Most income in the U.S. is taxable. Whether you earn money from your job, capital gains or dividend income from your stock and bond portfolio, or even rent from an investment property, you likely have to pay tax on the income.

However, not all gains are taxable. If you invest in retirement accounts and certain other brokerage accounts, you can benefit from tax-deferred growth. Keep reading to learn more about tax-deferred growth and how you can take advantage of it.

What exactly is tax-deferred growth?

What exactly is tax-deferred growth?

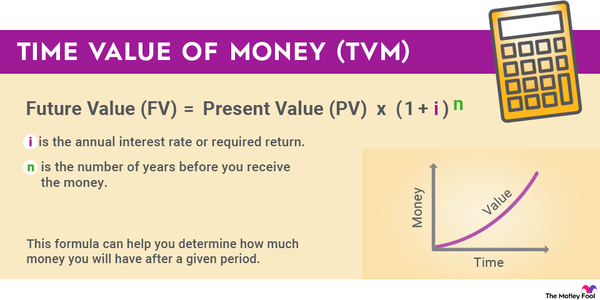

Tax-deferred growth refers to the ability of gains in an investment vehicle, such as a brokerage account or a real estate property, to compound without being disrupted by tax payments. You pay taxes later than you would in a taxable account.

Paying taxes on investments while they're compounding will naturally deplete the gains, as your investment would be compounding off a lower base. Even if you ultimately have to pay taxes on those gains, you're better off if you can defer taxes since you'll end up with a larger gain.

How you can take advantage of tax-deferred growth

How you can take advantage of tax-deferred growth

Several tax-deferred investment and retirement options are available to individuals depending on their employment status. One of the most common is a 401(k) employer-sponsored retirement plan. Some employers will even match your contributions to a 401(k), giving you an added incentive to save through this type of vehicle.

Unlike a taxable brokerage account, when you sell stock in a retirement account like a 401(k), you don't have to pay taxes on it if you reinvest that money. Additionally, the money you invest in a retirement account is tax-deductible. That means you don't pay taxes on that income until you withdraw from the account in retirement, at which point the money will have hopefully appreciated significantly.

Other tax-deferred employer-sponsored retirement plans include the 457 and the 403(b). Another popular tax-deferred retirement account is the individual retirement account (IRA), which is open to anyone regardless of employment status.

A traditional IRA works similarly to a 401(k). You contribute pre-tax income up to a set limit, which can grow without capital gains taxes until you withdraw from it, and it's treated like ordinary income.

There's also the Roth IRA, which does not offer a tax benefit when you contribute to it, but withdrawals are tax-free, making it a different way to take advantage of tax-deferred growth. Effectively, a Roth IRA gives you tax-free growth once you contribute to it.

Other ways to benefit from tax-deferred growth

Other ways to benefit from tax-deferred growth

If you're investing in a traditional taxable account, the laws of compounding and tax deferment incentivize you to buy and hold stocks rather than trade them frequently. While you'll still have to pay capital gains tax on those investments, you'll pay less than you would by selling frequently.

Another source of tax-deferred growth is annuities, which are contracts between you and an insurance company that makes payments to you once you fund the annuity. Annuities don't have a contribution limit, making them different from traditional retirement accounts.

You can also benefit from tax-deferred growth in real estate. Real estate investors can defer gains on an investment property sale through a 1031 exchange, which allows for capital gains tax to be deferred as long as a "like-kind" property is being purchased within a certain timeframe. Here, the tax deferment gives the investors more money to put into the next property, allowing for more gains in the long run.

1031 Exchange

How tax-deferred growth works

How tax-deferred growth works

Let's say you have a stock portfolio that you invest $10,000 into each year. If we assume you made a 9% annual return on those investments, after 10 years, you would have $165,603 in your account, and the initial investments would have more than doubled.

Related investing topics

The first year of investments would be worth $23,673. If you sold just those stocks, you would owe $13,673 in capital gains in a taxable account.

In a tax-deferred account, you wouldn't have to pay tax on those gains until you withdraw the money (presumably to spend it). And you can control how much you withdraw more easily than how much capital gains you make on your investments.

Tax-deferred growth could be even more valuable in a new bull market as stocks will likely experience above-average growth in an early bull market. Consider your options for tax-deferred growth and find the one that works best for you.