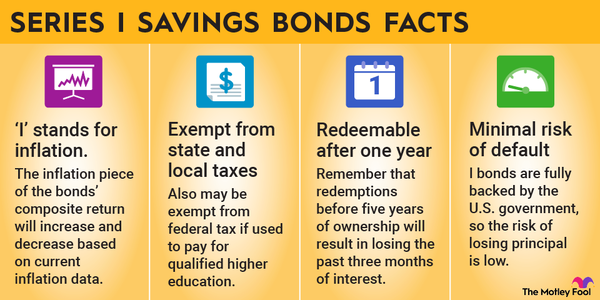

After inflation rose to a 40-year high in 2022, Series I savings bonds -- better known as "I Bonds" -- re-entered the mainstream conversation. As of October 2024, I Bonds pay an annualized rate of 4.28%. Given persistent inflation, they will continue to pay competitive interest for the immediate future.

This article will review where and how to purchase I Bonds and answer a number of frequently asked questions.

How to buy

How to buy Series I bonds

The most common way to buy I Bonds is to visit TreasuryDirect, the government website that allows for the purchase of government securities. You won't need to worry about paying fees or a commission to buy the bonds.

It's possible to buy I Bonds through a payroll savings plan or with your IRS-issued tax refund, but these are much less common methods.

The instructions below describe how to purchase I Bonds for yourself:

- Navigate to the TreasuryDirect website at treasurydirect.gov.

- Click on "Open An Account."

- Fill out an electronic account application. Have key information available, such as your Social Security number.

- Wait for account approval. Some people may be required to authenticate their account by sending in a paper application with a Medallion Guarantee, a stamp that can be obtained at many major financial institutions. If you are required to go through this additional step, expect a delay of several weeks.

- Once your account is approved, log in to your new account.

- Click on "BuyDirect" from one of the tabs on the banner of your screen.

- Under Savings Bonds, choose "Series I."

- Specify the purchase amount and link to a source of funds. Remember that you can only purchase $10,000 of Series I savings bonds per Social Security number per year.

- Complete your purchase.

As interest accrues on your bonds, you'll be able to follow any value changes by simply logging on to your TreasuryDirect account or linking it to a financial account aggregator.

Historical I bond rates

Historical I bond rates

As you'll note from the table below, composite I Bond rates have increased dramatically since before the pandemic. Also of note is that the fixed interest rate component of the composite rate is now 1.3% rather than 0.00% (as it had been for many years).

| Issue Date | Fixed Interest Rate | Semi-annual Inflation Rate | Composite Rate [Fixed Rate + (Semi-annual Inflation Rate x2) + (Fixed Rate x Semi-annual Inflation Rate)] |

|---|---|---|---|

| 05/24-10/24 | 1.30% | 1.48% | 4.28% |

| 11/23-04/24 | 1.30% | 1.97% | 5.27% |

| 05/23 - 10/23 | 0.90% | 1.69% | 4.30% |

| 11/22 - 04/23 | 0.40% | 3.24% | 6.89% |

| 05/22 - 10/22 | 0.00% | 4.81% | 9.62% |

| 11/21 - 04/22 | 0.00% | 3.56% | 7.12% |

| 05/21 - 10/21 | 0.00% | 1.77% | 3.54% |

| 11/20 - 04/21 | 0.00% | 0.84% | 1.68% |

| 05/20 - 10/20 | 0.00% | 0.53% | 1.62% |

| 11/19 - 04/20 | 0.20% | 1.01% | 2.22% |

Related investing topics

The rundown on I Bonds

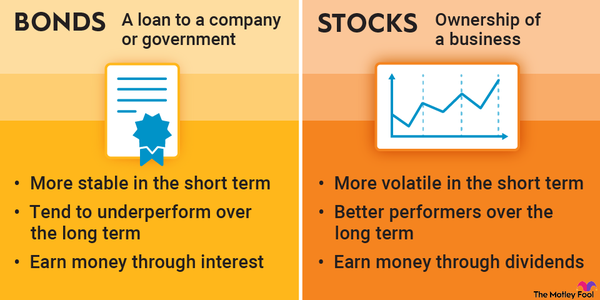

I Bonds can make sense as a side dish to an already-diversified portfolio. They had fallen out of favor in recent decades, but investors flocked to I Bonds in 2022 due to high inflation and a bear market.

Look to I Bonds for stability of principal, reduced risk, and protection from inflation.

FAQ

FAQ on buying I Bonds

Can I buy I Bonds with my tax refund?

Yes. When it comes time to file your annual tax return, and you are due a federal refund, you can fill out IRS Form 8888 to purchase I Bonds in paper form. You can buy as much as $5,000 worth of paper savings bonds with your tax refund, a smaller maximum amount than if you bought them electronically. If you decide later that you'd like to convert your paper I Bonds to an electronic format, you can do this via the TreasuryDirect website.

How do you buy an I Bond for a child?

Since you need to be 18 years old to buy Series I or Series EE bonds, adults will need to buy bonds on behalf of their children if they want their kids to own them. Here's how to buy bonds for a minor child:

- Log in to your TreasuryDirect account.

- Navigate to the ManageDirect tab at the top of the screen.

- Under the "Manage My Linked Accounts" section, click "Establish a Minor Linked Account."

- Enter your minor child's personal information, including their Social Security number.

- Wait for the minor's account to be approved; it may happen instantly.

- Navigate again to the My Account tab.

- Click on the newly created account for your child under "Linked Accounts Information." This functionally changes the account in use to your minor's account.

- Navigate to the BuyDirect tab and choose Series I bonds.

- Indicate the amount you'd like to buy and complete your purchase.

The balance of bonds you buy for your minor child will appear on the My Account tab under "Linked Accounts Information" once the purchase is complete.

How do you buy an I Bond as a gift?

The process is fairly similar to buying a gift for a minor, but it's important to confirm that the gift recipient also has a TreasuryDirect account.

- Navigate to the BuyDirect tab and choose Series I bonds.

- Select the gift recipient's registration from the drop-down list at the top of the page. If you've never created a registration for the recipient, click "Add New Registration."

- When adding a new registration, make sure to indicate that "This is a Gift."

- Return to the purchase page and designate the newly created registration as the savings bond recipient.

- Purchase the desired amount of I Bonds, up to $10,000.

- Complete the purchase and print a gift certificate for your records.

Note that the bonds will be delivered to your "Gift Box," and that you'll need to deliver the bond electronically to the recipient's account. This is a popular method for buying bonds when the recipient is the buyer's spouse.

Can you buy I Bonds in an IRA?

Unfortunately, you can't purchase I Bonds in your individual retirement account (IRA) or in any other tax-advantaged account. You'll need to use any available cash or your tax refund to purchase I Bonds.

Remember that the balance of your I Bond allocation will sit in your TreasuryDirect account. You must hold the bonds for at least a year, and you will lose the last three months' worth of interest if you redeem the bonds before five years have passed since the purchase.

How do you buy paper I Bonds?

The only way to buy paper Series I bonds is with a tax refund.

However, there's no guarantee that you will actually receive a refund since you might end up owing the IRS at tax time. If you have a balance due, you won't be able to purchase paper I bonds.

If you do have a refund, you can buy up to $5,000 worth of paper I Bonds. You don't need to use your entire refund to purchase bonds, but you have the option to do so.

Indicate that you'd like to use some or all of your refund to buy paper bonds on IRS Form 8888. Include the form with your annual tax filing. The bonds should arrive at your address shortly.

How do you buy more than 1,000 I Bonds?

There isn't anything special about the number 1,000 here. If you do want to own 1,000 I Bonds in $25 increments, you'd need to buy them over a span of three years because of the $10,000 purchase limit.

For example, you could buy 400 I Bonds in the first year, 400 in the second year, and 200 in the third year. The point is that you wouldn't be able to buy 1,000 I Bonds all at once.

If you did want to own more I Bonds immediately (albeit indirectly), you might consider any of the following choices:

- Buying bonds for your spouse.

- Buying bonds for your minor child or children.

- Buying bonds for a trust with a separate tax ID.

I Bonds make a great investment for extra cash that you don't want to risk in the stock or bond markets. But you'll be constrained in the number of I Bonds you can buy in any one year.