The Roth IRA is likely the most powerful wealth-building vehicle in your retirement account fleet. Money in a Roth IRA grows tax-free forever. This means all dividends, capital gains, and withdrawals will always remain unimpeded by tax, assuming you've had your account open for five years.

If you have existing retirement accounts -- whether pre-tax or post-tax -- you generally have the option of rolling over your account to a Roth IRA.

It's also important to draw a distinction between a rollover, a contribution, and a conversion. A rollover refers to the transfer of money from one retirement account to another. A contribution, on the other hand, is the placement of new money into an account. While there are very specific Roth IRA annual contribution limits, there is no limit to the number of rollovers you can complete or the amount of money you can roll over.

Avoiding consequences

Roth rollovers with no tax consequences

First, there are some Roth IRA rollovers that don't have any tax consequences if done correctly. The simplest is moving money from one Roth IRA to another. There is only a risk of tax consequences if the rollover isn't completed in a timely manner.

In addition, if you have access to a Roth 401(k) account at work, then rolling over that money into a Roth IRA also avoids any tax consequences. The tax-free nature of the Roth assets is preserved, and you have the full range of investment alternatives your Roth IRA offers. You still may receive a tax reporting form (a 1099-R), but the movement of assets from one Roth to another should result in zero additional tax.

Conversions

Roth conversions from traditional IRAs

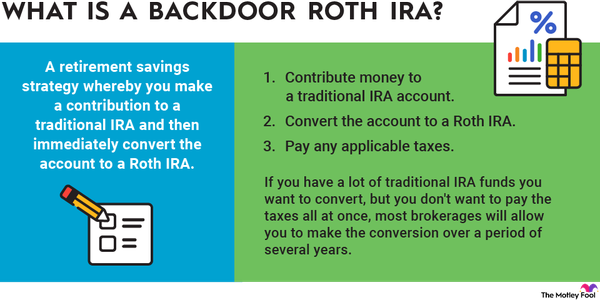

If you have money in a traditional IRA, there's no income restriction on your ability to convert it to a Roth IRA. However, there are tax consequences. To the extent your IRA has money that came from deductible contributions or earnings, you'll have to include the amount you convert in taxable income.

This happens because you are converting money from a pre-tax to a post-tax status. In addition to increasing your taxable income, a traditional-to-Roth conversion can push you into a higher tax bracket. For this reason, it's important for you to estimate all of your income for the year before completing Roth conversion. This will help you determine the tax cost of such a conversion.

One thing to keep in mind, though, is if you made nondeductible contributions to your traditional IRA, you'll be entitled to claim a pro rata share of those contributions to reduce the amount of taxable income you report. For instance, if you made a nondeductible contribution of $1,000, and you convert half of your total IRA assets of $10,000 to a Roth IRA, then you'll have taxable income of $4,500. That's half of the $10,000, or $5,000, minus half of the nondeductible $1,000 contribution amount, or $500.

Rollovers

Rollovers from traditional 401(k) and other retirement plans to Roth IRAs

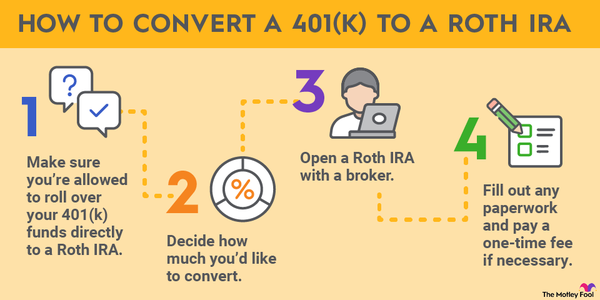

For a long time, rollovers from 401(k) plans or other employer-sponsored retirement accounts such as a 403(b) or 457(b) directly to a Roth IRA weren't allowed. You first had to roll over employer retirement money to a regular IRA and then convert the regular IRA to a Roth IRA.

Now the government has recognized that extra step shouldn't be necessary and has allowed direct rollovers from traditional 401(k)s to Roth IRAs.

The tax consequences for such a move are the same as a conversion from a traditional IRA to a Roth IRA. You'll have to treat pre-tax contributions as taxable income in the year in which you convert to the Roth IRA, but any after-tax contributions aren't required to be included in taxable income.

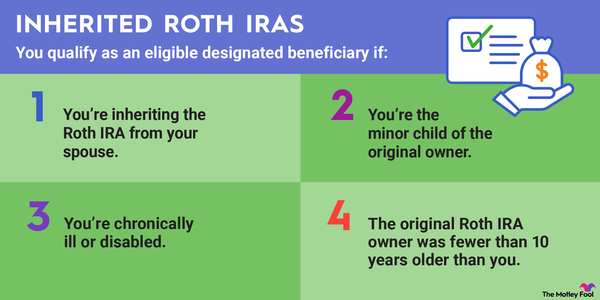

What you can't roll over to a Roth IRA

Finally, there's one category of retirement account that's not eligible for rollover to your personal Roth IRA: an inherited IRA. If you inherit a traditional IRA from a non-spouse, you're stuck with the traditional nature of that retirement account under current law. If you inherit a Roth IRA from a non-spouse, you'll need to open an Inherited Roth IRA and plan to take required minimum distributions (RMDs) over a 10-year period (assuming you inherited the account after Jan. 1, 2020; if it was before then, you are able to take RMDs over your lifetime).

The only exception is if you're the spouse of the deceased IRA holder, in which case you have the right to move inherited IRA assets into your own IRA. From there, you can then convert your own IRA to a Roth. However, as mentioned above, non-spouse beneficiaries don't have that option.

Chart of Roth IRA rollovers

| Account Type | Roll Over to Roth IRA? | Affects Taxable Income? | Limits? |

|---|---|---|---|

| Roth IRA | Yes | No | No |

| Roth 401(k) | Yes | No | No |

| Traditional IRA | Yes | Yes, if contributions were deductible | No |

| 401(k) | Yes | Yes | No |

| 403(b) | Yes | Yes | No |

| 457(b) | Yes | Yes | No |

| Inherited IRA from spouse | Yes | Yes | No |

| Inherited IRA from non-spouse | No | N/A | N/A |

| Other pre-tax account | Yes | Yes | No |

How to tackle a Roth IRA rollover

Practically speaking, a Roth IRA rollover is very simple to complete. Common practice is to simply contact the administrator for your current retirement account and request a rollover to a Roth account (either at the same or another institution).

But before you do so, it's critical to know if the rollover will trigger a tax liability so you can plan accordingly.

Once the rollover is complete -- assuming you're eligible to complete one -- you'll be well-positioned to generate tax-free growth and unhindered income for decades to come.