Saving and investing are related strategies for achieving financial security. To save or to invest, you must forgo spending now to build wealth for your future. The difference between saving and investing is whether you hold your unspent funds in cash or some other form.

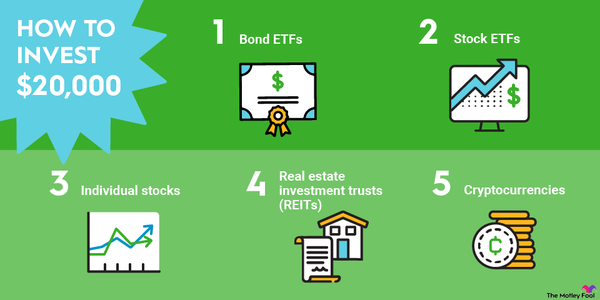

Saving means setting aside cash for future use. Investing means using cash to buy assets that should produce wealth through appreciation or income. Those wealth-producing assets are often stocks, bonds, and exchange-traded funds (ETFs). Real estate, cryptocurrency, and collectors' items are also investable assets.

Differences

How saving and investing differ

Saving is a cash activity. You set aside excess cash in a savings account, certificate of deposit (CD), or somewhere in your home. You might earn interest on cash held in an account, but the goal is to have those funds available for later use.

When you invest money, you use your cash to buy another asset. The goal here is to create profits or income. Examples of investing include:

- Buying stocks you expect to appreciate. When the value of the stock rises, you can sell it at a profit.

- Buying stocks that pay dividends. You can use the dividend income to pay bills or to buy more stocks.

- Buying real estate that earns rental income. The rent you collect should create profits after you pay your property expenses.

- Buying bond ETF shares that pay interest. As with dividend payments, you can use the income to pay bills or to buy more shares. Buying more shares, called reinvesting, enables compounding -- a powerful way to build wealth over time. Compounding happens when your earnings start generating more earnings. This can expedite wealth creation dramatically.

Dividend Payments

When to save

When to save

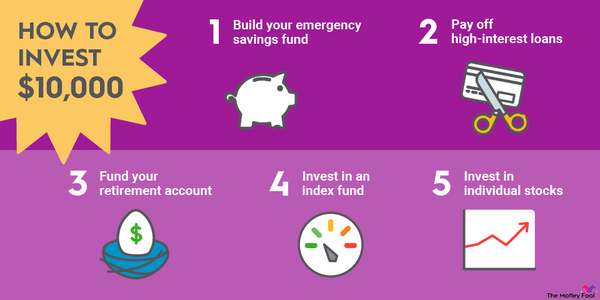

You should save when you have income but little or no cash on hand. Set a goal to build a cash savings balance that can cover six months of your living expenses. This protects you against unexpected financial emergencies, like losing your job or wrecking your car.

Saving is also appropriate for short-term financial goals. Examples include buying a home, paying for college, or funding a wedding. If the timeline for reaching your goal is five years or less, saving is a safer choice than investing. Investing, even conservatively, is risky when the timeline is short.

Note that high-interest debt balances can complicate your savings efforts. Some will argue it's better to repay debt before you save. However, living without an emergency fund is risky. Should you have a surprise expense, you'd have to borrow more to cover it. To avoid that scenario, save what you can as you repay debt.

Where to save?

Choosing a savings account

The right savings account will be easy to use and free of monthly charges. Consider these pointers as you weigh your savings account options:

- Is the interest rate competitive? Interest rates on savings accounts vary widely. Look for a high-yield savings account so your cash deposits earn a competitive rate.

- Can you automate deposits into the account from your checking account? Automation will streamline your savings efforts. Find an account that allows you to implement hands-free transfers from checking to savings -- ideally, on the day you get paid.

- Check the fee schedule. Will you incur fees for normal account management activities?

- Are transfers and withdrawals easy? Are there free ATMs nearby? How long will it take to transfer money back into your checking account?

- Are there extra features that make saving money easier? Some accounts have broader savings management capabilities beyond automated transfers. Look for accounts that help you manage a budget and create and track savings goals.

When to invest

When to invest

You should invest when you have income, a cash emergency fund, and no high-interest debt.

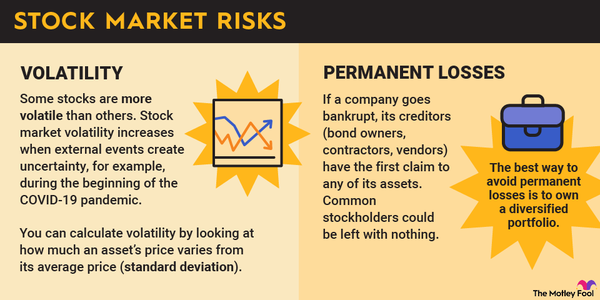

Cash emergency fund. This cash helps you manage the risks of investing. Any asset you buy can lose value or fail to produce the expected income. Stocks, for example, rise and fall in value daily. It's easier to tolerate those normal ups and downs if you have another source of cash available to cover financial emergencies.

Without cash on hand, you may have to sell your investments quickly if something bad happens. Selling too soon limits your wealth potential. Worse, if you sell when your asset's value is temporarily down, you may lose money.

No high-interest debt. Paying off debt provides a guaranteed return because you're spared future interest expenses. Investing is less certain in terms of return potential and timeline. Take the sure thing and repay your high-interest credit accounts before you start investing.

Where to invest?

Choosing a brokerage account

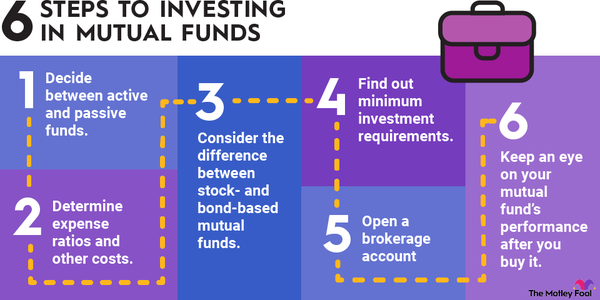

As with savings accounts, your ideal brokerage account should be convenient and low-cost. The selection process is similar to choosing a savings account but with one extra complication. To start, you must pick the type of investment account you need.

A taxable brokerage account is appropriate when you don't know your investing timeline. Taxable accounts have no withdrawal restrictions and no tax perks. You will owe taxes annually on any dividends, interest, or realized gains you earn.

If you are specifically investing money for retirement, consider an individual retirement account (IRA). With traditional IRAs and Roth IRAs, your earnings are not taxable from year to year. There is a trade-off, however. You may incur taxes and penalties for withdrawing IRA funds before retirement.

Once you decide on the type of brokerage account you need, you can start shopping for options. Compare prospective accounts based on these factors:

- Available investments. More is better. At a minimum, you want access to the full range of exchange-traded stocks and funds.

- Fee schedules. Maintenance and per-trade fees should be minimal.

- Look for automation features. Ideally, you'd set up your brokerage account to pull in money and automatically invest it each month.

Save: Pros & cons

Pros and cons of saving

Relative to investing, saving offers three advantages:

Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could lose 50% of its value in a day, and your savings balance won't change.

Pro: You can use your savings immediately. Cash is liquid. You can use it directly to buy things, pay bills, and repay debts. You can't "spend" stocks and bonds. You must convert them into cash first.

Pro: Saving enables you to invest. You cannot invest unless you've saved first. This is true on two levels:

- You must deposit cash into a brokerage account to invest in the stock market. You then use that cash to buy securities. The first step, depositing the funds, is an act of saving.

- The best practice is to refrain from investing until you have a cash savings balance. If an emergency were to arise, you'd use your cash to cover the expense. This protects you from having to sell your investment assets before they've appreciated.

Saving also has two disadvantages relative to investing.

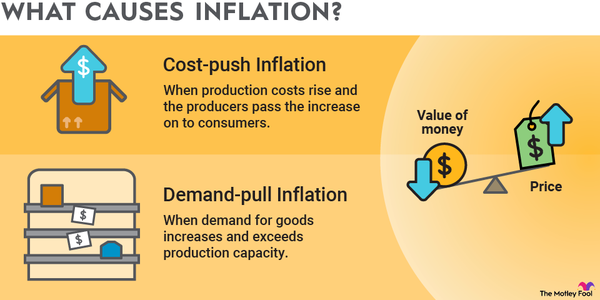

Con: Savings provide negative returns after inflation. Cash's spending power declines over time due to rising prices, also known as inflation.

A normal inflation rate is 2% to 3% annually. At those rates, $100 cash on Jan. 1 will buy only $97 to $98 worth of stuff by year's end.

Inflation is why you'd hold cash in a high-yield account rather than a checking account or under the mattress. The interest helps offset inflation. For example, 2% inflation nets to 1.5% if you are earning 0.5% on your savings balance.

Con: Savings returns are lower than investing returns. You need cash on hand for emergencies, but there's a cost to that beyond the negative real returns. When you hold cash, you're forgoing the chance to invest and earn inflation-beating returns.

Invest: Pros & cons

Pros and cons of investing

Investing outshines saving in its return potential.

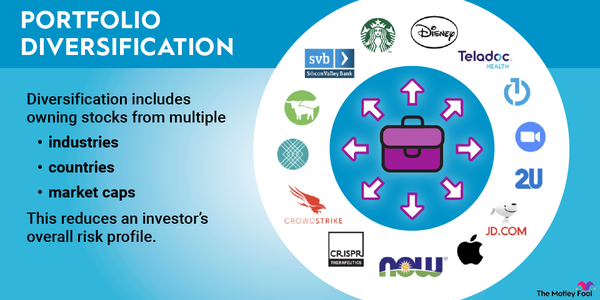

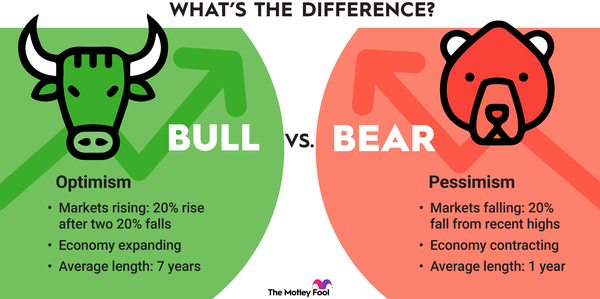

Pro: Investing return potential is high. Over the long term, the average annual growth of the stock market is about 7% after inflation. At that growth rate, invested assets double in value roughly every 10.5 years.

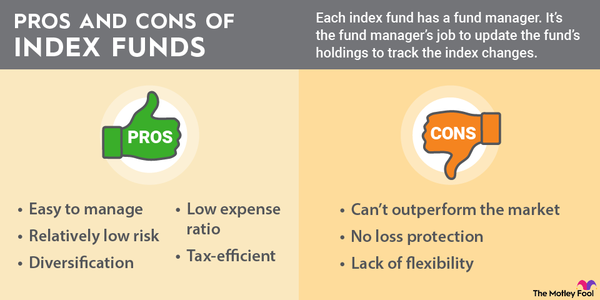

To access market-level growth, you'd invest in broad market index funds with low fees. However, there are two downsides to investing compared to saving.

Con: Your assets can lose value. Your investments are only worth what someone is willing to pay for them. That value can rise or fall based on factors outside your control.

Con: You must sell your assets before you can use the funds. To use the value locked in your investments, you must find a buyer, settle on a price, and collect your cash. With publicly traded stocks and bonds, this process takes a few days. Other assets, such as real estate, can take months to sell.

Invest or save?

Should you invest or save?

Prioritizing saving over investing can be tough. Here are some guidelines to help you decide which comes first.

Saving is the higher priority when:

- Your cash savings will not cover three months of living expenses. As previously noted, cash on hand keeps you afloat through unexpected financial challenges, such as job loss, accidents, and injuries.

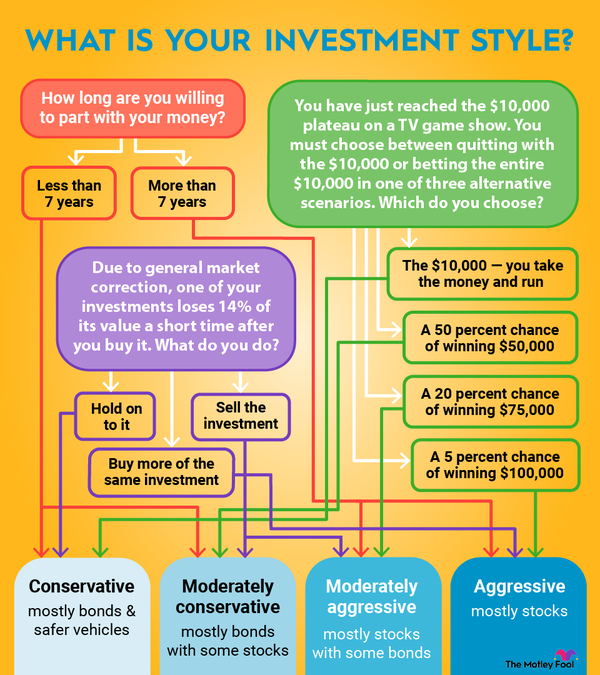

- You're targeting a short-term financial goal. If you want to buy a home within five years or pay for your daughter's wedding next year, it's better to save. Investing is too risky when the timeline is short.

Investing is the higher priority when:

- You can afford to keep the money invested. Investing requires a minimum timeline of five years. In shorter timeframes, the stock market can be volatile. The shorter your timeline, the less likely you are to see the desired results.

- You are preparing for retirement or another long-term goal. Investing is ideal for long-term goals. With stocks in particular, a longer timeline allows you to practice buy-and-hold investing. This involves buying shares in quality companies and letting them appreciate for decades. It's the simplest way to build wealth with stocks.

Related investing topics

Can't decide?

You don't have to choose one or the other

You can also save and invest at the same time. For example, you might contribute enough to your 401(k) to max out your free employer matching contributions. Meanwhile, you can add to your cash savings until you reach your target balance.

Once you reach your cash savings goal, you can pause those deposits and increase your 401(k) contributions to ramp up your retirement savings.

Saving and investing are two levers you can pull to achieve financial security. Saving is for short-term needs, and investing is for the long term. To find and keep prosperity, master the skill of using both.

FAQ

Saving vs. investing FAQ

Why is saving better than investing?

Saving is better than investing when you have minimal cash savings. Having cash on hand allows you to pay for unexpected expenses without incurring debt.

Alternatively, investments cannot directly cover your expenses -- you must sell them first. Selling investments too soon can easily create losses or limit your investment returns.

How much should I keep in savings vs. investments?

You can begin investing once you have saved enough to cover three to six months of your living expenses. There is no limit to how much wealth you can build and hold within an investment account. More is better. Most people require a large investment balance to retire comfortably.

What is the difference between savings and investment?

Saving involves holding and accumulating cash. Investing uses cash to purchase other assets, with the expectation that those assets will produce income or increase in value. Saving produces low returns with low risk, while investing has more risk but produces much greater returns.