Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

No Fund At All

After luring influencers with massive creator funds, social media companies are reverting back to an advertising revenue-share model to compensate creators.

Meta will put its Reels Play bonus program for US Instagram users on hold, and Facebook is dropping the fund payouts globally starting next month, Insider reports. Instead, Meta says it will prioritize options that cut creators in on advertising revenue.

While the Reels backtrack seems like a bait-and-switch, influencers have long complained about inconsistent and unsatisfactory payments from creator funds.

Social media companies are experimenting with ways to provide influencers with consistent enough revenue to keep them on their platforms and revive businesses that have dropped off without targeted ads to drive growth.

Meta is throwing the kitchen sink at the problem with a don’t-fear-failure mentality. Instagram alone has launched 11 monetization features since 2020, five of which have since been shut down.

Meta’s latest decision follows similar moves by YouTube, which shut down its YouTube Shorts fund when it put in place a rev-share model in February, and TikTok, which revamped its Creator Fund to set higher subscriber requirements as it tests ad rev-sharing in the US.

Who Knows Best?

Roku will sell its first line of TV sets exclusively in Best Buy, the companies announced late last week.

The partnership also includes Best Buy’s retail media business, which shows how companies in that category can create strategic commercial pairings with the ability to overlap audiences.

Best Buy doesn’t have much media to speak of, but it has a hefty warranty and customer service membership program, called Totaltech, as well as sweet, sweet purchase data.

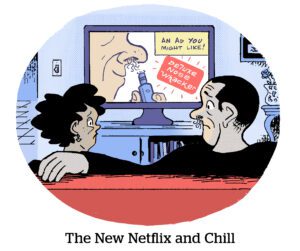

Roku will be able to use Best Buy Ads data to target and measure campaigns – which means offering TV sets at a low price (Roku profits by ads, not hardware sales) and ostensibly an improved streaming experience with personalized ads and better frequency capping.

Roku has been the first mover with retail media. It cut a deal with Kroger in 2020, then a first-of-its-kind attribution setup between CTV impressions and store sales. Walmart added Roku as an advertising services partner last year.

Roku is generally a savvy strategic partner. Nielsen isn’t the fittest incumbent right now, but it’s still the go-to for TV measurement, and Roku may be Nielsen’s most important partner for the purposes of both PR and actual measurement visibility.

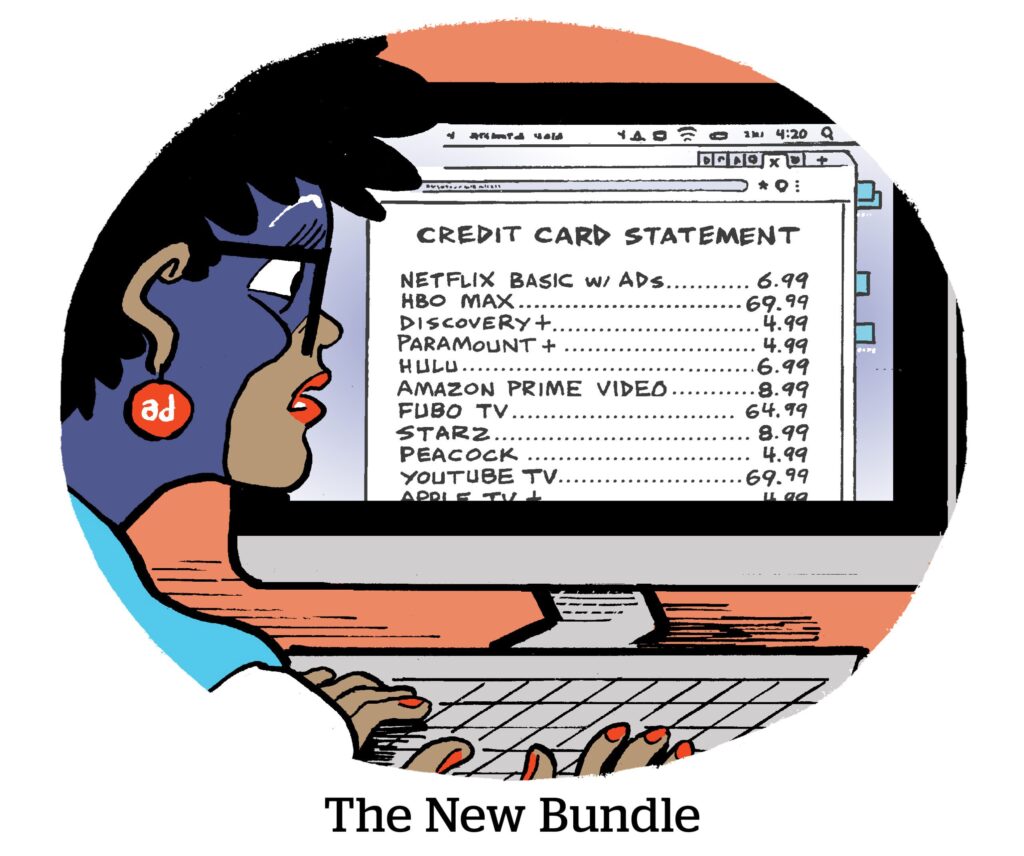

On The Plus Side

For another example of how retail media businesses collide with media subscriptions and membership-based programs of all kinds, check out Verizon’s latest ad campaign, which hit the airwaves during the Oscars broadcast last night. The spot recreates lines from the Beatles song “All Together Now” from shows and characters from Netflix, Disney and Paramount, as well as other subscription services that can be packaged by Verizon, including Peloton, MasterClass and Blue Apron.

Verizon calls this program “+play” (please, lord, can we be done with the “pluses” already?), and it includes a free year of Netflix Premium.

Paramount and Walmart likewise partnered to include a Paramount+ subscription gratis with a Walmart+ membership.

It isn’t encouraging that some of the world’s deepest-pocketed businesses and most famous creative production companies can do no better than adding a “plus” to their name and bundling in whatever they can. But that’s the future of media.

Struggling apps from across verticals, such as Calm or Spotify, will be packaged with retailer and media “plus” programs. As will news publishers and anyone else with a monthly subscription and first-party logged-in audience to use as partner currency.

But Wait, There’s More!

One investor analyst is switching The Trade Desk to ‘Sell,’ citing unsustainable buy-side expectations. [Yahoo]

Publisher ad alliance Ozone plays the long game on ‘underweight’ advertising on premium editorial. [Digiday]

Kroger spent millions advertising its own peanut butter – why? [Marketing Brew]

RIP Recode, a tech blog that never quite found its business model. [The Rebooting]

How Parade Underwear built a brand using Gen Z micro-influencers. [New York Mag]

Stitch Fix walks back key initiatives in quest for recovery. [RetailDive]

You’re Hired!

Taylor Simons was promoted to MediaMath SVP, managing director for North America. [post]