There are a few factors to consider when deciding how many shares of a particular stock to buy. In addition to your available capital, you should consider diversification and purchasing fractional shares of stock.

With that in mind, here's a quick guide that can help you determine the ideal number of shares to buy.

How many shares can you buy based on price?

How many shares can you buy based on price?

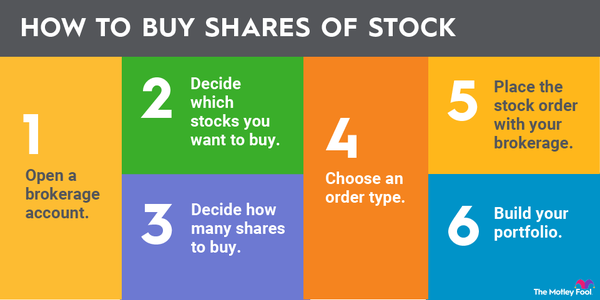

First, let's look at how many shares you can buy. Assuming your broker doesn't charge commissions for stock trades (online brokers typically don't), calculating the number of shares you can buy with a certain amount of money is easy.

To help you determine how many shares of a particular stock you can buy, here's a three-step process to use:

Find the current share price of the stock you want

You can obtain the share price through your broker or from a financial website. Make sure you're looking at a real-time quote, not a delayed one. Some public news sites offer quotes delayed by 20 minutes or so.

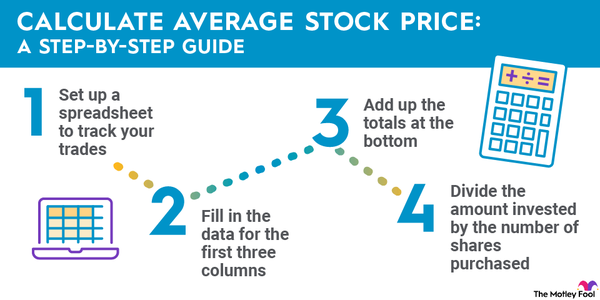

Divide the amount of money you have available to invest in the stock by its current share price.

For example, if you have $1,000 to invest and a stock is trading for $40, this equals 25 shares. Of course, in the real world, you will probably not get a whole number, and that's why the next step is needed.

Determine the number of shares you can buy

If your broker allows you to buy fractional shares, or you got a whole number in the second step, the result is the number of shares you can buy. If you can't buy fractional shares, round down to the nearest whole number.

Example

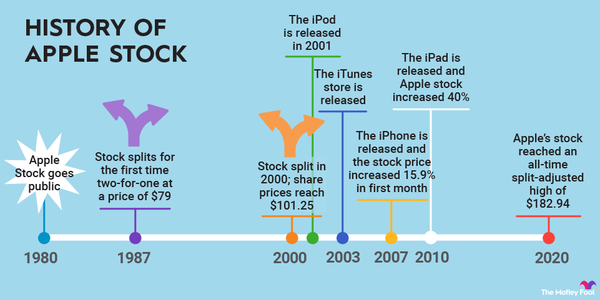

As an example, let's say you want to buy Apple (AAPL -1.32%) stock, and you have $2,000 to invest. According to a real-time stock quote, Apple is trading for $183.20 per share as I'm writing this. Dividing those two numbers would give you about 10.92 shares. If your broker supports fractional shares, this means you can afford to buy 10.92 shares of Apple. If your broker doesn't support fractional shares, you would be able to buy 10 shares.

What about diversification?

What about diversification?

Here's an important point, especially for newer investors. Just because you can buy a certain number of shares of a particular stock doesn't mean you should. For example, if you put $1,000 into a newly opened brokerage account and a stock you want to own trades for $50, you have the ability to buy as many as 20 shares.

However, don't forget about portfolio diversification. Instead of a large position in one stock, a better investment strategy is spreading your initial brokerage deposit across a few different companies.

Most experts tell beginners that if you're going to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings. Since most brokers no longer charge commissions for online stock trades and many allow you to buy fractional shares, it's more practical than ever to spread a relatively small amount of capital across many different stock positions.

Is it worth buying one share of stock?

Is it worth buying one share of stock?

Absolutely. In fact, with the emergence of commission-free stock trading, it's quite feasible to buy a single share. Several times in recent months, I've bought a single share of stock to add to a position simply because I had a small amount of cash in my brokerage account.

However, if your broker is one of the few who still charges commissions, it might not be practical to make small investments. If you are still paying commissions, consider making the switch to a top-rated online broker who doesn't charge commissions on online stock trades. Let's be perfectly clear: With so many great commission-free options, there is no reason to pay commissions on online stock trades.

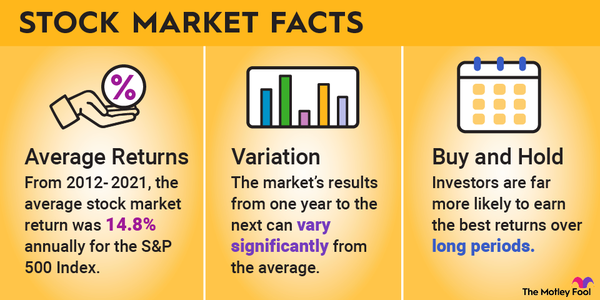

Buy-and-Hold Strategy

Is it possible to buy less than one share of stock?

Is it possible to buy less than one share of stock?

In recent years, brokers have started to embrace the idea of allowing investors to buy fractional shares directly.

There are two big benefits of fractional share investing. First, it gives newer investors access to stocks with a high share price. As one example, if Chipotle Mexican Grill (NASDAQ :CMG) is trading for $2,000 per share, an investor with only $500 to invest could buy 0.25 shares of the stock. If the broker didn't allow fractional share investing, they couldn't buy any.

Second, fractional share investing allows investors to put all of their money to work. Using our Chipotle example, if you had $3,000 to invest and didn't have the ability to buy fractional shares, you would be able to purchase just one share and have $1,000 left over. With fractional shares, you could invest your entire $3,000 and purchase 1.5 shares of the fast-casual dining giant.

Related investing topics

How many shares of stock should you buy?

How many shares of stock should you buy?

The bottom line is that there is no universal answer to this question -- it depends on your personal situation. Just remember to consider these important factors:

- How much money you have to invest.

- Whether you need to diversify your investment portfolio or want to put all your available capital into the stock.

- Whether your broker allows fractional share investing.

Matt Frankel has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.