Organise your finances with Saving Spaces

What are Saving Spaces?

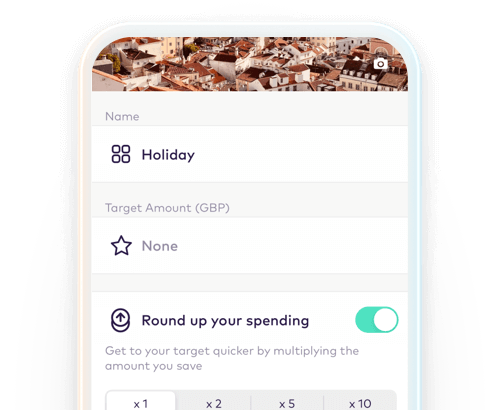

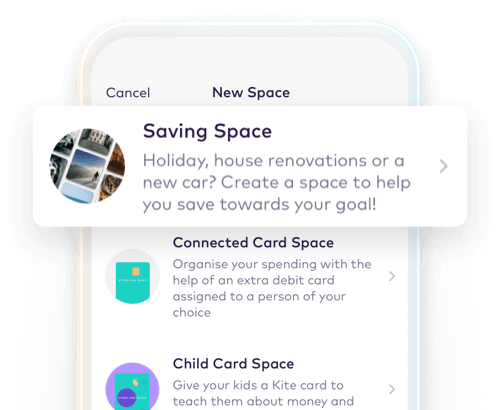

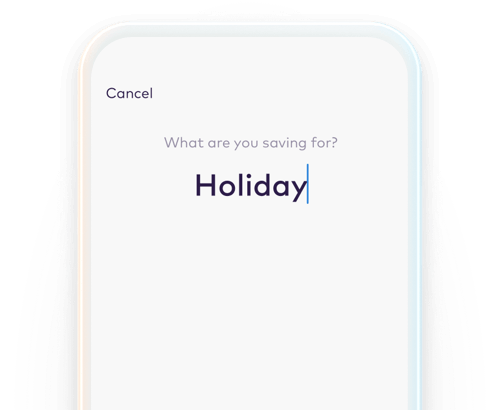

Think of them as virtual change jars. Your money is kept separate from your main balance – so you’ll never accidentally dip into your savings. Spaces are very visual, so you can see how close you are to reaching your goal.