Amazon’s acquisition of Sizmek’s ad server and dynamic creative optimization (DCO) platform Friday puts it in a better position to compete with Google for advertiser budgets.

Amazon will likely gain new clients from Sizmek who don’t want to deal with switching ad servers, as well as some advertisers who don’t like the idea of working with Google.

But the pairing is about more than competing head-on in the third-party ad serving market, which is a tough business with razor-thin margins where Google is already dominant.

“The strategic decision [Amazon is] going to make is: Do we put this out as a third-party ad serving platform like Google Campaign Manager?” said Oscar Garza, head of media activation at Essence. “That seems like a departure from their strategy.”

Rather than compete on ad serving, buying Sizmek is more likely a play by Amazon to bolster its own ad stack. An ad server, which acts as a ledger for all of a brand’s media activity, could enhance Amazon’s attribution and measurement solutions – and pull its biggest customers deeper inside its garden walls.

“Amazon has the DSP, but you still need to utilize a third-party ad server,” said Tyler Pietz, VP of global consulting at MightyHive. “They don’t [want] to rely on someone else’s technology in order to deliver a fully integrated digital ad offering.”

Amazon’s ad server strategy

For Amazon, owning an ad server offers strategic value beyond a new revenue stream.

While many view the ad server as a commoditized technology, it’s at the heart of any ad tech stack because it traffics all of the data and IDs associated with every buy. Incorporating an ad server into its offering could encourage Amazon buyers to use other parts of its stack, said Joanna O’Connell, VP, principal analyst at Forrester.

“Getting people on to the ad server makes it easier to start using other parts of the stack, because everything is designed to work together,” she said.

For brands that sell a significant amount of product on Amazon, that full-stack offering enhanced by Amazon’s data may be attractive enough to warrant switching off of Google’s ad server.

Like Google, Amazon could bundle ad serving with its other solutions at a discount, and use Sizmek’s DCO capabilities to enhance its off-platform ads. Sizmek’s data could also augment Amazon’s attribution capabilities, which are currently fixed at a 14-day window.

“Having a built-out ad serving product will allow them to pull down impression level data and attribute against sales on Amazon,” Pietz said. “That’s a big missed opportunity for them right now.”

And regardless of how Amazon implements Sizmek, it’s gaining an army of ad tech and engineering talent through the acquisition to help it continue to build on its offering as it wades deeper into programmatic.

But for non-endemic Amazon brands, Google is so deeply embedded into advertiser and agency processes, it’ll be hard for Amazon to poach clients who weren’t already thinking of leaving.

“In the enterprise or agency world it’s very process-driven, and DoubleClick is core to the process,” said Adam Heimlich, president at Adelaide.

Remember Atlas?

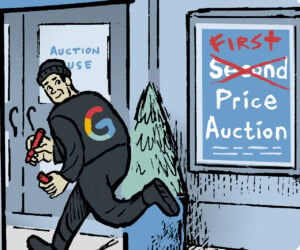

If Amazon does try to compete head-on with Google’s ad server, it should take a lesson from both Microsoft’s and Facebook’s failed acquisitions of Atlas.

Microsoft bought Atlas as part of its acquisition of aQuantive in 2007, but wasn’t able to execute on the strategy. Microsoft wrote the acquisition down by $6.2 billion and sold Atlas to Facebook, which also shuttered the ad server three years after buying it.

“The same thing could happen to Sizmek,” Heimlich said. “If they have a chance to pick something up cheap, these big companies don’t have to think it through. They figure out what to do with it later.”

And just like advertisers were wary to use a Facebook-owned tool as their ad server, Amazon’s ownership of Sizmek could actually deter marketers from working with it – and leave more business safely in Google’s grip.

“I have a hard time imagining that a big marketer is going to defect from Google to Amazon,” O’Connell said. “It’s another walled garden and it’s a less robust stack.”