Mediaocean will be switching private equity portfolios, moving from Vista Equity to CVC Capital Partners and TA Associates, the company announced on Tuesday.

Mediaocean will be switching private equity portfolios, moving from Vista Equity to CVC Capital Partners and TA Associates, the company announced on Tuesday.

The valuation of Mediaocean or of Vista’s stake was not disclosed, except that CVC and TA are taking on Vista’s equity share.

John Nardone, CEO of the Flashtalking ad server that Mediaocean acquired for $500 million in July, has been named company president, overseeing product and technology. And Lance Neuhauser, the former CEO of 4C Insights, which Mediaocean acquired a year ago, will be commercial president, overseeing sales, marketing and partnerships. Bill Wise will remain CEO.

Mediaocean’s mainstay product is television advertising software, but as the new executive appointments show, the company is more and more focused on digital media.

Of the $200 billion in annualized ad spend on the platform in the past year, more than half was delivered by the internet: an important benchmark considering Mediaocean’s deep roots in linear television.

AdExchanger spoke with Nardone and Neuhauser about the company’s plans for the cash infusion, and how Mediaocean will evolve in the next few years.

What are the plans for Mediaocean following this ownership change?

JOHN NARDONE: There are a number of product lines within the company that were fairly new or emerging for both Lance with Scope [a product Mediaocean picked up with 4C] and for the Flashtalking product set. In this scenario, those products get a lot more investment.

Flashtalking acquired verification firm Protected Media back in March. And we’re rolling out and putting some muscle behind the brand safety, viewability and fraud detection capabilities that we acquired there.

LANCE NEUHAUSER: I would add converged TV products. The move from linear TV viewing to digital TV viewing is happening. Obviously, it accelerated through the pandemic. We, as in Mediaocean and 4C previously, invested for years in that space anticipating that acceleration.

And one of the main areas of investment by marketers is a converged media planning opportunity, where they can have that single view across all inventory that we’re plugged into. That’s really become the exciting opportunity.

With the Flashtalking deal, Mediaocean acquired a DSP. Is it a new step for Mediaocean to be the media-buying platform?

NARDONE: It’s actually very consistent. Mediaocean has always been a neutral platform. And I think of the decision is not to invest in a DSP, if you will, but rather to enable all DSPs by acquiring the ad server. But we had a whole bunch of different products that wrap around the media buy, from the creative development, personalization, verification, identity, to advanced analytics – all of the pieces needed in order to manage your programmatic buy, except for the doughnut hole in the middle of actually doing programmatic buying.

We enable all partners, even those we do compete with in different areas.

Many ad tech and marketing companies have IPO’d lately. Do you have any thoughts on why to go the private equity route rather than IPO?

NARDONE: There are some prerequisites you want to have in place before going public. And certainly one is to be integrated and smoothly running two major acquisitions. So we do have some work to do.

The opportunity in front of us is to be one of the foundational platform companies of the open and independent internet ecosystem.

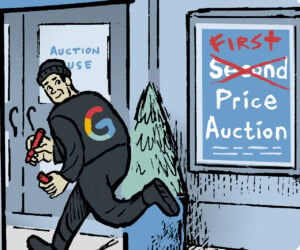

We believe that advertisers desperately need a platform that is for them, and is not conflicted in the way that Google and Facebook and some of the platform companies are. And we have some things we would like to get done we think are requisite before we take the next step as a company.

NEUHAUSER: I think you also have an incredibly hungry and confident leadership team at Mediaocean that is excited to continue to invest back into the product and service. We like the aggregation of the teams that just came together with CVC and TA. And we want a little bit of runway, to John’s point, to operate and demonstrate to the market why Mediaocean has taken another leap forward.

Is the company profitable?

NEUHAUSER: Flashtalking independently was profitable and Mediaocean is historically profitable.

The company has found product-market fit in a capacity that allows us to continue to invest back into the business, affording us the opportunity to bring on amazing companies like Flashtalking and like 4C.

It’s an area where advertising technology through the last couple of decades has struggled at times. VC-backed organizations would be able to get a product to a certain point, but never break through that profitability element. Therefore, their ability to continue to invest into the product for the long term is challenged. Whereas with Flashtalking and Mediaocean, our ability to invest is considerable.

CVC has the mindset that products need to lead the market, and need consistent investment. With Mediaocean’s historical position, and so many people in the industry relying on Mediaocean as a system, it is critical it’s given the oxygen to continue to be a leader in market.

How does the pricing model of the companies change as they’re integrated into Mediaocean?

NARDONE: We believe very strongly in having the products work together in a way that, when you use them together, it’s to their advantage. At the same time, part of that dedication to independence is advertisers don’t have to be locked in to buying everything end to end. So if they buy from someone else, we remain committed to integrating partners in the ecosystem and having that open position.

But there are some immediate opportunities where the products coming together bring enormous value. One is bringing Flashtalking’s dynamic creative and creative automation capability to the closed ecosystems through Scope [the 4C product]. That’s an immediate focus of our joint development teams. Advertisers and agencies will begin to see the fruits of that collaboration over the next six to 12 months.

The next really big opportunity is to have the ad server and the verification products more tightly integrated into the buyer workflow, which is very important for automating the invoice reconciliation process between publishers and buyers.

The one that is hardest, and the granddaddy of opportunities, is converged media. In a matter of weeks, we’re going to be able to take advantage of the joint platforms to provide real insight into digital TV delivery, CTV and OTT delivery, and in the context of linear. It’s a unique capability, frankly, that only Mediaocean is positioned to provide today.

This interview has been condensed.