit our report.

Predictive modeling

The more sophisticated a mobile gaming advertising strategy becomes, the more it needs to embrace predictive modeling, which leverages historical data in order to make accurate predictions.

And these days, when access to user-level data is more challenging than ever before — the difference between success and failure often lies with predictive modeling.

That said, creating a solid prediction model is not an easy task. It requires solid goals, a strong data-oriented mindset, and plenty of savvy.

Prediction models are generally relevant for two critical activities:

1 – User acquisition

Knowing your typical user behavior and the early milestones that separate your high from your low potential users — can help you create sound UA budgets.

For example, if you know that a user needs to generate X by day 3 for you to make a profit after Day 180, and that number comes in under your benchmark — you know that you will need to adjust bids, creatives, or segmentation, to improve the cost and quality of your acquired users, or to improve your monetization strategies.

If X is over your benchmark, you can confidently increase budgets and bids to get even more quality users from a particular source.

2 – Re-engagement

If users with some potential are under-performing (in terms of payment) during the early stages, you can focus your paid or owned channels’ re-engagement efforts on these users — to increase how much and how often they pay.

If you identify at-risk users, you can try to re-engage them long before you need to win them back. Or, if your data shows there is a very low probability of long-term engagement, you can exclude these users from your paid campaigns altogether — to minimize further future losses.

Prediction models are built with layers, with the following data points:

Legacy metrics

These are easily available, but the correlation between them and actual profit is fairly low:

Early indicator metrics

- Cost per Install (CPI)

- Retention rate

Common KPIs with predictive modeling include:

Tier 1 predictors

- Return of ad spend (ROAS)

- Lifetime value (LTV)

Tier 2 predictors

Each app and each team have their own mix of parameters and considerations that affect predictive modeling data points:

- Customer acquisition cost.

- Time-based cost or conversion of key actions (e.g. cost per number of games played in the first day or cost per content view during the first session).

- Cost per day X for a retained user: Total spend per day * X number of retained users on that day.

- Vertical specific in-app events: e.g. tutorial completion, completion of Level 5 on Day 1.

For more on predictive modeling in the age of data privacy – check out our guide.

Marketing analytics

When you’ve got your setup complete and the data infrastructure in place, you are ready to roll. After all, setup is only the means, whereas the goal is to draw actionable insights from all the data at your disposal.

And that’s where marketing analytics come in. There are four key reports for gaming app marketers: Cohort & retention, Ad revenue, LTV, and Ad spend & ROAS.

Let’s dive deeper into each:

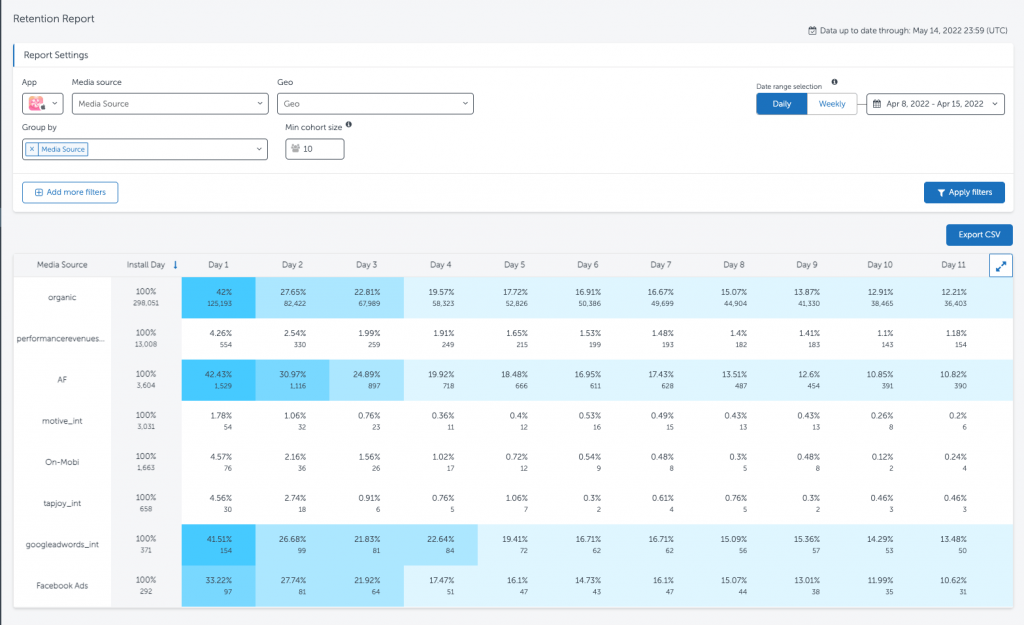

Cohort & retention

This fundamental analysis provides insights into performance metrics and KPIs, and enables marketers to determine how specific segments of users (cohorts) behave over time.

User retention

One of most important KPIs mobile marketers obsess over — and for good reason. It costs far more to attract a new user than it does to maintain an active one, which is of particular importance in highly active or addictive app verticals, such as gaming, serving as the basis of monetization and a key factor in prediction models.

However, retention only tells us how many users who launched the app during a set timeframe reopened the app in the days that followed. Cohort goes even deeper.

Cohort analysis

Allows marketers to compare the performance of new campaigns to the determined goals and evaluate future tactics accordingly. It’s done by grouping together users with common characteristics to be able to measure specific KPIs over different time frames.

A cohort analysis report can provide insights from both revenue streams, in-app and ad revenue. With it lie the answers to questions like “which media source drove the most IAP?” or “which campaign drove the highest revenue per user in Mexico?” and so on.

When it comes to holding KPIs up side-by-side and assessing strategy success, cohort is the report you need.

In the following example, we’ll look at two different pre-defined metrics — average sessions per user and average revenue per user. When looking at the average number of sessions per user, this is what we see:

At first glance, the Spring campaign seems to be performing exceptionally well in Japan & Korea and very poorly in the Middle East and India. But this data isn’t giving us the full picture. We can see that there is high engagement in Japan & Korea, but does that mean that the campaign was most successful there?

Hardly. If we switch the data view to average revenue per user, we’ll see that while Japanese and Korean users are taking an active part in the campaign, they’re not spending any money. Chinese users, however, are averaging a high spend per visit.

The conclusion is that there’s room to optimize the campaign for the Japanese and Korean market. And given that the Chinese user spend plateaus around Day 4, we can schedule a remarketing campaign around that time. Lastly, Indian users are showing a steady incline in spend, which is exactly what we’re looking for.

Ad revenue

When investing in IAA campaigns, this report can provide you with a full view of the return on ad spend (ROAS) of acquired users.

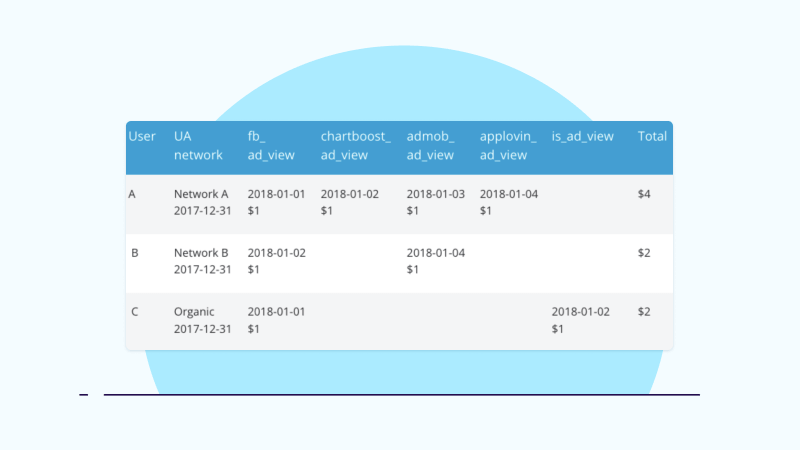

Let’s explore the following example, by which 3 users install an app on December 31, 2021, and are attributed as follows:

User A: Network A

User B: Network B

User C: Organic

The app integrates with 5 different monetization platforms, and each one uses a unique in-app event as follows:

Facebook Audience Network: fb_ad_view

Chartboost: chartboost_ad_view

Admob: admob_ad_view

Applovin: applovin_ad_view

IronSource: is_ad_view

After the install, users are shown ads for a period of 4 days, as follows:

From a UA perspective, we can see that Network A delivered User A who generated $4 just by engaging with ads. From a holistic LTV point of view, understanding the total revenue generated by a user — combining both IAA and IAP — is absolutely critical.

If that user generated $2 worth of purchases in those 4 days, their total value was actually $6. Knowing that specific users acquired from a particular media source generated a certain ad revenue — enables app marketers to be far more precise in their selection of UA sources, while contributing to the optimization of their own inventory.

For example, excluding users who never engage with ads, and rewarding the users who produce significant revenue from ads.

In another example, a campaign manager spent $88,593 on running ads with Media Source 1 and acquired over 586,000 users. These users are clicking on in-app ads, earning some revenue, and we can tell it’s a slow, steady incline.

Media Source 2, on the other hand, is significantly less expensive for UA and brings in more in-app ads revenue. By Day 7 post-install, Media Source 2 is therefore much closer to breaking even than Media Source 1.

LTV reports

Lifetime value is a KPI that’s at the very heart of app marketing. Knowing exactly how much revenue users generate throughout their lifetime informs marketing investment in UA, engagement and retention. LTV is also essential to measuring the extent to which marketing investments deliver a positive ROI.

The LTV report helps you understand how valuable different users are to your business based on their overall performance — and compare them.

For example, you can compare the LTV of users you acquired through email or paid search, and then determine how much budget to allocate toward acquiring users in each group.

You can also compare the LTV of users acquired through different methods. For example, users acquired through organic search vs. users acquired through social, or social vs. email, to see which method brings in higher-value users.

Ad spend & ROAS

Return on Ad Spend is the holy grail of mobile app measurement. But, in order to determine the ROAS for your game, you need deep analysis.

This can be done manually by consolidating multiple spreadsheets from diverse sources, pulling data from multiple dashboards, normalizing data across different time zones and currencies, and sorting by region, platform and app.

Clearly, it’s a handful — and increases the likelihood of human error, which is why many marketers turn to their MMP. Your marketing measurement partner can help you calculate your ROAS by matching media cost data provided by hundreds of media sources with the revenue data of multiple revenue streams.

With all media-driven ROAS data in one place, marketers can then easily compare apples to apples. Campaign, Ad Group, SiteID and creative variation breakdown are also available for deeper level insights.

How is ROAS calculated?

It’s the money spent on marketing divided by the revenue generated by users in a given time frame. For example, a Day 7 ROAS of 50% means that a player generated revenue that was 50% of the money spent to acquire that user.

Creative analytics

Fragmented data and lack of standardization in ad formats, or creative specs between networks — can make it incredibly challenging for marketing teams to get a clear view of their creative performance.

The process of creating, uploading and managing creatives is tedious and often builds up bottlenecks for the media buying teams. Not to mention that the limited number of campaigns per channel, and slower test cycles for creatives due to iOS 14 restrictions — can lead to a bumpy road when it comes to quantifying your creative efforts.

Marketers should therefore opt for a mobile measurement solution that allows them to normalize data from multiple partners and aggregate it into a single dashboard, all while enabling a high number of partner integrations for wider coverage.

Having the option to easily upload and manage your creatives, automate deployment across multiple partners, and leverage multi-testing and incrementality experiments to validate your creative efficiency — could very well be a game changer when aiming to maximize your campaigns’ ROI.

Final thoughts

Mobile game developers are the pioneers of the app economy. But as mobile is taking over our lives, increased competition means that building a great app is not enough. You’ll need to invest in marketing, advertising, and analytics so that you will be able to monitor and optimize these budgets effectively.

In this stage of overall mobile growth, and despite limited access to user-level data, gaming app marketers have more factors on their side than less to reach their business goals.

A pandemic-accelerated mobile explosion and a growing demand from consumers to save both time and money — has driven a rise in technologies which have greatly enhanced the gaming experience across platforms, without compromising users’ privacy.

Facing this growth, the bottom line takeaway is the importance of granular measurement to carry marketers forward.

By making the most of the data at your disposal and setting up the right infrastructure, you can make smart marketing decisions that will help your game unlock one achievement after another, and build the foundation for future profitability, performance, and success.