The list of failed DSPs is getting long: Sizmek. IgnitionOne. Eyeview. Audience Science.

The list of failed DSPs is getting long: Sizmek. IgnitionOne. Eyeview. Audience Science.

Each DSP left unpaid invoices to suppliers they went bankrupt or closed, forcing exchanges to eat the losses or claw back money it already gave to publishers.

Now exchanges are getting tough about getting paid.

Nearly one year post-Sizmek, BidSwitch, TripleLift, PubMatic, OpenX, Sovrn and other companies that work with DSPs have all tightened collection processes to ensure on-time payments and are flagging companies at risk of default.

These tightened processes differentiate them from competitors and ensure the confidence of clients – mostly publishers – at a time when most of the industry operates under a sequential liability clause.

If a DSP sources $100 in ads from an exchange, the exchange would give a publisher its $85 cut and wait another month or two for the DSP to pay up. If the DSP never pays the $100, the exchange can, under sequential liability, require the publisher to give back the $85. Naturally publishers would like more transparency to ensure they don’t ever have to pay back that $85.

“Publishers are starting to ask what demand sources are plugged in and if there’s risk on the other side of exchange,” said OpenX CEO John Gentry.

To protect themselves from DSP defaults, downstream ad tech companies now strictly enforce contracts. They set spend caps and cut off late buyers. Some bought insurance. And communication is key. Finance teams talk to business teams, people’s ears perk up when they hear payment gossip and DSP and SSP finance teams keep close lines of communication.

Here’s how infrastructure vendor BidSwitch and exchanges OpenX, Sovrn, TripleLift and PubMatic have tightened their approaches in the wake of Sizmek’s 2019 bankruptcy, the industry’s largest (and most painful) DSP failure.

Insurance

Worried a company will go under? There’s insurance for that.

TripleLift bought third-party credit risk insurance where available to protect against defaults.

Sovrn is looking into the insurance, CFO Chip Corboy said. OpenX is “deep in the process” of securing credit risk insurance, Gentry said.

But it’s not perfect. PubMatic decided against insurance, because coverage was too spotty. Insurers will only cover a subset of spend, and they generally won’t touch the riskiest buyers.

“It sounds good. We haven’t found it to be a practical solution in reality,” PubMatic CEO Rajeev Goel said.

That’s led to a small but growing market for publisher insurance products that protect against sequential liability.

PubMatic introduced a payment protection plan that charges publishers an additional fee for guaranteed payment even if a DSP shutters. Surprisingly, both large and small publishers have signed on, Goel said. “It’s definitely not the majority of our customers, but we view it as one solution post-Sizmek to make publishers comfortable.”

Cutting off spend

Exchanges worry most about the lag between when they pay publishers and DSPs pay them. Sizmek’s debts, for example, were all recent outstanding and late payments.

Late DSP payments, partial payments or excuses are among the biggest financial red flags for exchanges. One behavior in particular makes the blood run cold for business and finance teams: ghosting.

“The most common thing is people stop communicating when things get rough,” OpenX’s Gentry said. “Someone who goes completely incommunicado is a warning sign.”

To minimize risk, some companies cut off those who pay late.

“To protect the suppliers, as soon as anyone is 10 days late on payments, we pause trading,” BidSwitch GM Barry Adams said. BidSwitch also sets maximum payment terms of 45 days.

TripleLift contacts late payers before cutting off spend.

“When we see stretch payments, meaning the number of days past due based on our risk profile of them, we get in touch immediately with the buyer partners,” TripleLift Chief Strategy Officer Ari Lewine said.

If they don’t have a good reason for being late, “that can escalate into us shutting them off.”

That is a “method of last resort,” Lewine said. Buyers usually pay immediately to resume service, but some never get turned back on because of their payment and credit history.

Assessing risk

Finance teams increasingly build risk profiles of new and existing partners.

During onboarding, they check financial statements and credit history to determine payment ability.

TripleLift requests a CFO-to-CFO meeting to discuss a company’s financial situation and prospects. Most exchange teams communicate regularly with DSP finance teams, so they can assess whether a late payment is due to a partner’s finance team being slammed, someone on vacation or the DSP experiencing cash-flow problems.

Many exchanges, including Sovrn, beefed up risk assessments post-Sizmek. “We looked at our entire credit process and enhanced it to protect publishers,” Sovrn’s Corboy said. “That means digging in and understanding a DSP’s financial situation, from financial statements to payment history to external information about credit-worthiness.”

Enforcing contractual limits

Most exchanges now set monthly spend caps, so that new partners can’t spend $3 million one month and split.

BidSwitch recalibrates spend caps every month, Adams said. Its late payment terms are especially strict because it considers itself more exposed than an exchange given its high volume and low fees. It could connect a DSP to an SSP for a low fee, for example, with a tiny take rate, so it doesn’t want all that cash to be held up.

BidSwitch also learned hard lessons early. AudienceScience spent heavily through BidSwitch, leaving it exposed when the DSP went under in 2017. By the time Sizmek hit, BidSwitch had already put tight controls in place.

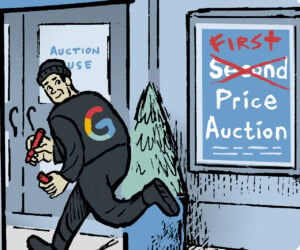

While most exchanges modify contracts to protect themselves and publishers, Google doesn’t accept sequential liability. If a DSP goes bankrupt, the exchange must still pay Google if they transact through open bidding – a riskier path for some exchanges without sequential liability protection.

Industry chatter

Sometimes, exchanges augment financial information with an informal information source: industry chatter.

“We use the entire company to understand potential default situations and create our own internal credit worthiness risk,” TripleLift’s Lewine said. This profile could include information from industry conferences, partner conversations or online message boards.

Not everyone pays attention to gossip. “It’s mostly noise,” PubMatic’s Goel said. It has access to a company’s finance team and income statements – information he sees as far more reliable.

But across the board, most exchanges boosted internal communications. The business side alerts finance about potential issues that could affect a company’s creditworthiness.

Transparency in finance

The supply chain transparency trend is now extending to finance. Some exchanges said they’re exploring giving publishers breakdowns for how much individual DSPs are spending with them and giving them control to turn on or off specific DSPs.

Most seemed optimistic that the scale of Sizmek’s bankruptcy would be the exception, not the rule. Although it is the biggest DSP that had gone under so far, it accounted for a small portion of most exchanges’ demand. “Even when Sizmek went under, it was not a major player,” TripleLift’s Lewine said.

But as consolidation puts pressure on long-tail buyers, exchanges now have processes to minimize their exposure – just in case.