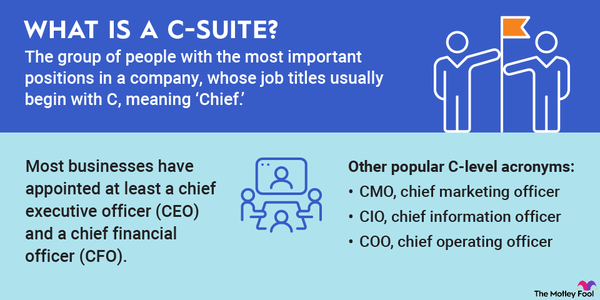

A chief executive officer, or CEO, is in charge of running the day-to-day operations of an organization. Although some CEOs may refer to themselves as “chief cook and bottle washer,” that description understates the importance and the roles of a competent chief executive. A good CEO is a strategist, therapist, evangelist, decision-maker, communicator, manager, and, above all, leader.

What is a CEO?

What is a CEO?

Business journalism often focuses on CEOs and for good reason: A strong chief executive can help a company to prosper, and a bad chief executive can drive it into the ground. A good CEO has many qualities, but the most important are the ability to make sound decisions, adapt when necessary, and remember that their success is directly tied to the people who work for the company.

Although some profiles make CEOs appear to be a modern-day combination of Henry Ford and Louis XIV, who called himself the Sun King, even chief executives have bosses. In most cases, a CEO is the second-most-powerful person in a corporation; the chairman of a board of directors generally has the most sway over the CEO’s job security. Even so, most chief executives are responsible for running the day-to-day operations of a business, whether it’s a small collection of franchises or a Fortune 100 corporation.

Why are they important?

Why is a CEO important?

Good or bad, the CEO sets the tone for an entire company. It may be ambitious, or it may be cautious, but the chief executive will use his or her personality and skills to determine the path the company takes to achieve its goals.

The role of the CEO is a relatively recent one, tied to the rise of shareholder capitalism. The term “chief executive officer” is generally thought to have first been coined in 1917 . Although the title hasn’t changed, the job has evolved significantly. One of the key roles of a chief executive now is ensuring that share prices -- your investment -- are as high as possible, and that dividends -- also from your investment -- are maximized and paid regularly.

The best CEOs appreciate the need to keep shareholders and investors happy. But they also have a deep and broad understanding of the company they supervise, even if they’re relative newcomers to it. A good chief executive is familiar with a company’s operations (its core business), as well as its marketing, finance, and human resources functions. It helps if the CEO is also familiar with the company’s competition, its market environment, and its history.

How do they affect investors?

How does a CEO affect investors?

When you put money into a company, a chief executive can make or break your investment. Good CEOs will take action to increase profits over the long term and make sure that investors share in the wealth creation. The best CEOs also will put the success of the company over their own; while there are a healthy number of “superstar” CEOs, their reputation often fares better than your bottom line.

Competent CEOs also will take care to keep shareholders informed about the company’s performance, often through quarterly earnings calls or investor presentations. Such efforts reassure investors and can boost not just shareholder confidence, but share prices.

Although a good chief executive might not want to become the face of a corporation, the CEO often winds up being responsible for its image. Good management and quality performance can reflect well on the chief executive; poor management and little or no profits can reflect poorly.

Related Investing Topics

CEOs: The good and the bad

CEOs: The good and the bad

Chief executives come with different skill sets, abilities and legacies. Consider one of the worst of the past half-century: Scott Paper’s Al Dunlap. Nicknamed “Chainsaw Al” for a two-year reign of terror between 1994 and 1996, Dunlap oversaw the layoff of 11,000 Scott employees, a 60% reduction in its research and development, the banning of managers from being involved in community events, and the elimination of corporate contributions to charities. Dunlap also moved the company’s headquarters from its long-time home in Philadelphia to Boca Raton, Florida, where he had purchased an $18 million home.

Dunlap was hardly punished by short-term investors since the cost cutting helped to increase shares 149% during his tenure. Long-term investors, however, were disappointed and accused Dunlap of simply slashing costs to increase market cap. Even after Scott was sold to Kimberly-Clark (KMB -1.0%), Dunlap was given a golden parachute worth almost $100 million before moving on to run Sunbeam.

In 2002, the SEC accused him of orchestrating a “massive” securities fraud at Sunbeam. Dunlap agreed to be permanently barred from serving as an officer or director of a public company.

Fortunately, good CEOs also exist. Consider one of the best of the past 50 years -- Apple’s Tim Cook. After being hired by Apple (AAPL -1.32%) co-founder Steve Jobs, Cook rose through the ranks and became CEO in 2011, spearheading one of the most spectacular turnarounds in U.S. corporate history. Since Cook took over as chief executive, Apple’s market capitalization has risen from a little more than $350 billion to $2.4 trillion as of early 2023.

Cook has increased the company’s charitable contributions, emphasized renewable energy sources, and focused on people, strategy, and execution. He’s also emphasized the importance of a stable workforce. When Apple workers grumbled about a return-to-office policy as the COVID-19 pandemic began to wane, Cook took notice, writing in a memo that “we are committed to listening, adapting, and growing together in the weeks and months ahead” and mandating a more flexible policy. And, even as almost 90,000 tech workers lost their jobs during the first five weeks of 2023, Cook described the potential for layoffs as “a last resort.”

The truth about CEOs is that not all of them will be as good as Tim Cook or as bad as Al Dunlap. Still, it’s important as an investor to do a bit of research and find out who’s going to ensure that your holdings work for you. Look at the history of the chief executive. Has he or she ever run a large company before? What’s their management philosophy? And how seriously do they take stockholders? Answering these questions will go a long way to providing peace of mind and return on capital.