It's no secret that the ultra-rich have access to the best alternative investments that are often unavailable to the average investor, such as expensive wine, fine art, and equity in private companies.

What may come as a surprise is just how much their portfolios are weighted towards these types of investments. Among ultra-high-net-worth investors (those with a net worth of at least $30 million), alternative investments make up 50% of assets, compared to just 5% for the average investor.

Read on to find out how the ultra-wealthy incorporate alternative investments into their portfolios.

Key findings

- Alternative investment assets under management totaled $16.8 trillion in 2023 and are projected to reach $29.2 trillion by 2029, according to Preqin.

- Alternative investment usage is higher among wealthier investors, with 69% of ultra-high-net-worth (those with assets worth $30 million or more) investors having alternative assets in their portfolio compared to 45% of “mass affluent” (those with assets between $250,000 to $1 million) investors, according to a survey of EY clients.

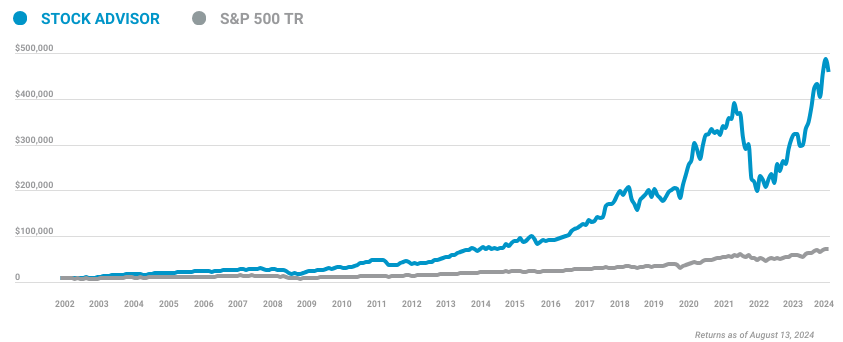

- Private equity is the only alternative investment to consistently outperform the S&P 500.

What are alternative investments?

What are alternative investments?

Alternative investments are investments in anything outside of the stock, bond, and currency markets. It's a broad term that encompasses tangible assets, commodities trading, investments in hedge funds, and even digital assets. These types of investments are often chosen as a hedge against inflation and, of course, to maximize returns.

Examples of alternative investments

Since there are so many things that fit the description of an alternative investment, here are some common examples:

- Private equity

- Real estate

- Hedge funds

- Private credit

- Rare whisky

- Art

- Watches

- Coins

- Cars

- Cryptocurrency

Financial Securities

Alternative investment use

Alternative investment use among investors

For the everyday investor, alternative investments typically make up a small portion of their overall assets. Retail investors have about 5% of their portfolios in alternative investments, according to a survey from the Chartered Alternative Investment Analyst Association.

Among high-net-worth investors, it's a whole different story. Alternative investments make up a larger portion of their assets than equities, according to a survey from global investing firm KKR.

KKR found that high-net-worth investors (those with a net worth of at least $1 million) allocated 28% of their assets to alternative investments in 2022, an increase of 2% from 2020.

Family offices of high-net-worth investors -- private companies that manage assets of the rich - are tilted even more heavily toward alternative investments. Alternatives compose 42% of the assets under management of family offices surveyed by KKR, while equities make up just 32%.

| ASSETS | High-net-worth, asset allocation as a percent of AUM | Family offices, asset allocation as a percent of AUM |

|---|---|---|

| Cash | 34% | 11% |

| Alternatives | 28% | 42% |

| Equities | 23% | 32% |

| Credit | 15% | 15% |

Alternative investments as a response to volatility

One of the main selling points of alternative investments is that they are a way to diversify portfolios to mitigate stock market volatility, and they can offer a hedge against inflation.

Despite market volatility and red-hot inflation in 2022, the majority of investors stuck to their alternative investment strategy, per the 2023 EY Global Wealth Research Report. Fifty-six percent made no change to their alternative investment approach, 27% added, and 17% invested less in alternatives.

| INVESTMENT IN ALTERNATIVE INVESTMENT PRODUCTS IN RESPONSE TO MARKET VOLATILITY | PERCENT OF INVESTORS |

|---|---|

| More | 27% |

| No change | 56% |

| Less | 17% |

Asset allocation for high-net-worth families

High-net-worth family offices have 29% of their assets in listed equities, which make up the largest portion of their investments, broken down by subgroup, according to KKR's survey.

Private equity is next, with high-net-worth families allocating 27% of their assets to this type of alternative investment. And, like many Americans, they also put part (15%) of their assets toward investing in real estate and other tangible investments.

Family offices have pared their exposure to hedge funds since 2017 and equities since 2020. They’ve increased their allocation to real assets, which includes real estate, commodities, natural resources, and equipment.

| Asset Class | 2017 | 2020 | 2023 |

|---|---|---|---|

| Public equities | 29% | 31% | 29% |

| Liquid credit | 9% | 10% | 10% |

| Private equity, venture capital | 24% | 27% | 27% |

| Private credit | 6% | 4% | 4% |

| Hedge funds | 12% | 6% | 6% |

| Real assets | 11% | 13% | 15% |

| Cash | 10% | 9% | 9% |

| Asset class | 2017 | 2020 | 2023 |

Percentage of investors with alternative investments by net worth

EY classified investors into four groups based on their level of wealth. Alternative investment usage rises for each group, and among ultra-high-net-worth investors, 81% have alternative investments.

| Net worth level | Current usage level of alternative investments | Estimated usage level by 2024 |

|---|---|---|

| Mass affluent (< $1M) net worth | 14% | 32% |

| High-net-worth (≥ $1M net worth) | 29% | 46% |

| ≥ $5M net worth | 55% | 68% |

| ≥ $10M net worth | 81% | 85% |

Percentage of investors with alternative investments by region

Interestingly, North America is the region with the lowest usage of alternative investments. This is most likely due to the strong historical performance of the stock market, since investors don't need to seek out alternatives to get a good return.

| Region | Current usage level of alternative investments | Estimated usage level by 2024 |

|---|---|---|

| Global | 32% | 48% |

| North America | 18% | 27% |

| Asia-Pacific | 37% | 61% |

| Europe | 37% | 54% |

| Middle East | 55% | 71% |

| Latin America | 70% | 79% |

Percentage of investors with alternative assets by generation

Gen Xers are the most likely to have alternative investments, but that may not last much longer. The percentage of millennials who use alternative investments is expected to explode by 2024.

| Generation | Current usage level of alternative investments | Estimated usage level by 2024 |

|---|---|---|

| Millennial | 32% | 60% |

| Generation X | 38% | 54% |

| Baby boomer | 26% | 34% |

Satisfaction with alternative investments

Younger investors and wealthier investors are more likely to be satisfied with the performance of their alternative investments, according to new data from EY.

Sixty-three percent of the millennial clients EY surveyed are happy with how their alternative investments have performed, compared to just 40% of baby boomers.

When it comes to wealth, 45% of clients EY describes as mass affluent are satisfied with their alternative investments’ performance, compared to 63% of very-high-net-worth clients and 69% of ultra-high-net-worth clients.

Overall, 48% of clients EY surveyed are satisfied with how their alternative investments have performed.

| CLIENT TYPE | PERCENT SATISFIED WITH PERFORMANCE OF ALTERNATIVE INVESTMENTS |

| Millennial | 63% |

| Gen X | 49% |

| Baby boomer | 40% |

| Mass affluent | 45% |

| High net worth | 47% |

| Very high net worth | 63% |

| Ultra-high net worth | 69% |

| All clients | 48% |

Performance data for alternative investments

Performance data for alternative investments and the S&P 500

Private equity is the only alternative investment to outperform the S&P 500 (SNPINDEX:^GSPC) in the last three and five years. Several indices track major alternative investment classes, and we can use these to compare their performance over the years with more traditional investment options. No indices included in The Motley Fool’s analysis outperformed the S&P 500 in 2023.

| Index | 2023 | Past 3 years (2021-2023) | Past 5 years (2019-2023) |

|---|---|---|---|

| S&P 500 | 24.70% | 8.80% | 14.00% |

| Cambridge Associates U.S. Private Equity Index | 9.30% | 14.10% | 17.90% |

| Cambridge Associates U.S. Venture Capital Index | -3.40% | 6.70% | 18.10% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 5.53% | -3.31% | 1.11% |

| Cliffwater Direct Lending Index | 12.31% | -- | 9.09% |

| NCREIF Property Index* | -7.90% | 4.58% | 4.33% |

| Barclay Hedge Fund Index | 9.27% | 0.04% | 0.07% |

Luxury goods as alternative investments

How luxury goods fare as alternative investments

The value of luxury goods has increased by 100% over the past 10 years, as reported by the Knight Frank Luxury Investment Index at the end of 2023.

Certain items perform much better than others. Rare whisky is the standout, with its value increasing by 280% over the past decade. On the other hand, jewelry and colored diamonds have recorded far more modest 10-year changes of 37% and 8%, respectively.

Despite the potential for appreciation, luxury goods normally don't make up a large portion of wealthy investors' alternative assets. There are several reasons for that:

- Luxury goods are illiquid. They can be expensive and time-consuming to buy and sell even in small quantities.

- They're risky and relatively unregulated. For example, counterfeit art is a long-standing problem, and sales are not always reported.

- Historical data for particular items can be lacking.

- Some luxury goods can require significant costs over time for things such as maintenance and upkeep.

| Item | 12-month change | 10-year change |

|---|---|---|

| Rare whisky | -9% | 280% |

| Wine | 1% | 146% |

| Watches | 5% | 138% |

| Knight Frank Luxury Investment Index | -1% | 100% |

| Art | 11% | 105% |

| Cars | -6% | 82% |

| Handbags | -4% | 67% |

| Coins | 4% | 56% |

| Furniture | -2% | 40% |

| Jewelry | 8% | 37% |

| Colored diamonds | 2% | 8% |

Digital assets as alternative investments

Cryptocurrency hit the mainstream in 2020, but valuations throughout the sector have taken a beating, and a number of cryptocurrency exchanges have collapsed, casting doubts on its viability as an asset class.

Interest in cryptocurrency among high-net-worth individuals has plummeted. A 2022 survey from Knight Frank found that crypto accounts for just 2% of the portfolios of ultra-high-net-worth individuals. Crypto now makes up a smaller percentage of the average ultra-rich portfolio than gold (3%) and alternative investments, such as art, cars, and wine (5%).

Crypto is also considered the riskiest and most volatile asset class by high-net-worth individuals, according to Frank Knight. And while 59% of ultra-high-net-worth individuals are interested in investing in art, just 34% believe the non-fungible token (NFT) market still has potential.

Alternative investments are poised for growth

Alternative investments are poised for growth

Total alternative assets under management are projected to reach $29.2 trillion by 2029, according to Preqin, a firm that provides data and analytics on alternative investments. That's more than a 6x increase from the $4.1 trillion in alternative assets under management in 2010 and nearly triple the value of alternatives under management in 2019.

Institutional investors plan to increase their alternative investments

The vast majority (81%) of the institutional investors surveyed by Preqin intend to increase their allocation of funds to alternative investments by 2025.

Just 3% intend to decrease their allocation to alternative investments in that time frame.

| Institutional investors' plans for allocations to alternative investments by 2025 | Percentage |

|---|---|

| Will increase significantly | 26% |

| Will increase | 55% |

| Will stay the same | 16% |

| Will decrease | 2% |

| Will decrease significantly | 1% |

Institutional investors' plans for allocation to alternative investments by asset

Private equity is the best-performing alternative investment, and it's also where institutional investors plan to invest more, with 79% saying they'll increase their asset allocation by 2025.

| Institutional investors' plans | Private equity | Private debt | Hedge funds | Real estate | Infrastructure | Natural resources |

|---|---|---|---|---|---|---|

| Will increase significantly | 23% | 16% | 8% | 10% | 15% | 6% |

| Will increase | 56% | 51% | 27% | 41% | 51% | 29% |

| Will stay the same | 17% | 25% | 34% | 33% | 24% | 38% |

| Will decrease | 3% | 6% | 19% | 13% | 6% | 19% |

| Will decrease significantly | 1% | 2% | 13% | 2% | 3% | 8% |

Outside experts weigh in

Andy Puckett, PhD

Why do you think the ultra-wealthy are more likely to hold alternative investments than middle-class or mass affluent investors?

Alternative asset classes are often marketed as being uncorrelated (or having relatively low correlations) with publicly available investments such as stocks and bonds. There is also a suggestion that some of these alternative investments have high returns relative to their risk. Both claims are more controversial than most in the industry would have you believe. Ultimately, I think the allure of alternative investments for the ultra-wealthy is their exclusivity, not the true expected risk-return profile of the investment.

Should most investors consider more alternative investments, like cryptocurrency, luxury items, or direct lending? Why or why not?

Yes, I think investors should consider and investigate alternative investments. However, "alternative" investments are a very diverse bucket. Invest in what you know, what has intrinsic value, or what can provide expected cash flows in the future. If an investor considers Bitcoin as an "alternative" investment, then my answer would be a resounding NO. The purported benefits of Bitcoin are that it is an alternative currency and store of value, yet Bitcoin does not satisfy the conditions that we typically use to classify either a currency or store of value. I have yet to hear a coherent explanation for why Bitcoin will be valuable in 20 years.

Holdings of alternative investments are projected to increase by over 300% between 2010 and 2025. What do you think is behind this significant increase?

There are huge amounts of liquidity in the economy right now and ALL real asset prices are rising. Inflation figures are already above 5% per annum, and there is little evidence that anything is being done to curtail it. Given that, investors would be well advised to have a significant portion of their investments in real assets.

81% of institutional investors are planning on increasing their alternative investment holdings by 2025. Why do you think this is?

Public equities (at least in the US) are extremely expensive right now from a historical perspective, and fixed income yields are also at historic lows. My guess is that many institutional investors are looking to take some of their holdings from expensive public equities or low-yielding debt and put them in alternative investments.

32% of institutional investors are planning on decreasing their allocations in hedge funds. Does this signal a loss of confidence in the hedge fund model?

Hedge funds charge incredibly high fees for what they provide -- in some cases more than 100 times the fees of an index mutual fund. Yet there is evidence that hedge fund investors do not receive any type of superior return for their investments, and likely experience worse outcomes. I think that institutional managers are just finally understanding the empirical evidence.

Rare whisky, classic cars, wine, and handbags have increased in value by over 100% in the past 10 years. Does this mean more investors should consider investing in luxury items?

Again, investors should invest in what they know, what has intrinsic value, or what can provide expected cash flows in the future. While collectibles have had a great increase in value in recent years, there is a lot of evidence that these returns are incredibly heterogeneous and nuanced. For example, recent research on collectible coins shows that the returns during the 2008–2015 period of MS (Mint State) coins were approximately 4% per year, yet the returns to similar coins graded G (good) were less than -- 5% per year. The same kind of dispersion can be shown for baseball cards, wine, art, etc. If investors are going to put their hard-earned money in collectibles and luxury items, they need to know the particular market that they are investing in well.

Richard Warr

Why do you think the ultra-wealthy are more likely to hold alternative investments than middle-class or mass affluent investors?

The ultra wealthy are more likely to hold assets outside of retirement plans which typically have a lot of restrictions. So for many ordinary investors, these asset classes are just not available. For the ultra wealthy, alternative assets can provide higher expected returns, in part because they are much less liquid. But holding illiquid assets really only makes sense for those who have a good proportion of their portfolio already in liquid, traditional assets. High net worth investors can also afford to be more speculative - by definition they already have a lot of wealth, so they can take more risks.

Should most investors consider more alternative investments, like cryptocurrency, luxury items, or direct lending? Why or why not?

Alternative investments encompass a wide range of products. Real estate and private equity make a lot of sense for higher net worth investors. They tend to be quite illiquid, so should only be held in a portfolio that has a liquid portion - such as traditional assets like bonds and stocks.

My definition of an investment is something that has a fundamental value that we can estimate and that generates some sort of income stream (although that income can be retained in the asset -- such as a stock that doesn't pay dividends). Many alternative assets don't really satisfy this definition, and so in my opinion, many alternative investments aren't really investments. They are just stuff. Whisky, fine wine, art, and baseball cards aren't really investments. They are really more like aspirational items that high net worth investors might like to buy. I wouldn't seriously consider these to be a part of anyone's portfolio, but if someone wants to collect wine or art, then all power to them, but it shouldn't really be considered to be part of an investable asset class.

Cryptocurrency is more of a speculative instrument rather than an asset. Crypto generates no income and is very very hard to establish a fundamental value on, as a result, it's almost impossible to make a judgment as to whether any particular crypto is over or undervalued. With crypto you are just making a bet that it will increase in value, but there are really no fundamentals that can support any particular valuation.

Holdings of alternative investments are projected to increase by over 300% between 2010 and 2025. What do you think is behind this significant increase?

This is largely due to the continued increase in wealth of higher net worth individuals. As more money chases a limited supply of stocks and bonds, investors start looking for additional places to place their money. In addition, alternative investments tend to have much higher fees than traditional assets. They tend to be very profitable for investment companies and advisors and hence are promoted heavily to high net worth clients.

81% of institutional investors are planning on increasing their alternative investment holdings by 2025. Why do you think this is?

Most of them are chasing higher returns. The number of stocks listed in the stock market has been flat, yields in the bond market are very low, so institutions are looking for other places for yield. Alternatives such as private equity and real estate may help in this search.

32% of institutional investors are planning on decreasing their allocations in hedge funds. Does this signal a loss of confidence in the hedge fund model?

Hedge fund returns have really been overhyped for years. Hedge funds are incredibly expensive from a fee point of view and furthermore, buying and selling them is extremely complex. They are basically very expensive investments that in general, don't provide better performance than a diversified portfolio of stocks and bonds. My concern would be that an institution would move from one over-hyped expensive investment to another.

Rare whisky, classic cars, wine, and handbags have increased in value by over 100% in the past 10 years. Does this mean more investors should consider investing in luxury items?

These aren't investments! They are just expensive stuff that might increase in value. You should buy luxury items because you want to own them and they bring you pleasure. Trying to justify your purchase of a classic car as an investment is basically trying to justify your hobby as something more legitimate!

Dr. Pamela Drake

Why do you think the ultra-wealthy are more likely to hold alternative investments than middle-class or mass affluent investors?

The ultra-wealthy have a higher tolerance for risk; if they lose all of an investment’s value, they still have other resources. If someone in the middle class took significant risks with alternative investments, losses would impinge upon their standard of living. The willingness to take on more risk increases as wealth increases.

Should most investors consider more alternative investments, like cryptocurrency, luxury items, or direct lending? Why or why not?

Definitely not. Cryptocurrency is the Tulip Mania of our generation, so this should be off the table – no matter what you hear about great "profits." Everyone needs to live within their means. Shooting for the stars is fine if you have a significant financial cushion, but otherwise it is not wise.

Holdings of alternative investments are projected to increase by over 300% between 2010 and 2025. What do you think is behind this significant increase?

Worrisome. The mania will end. And predictions are often wrong.

81% of institutional investors are planning on increasing their alternative investment holdings by 2025. Why do you think this is?

Diversification and the search for returns. The returns on fixed income are so low that they are hunting for bigger, better returns, but these come with a greater risk.

32% of institutional investors are planning on decreasing their allocations in hedge funds. Does this signal a loss of confidence in the hedge fund model?

Hedge funds don’t really hedge, but take great risks. This works when the economy is doing well, but doesn’t in an economic downturn. Too many investors chasing too few returns.

Rare whisky, classic cars, wine, and handbags have increased in value by over 100% in the past 10 years. Does this mean more investors should consider investing in luxury items?

Absolutely not. Not only do these have price risk, but there is physical risk to these assets, which would require substantial insurance. Not worth it. Haven’t we learned from Beanie Babies?

From alternative to mainstream

With ultra-high-net-worth investors devoting half their portfolios to alternative investments, it's clear that these investments are actually mainstream for the wealthy. But those are people who have access to more investment options because they're far above the average net worth. What about alternative investments for retail investors?

Among fund managers surveyed by Preqin, 15% said they offer retail investors access to alternative investments and plan to expand those offers. Another 17% didn't currently offer these investments to retail investors but planned to do so in the future.

Retail investors already have access to many types of alternative investments, such as real estate, luxury goods, and cryptocurrency. Real estate investment trusts (REITs) have become a popular way for everyday individual investors to tap into the real estate market. And there are new alternative investment funds and platforms popping up to give the average investor the ability to invest in shares of fine wine, art, cars, and so on.

For retail investors who want to add more alternative investments to their portfolios, more and more options are becoming available. And for the ultra-wealthy, alternative investments will likely continue to be an extremely popular way to invest.

Sources

- Chartered Alternative Investment Analyst Association (2020). "The Next Decade of Alternative Investments: From Adolescence to Responsible Citizenship."

- EY (2021). "2021 EY Global Wealth Research Report."

- EY (2023). “2023 EY Global Wealth Management Research Report.”

- Financial Planning Association (2023). “The 2023 Trends in Investing Survey.”

- KKR (2024). “Loud and Clear.”

- Knight Frank (2024). “The Wealth Report.”

- Preqin (2020). "The Future of Alternatives 2025."

- Preqin (2020). "The Past, Present, and Future of the Alternative Assets Industry."

- Preqin (2023). “Preqin Global Report 2023: Alternative Assets.”

- Preqin (2024). “Global alternatives markets on course to exceed $30tn by 2030 — Preqin forecasts.”