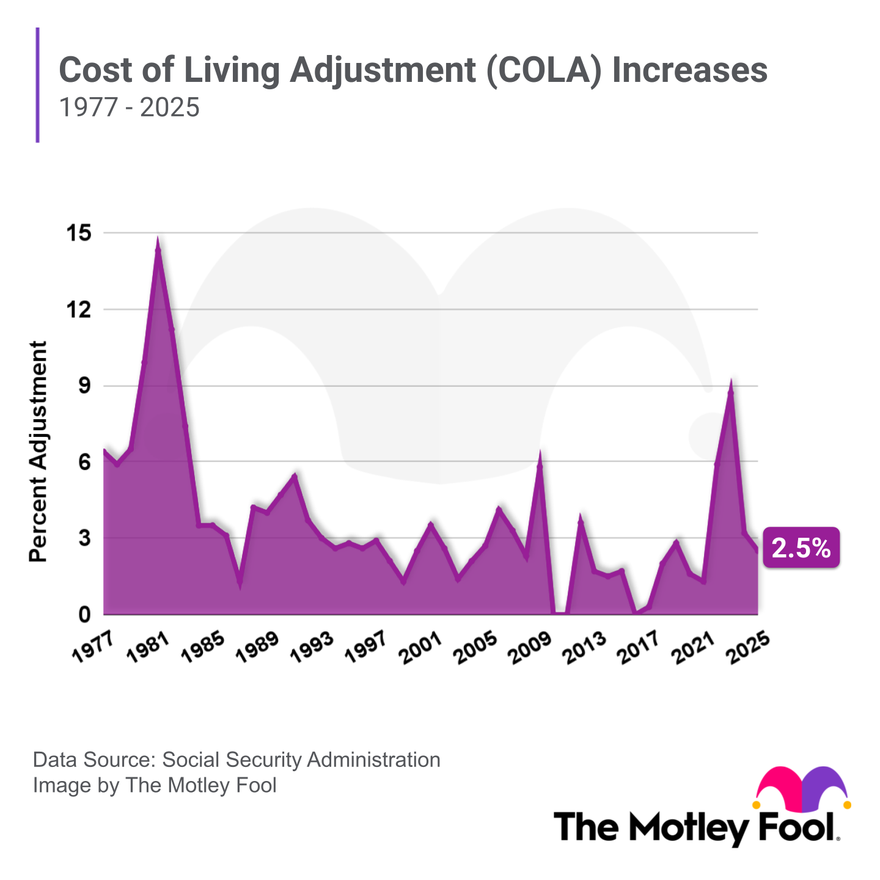

A cost-of-living adjustment, or COLA, is an inflation-based increase rolled out annually to all recipients of Social Security and Supplemental Security Income (SSI). For 2025, the Social Security COLA is 2.5%. We'll explain below exactly what that means for recipients.

What is it?

What is the Social Security COLA?

The Social Security COLA, or cost-of-living adjustment, is an annual adjustment to Social Security checks aimed at preserving the purchasing power of benefits. Without Social Security COLAs, benefits would buy less over time due to the effects of inflation.

Each October, COLAs for the following year are announced based on changes to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Beneficiaries then receive the increase in January.

The 2025 COLA

What is the Social Security COLA for 2025?

As mentioned, the Social Security COLA for 2025 is 2.5%. The Social Security Administration (SSA) announced the official 2025 COLA on Oct. 10, 2024, following the release of September 2024 inflation data.

The 2025 COLA will bump the average retired worker's monthly payment from $1,927 to $1,976, a $49 increase. The COLA takes effect in December, and the updated benefits are paid out starting in January 2025.

The 2025 Social Security raise is lower than the 3.2% beneficiaries received in 2024 or the 8.7% COLA for 2023. The 2023 increase was the highest since 1981 and the fourth-largest COLA in the program's history.

From 2010 to 2019, COLAs were 2% or less in eight out of 10 years. However, soaring inflation triggered by the COVID-19 pandemic resulted in the highest COLA in more than 40 years in 2023. The smaller COLAs in 2024 and 2025 reflect cooling inflation. Inflation in July, August, and September 2024 determined the COLA that Social Security and SSI beneficiaries will receive in 2025.

The calculation

How is the Social Security COLA calculated?

As mentioned, the COLA computation relies on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Like other measures for inflation, the CPI-W is calculated monthly by the Bureau of Labor Statistics.

Each year, the SSA averages the CPI-W value for the third-quarter months of July, August, and September. The average is then compared to the same value for the prior year. If the current year's average is higher, the percentage increase is the COLA.

For example, the third-quarter CPI-W for 2024 was 308.729. In the previous year, the average was 301.236. The percentage difference here is 2.5%, which became the 2025 COLA. Social Security and SSI recipients will see their benefits increase by that percentage in January 2025.

Related retirement topics

Start collecting

When can I start collecting Social Security?

You can start collecting Social Security retirement benefits at age 62. However, you won't be eligible for your full benefit until you hit full retirement age (FRA), which is 67 for anyone born in 1960 or later. If you claim benefits early, you'll permanently reduce the amount you can collect each month, though the trade-off is you'll get more checks during your lifetime.

You can also increase your benefits by waiting to collect Social Security past your full retirement age. You can receive an extra 8% for each year you delay past your FRA until your benefit maxes out at age 70.

Expert Q&A on Social Security and Retirement

Geoffrey Sanzenbacher

The Motley Fool: When asked about the 8.7% cost-of-living adjustment for Social Security benefits in 2023, 55% of respondents in a recent Motley Fool survey said they didn’t think it was enough. Why do you think retirees feel this way when it's one of the biggest COLAs in history? Did the SSA make a mistake in not raising it more? Are Social Security COLAs fair annual increases in your opinion?

Geoffrey Sanzenbacher: “The SSA COLA Adjustment is based on the CPI-W for urban wage earners and clerical workers from the third quarter of the prior year to the third quarter of the current year. The COLA has always been based on this number, which is generally quite close to the more traditionally cited measure of inflation, the CPI-U (Consumer Price Index for all Urban Consumers). This year, the CPI-W used to adjust Social Security was actually higher than the CPI-U (which went up 8.3 percent over the same period). So, in this sense, the adjustment seems fair -- it more than accounted for the traditional measure of inflation. That being said, certain expenses increased more than both the CPI-U or CPI-W. Fuel is about 11 percent higher than it was a year ago. Food is similarly about 11 percent higher. So, to the extent that these prices loom large in seniors' minds and are a larger share of seniors' budgets, then it could make sense that there is some feeling of inequity. Of course, other goods -- like clothing -- have gone up less than the adjustment (about 5 percent). So, it seems on the whole fair to me, although I understand the perception.”

The Motley Fool: Because of the COVID-19 pandemic, many Americans now fear they won’t be able to retire. What is your advice for someone who may be worried about retiring because of recent financial setbacks?

Geoffrey Sanzenbacher: “I would give the same advice I generally give -- if at all possible, try to work a bit longer. This will not only give you more time to save, allow you to delay claiming Social Security (and increase your benefit by 7-8 percent forever), but it will also allow you to avoid pulling money out of the stock market before it fully recovers from its recent downturn. Right now, the labor market is still pretty tight, so working a bit longer is a reasonable option.”

The Motley Fool: In 2019, the average retirement account savings for American households was $65,000 with the average American under 35 having $13,000 saved for retirement. Why do you think this average is so much lower than what experts typically expect Americans to have?

Geoffrey Sanzenbacher: “The biggest reason the typical American has little in their account is because our 401k system does not have universal coverage. Leakages (early withdrawals) and fees play a smaller role. Expanding programs like state-run Auto-IRAs is one way to fix this issue, but a federal program would likely work much better.”

The Motley Fool: There are no hard and fast rules about when to retire or how much we should have saved, but what three pieces of advice would you give someone who is just starting their first retirement savings account?

Geoffrey Sanzenbacher: “Three simple pieces of advice: 1) make sure you get your entire employer match; 2) put your money into a S&P Index Fund that has a low expense ratio (something less than 0.25 percent of assets); and 3) don't look at it...ride out the lows and be happy you are buying cheap.”

FAQ

Social Security COLA FAQ

How is the COLA determined?

The COLA is determined by increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers for July, August, and September, compared to the same three months for the previous year. If the CPI-W for these three months in the current year has increased over the previous years, the percentage increase is the COLA.

Will Medicare premiums increase in 2025?

The 2025 Social Security COLA is the smallest increase since 2021, but there's another unwelcome development for millions of seniors: Medicare participants will pay higher premiums next year.

Premiums for Medicare Part B, which covers doctor visits and other outpatient care, will rise from $174.80 to $185 in 2025, a 5.8% increase. That means Social Security beneficiaries won't see their full COLA reflected in their monthly benefit since most recipients have Part B premiums deducted from their benefits.

By law, Medicare Part B premiums cannot increase by more than the COLA in the same year.

What is the Social Security COLA for 2025?

The Social Security COLA for 2025 is 2.5%.

What is the Social Security program?

The Social Security program is a federal program that provides benefits to workers when they retire or become disabled. The program also provides benefits to surviving relatives of deceased workers. It's funded primarily by payroll taxes paid by workers and their employers.

Do all Social Security recipients receive a COLA?

Yes, all Social Security beneficiaries receive a COLA, whether they're receiving retirement, disability, or survivor benefits. COLAs also apply to Supplemental Security Income (SSI), a needs-based program that the Social Security Administration oversees.

The Motley Fool has a disclosure policy.