You need to conduct a competitive analysis as a part of your market research. Only then can you develop an effective marketing strategy to steer the ship in the right direction.

Here’s how to do the competitive analysis in 8 simple steps:

- Find your competitors

- Get background information

- Analyze competitors’ products and services

- Get familiar with their targeting and positioning

- Discover competitors’ distribution channels

- Dive into communication strategies

- Do some ghost shopping

- Conduct a SWOT analysis

Follow along for your business with our free competitive analysis template.

A competitor is any company that solves the same problem as you in your target market.

For example, Pepsi and Coke are competitors because they sell the same thing to the same market. However, not every similar business is a direct competitor, which is a common mistake people make.

Take restaurants and cafes, for example. Both of them are places to eat, but they don’t compete with each other. Restaurants are for meals, whereas cafes are for light bites or refreshments. It’s a similar story for freelance vs. enterprise solutions. The products might be similar, but the same solutions don’t appeal to both demographics.

Now that you understand that, your first step is to find 3-5 relevant competitors (anything more would be overkill).

Here are three ways to do it:

a) Look at keyword overlap

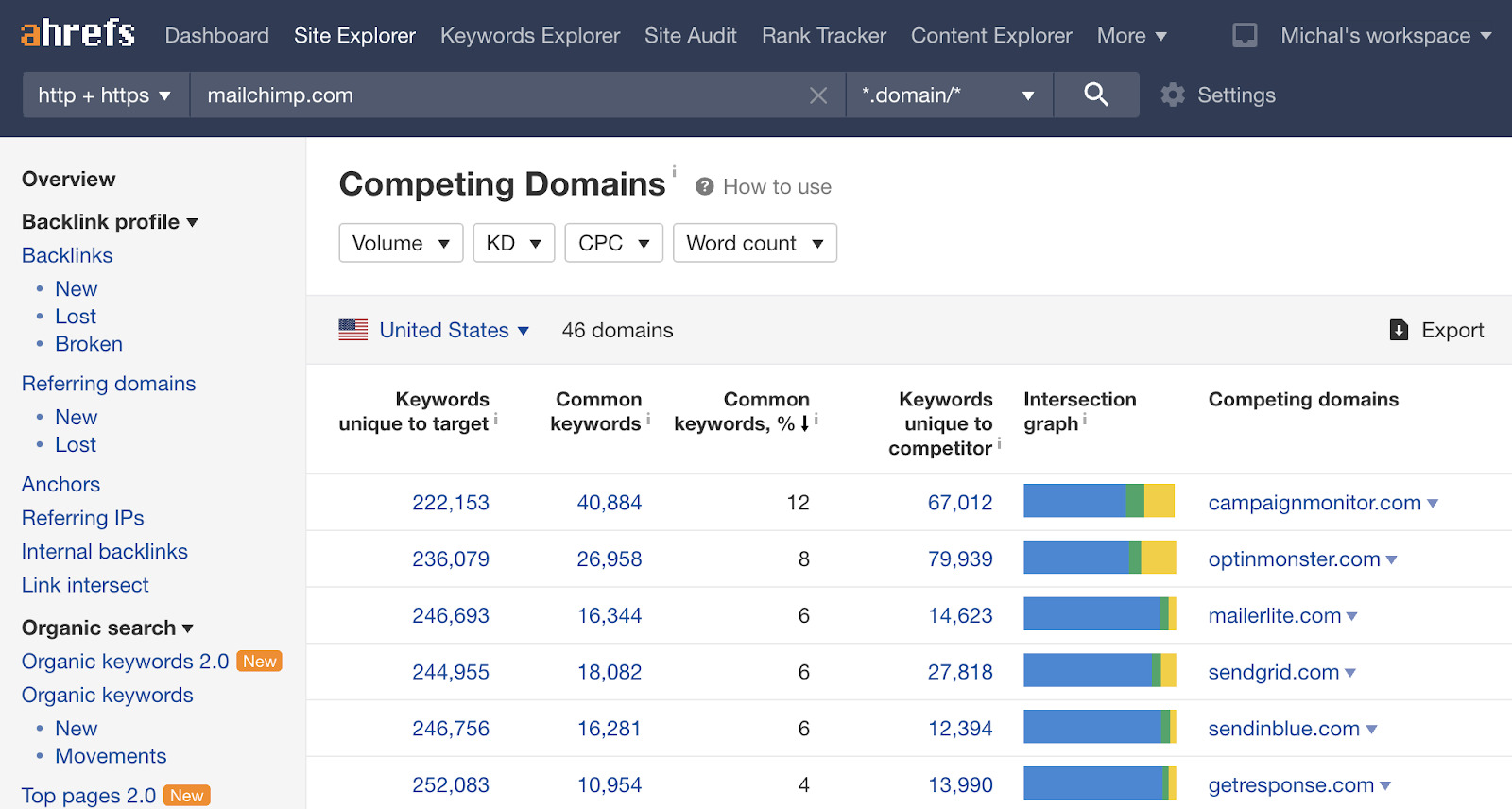

Everyone should know at least one competitor, and you can use that information to find others. Just plug your competitor’s domain into Ahrefs’ Site Explorer and check the Competing Domains report. It shows other websites that rank for many of the same keywords as your known competitor.

For example, if you work for ConvertKit, you might look for sites that compete with MailChimp.

Just keep in mind that not all of those domains will be your business competitors. Some websites might monetize the same traffic with affiliate marketing or ads.

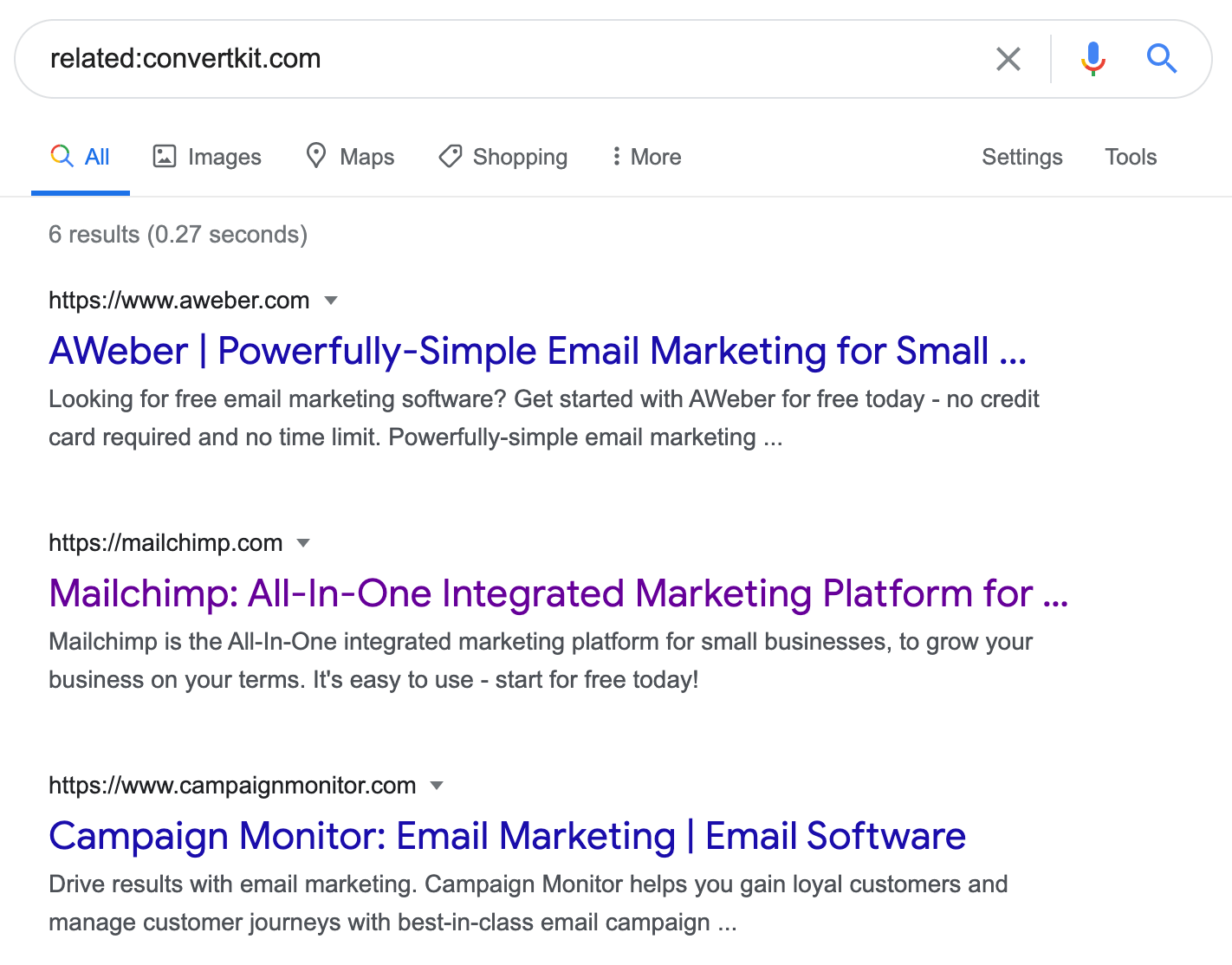

If you don’t use Ahrefs, try searching Google for related:competitor.com.

This search operator finds sites related to a given domain. It works well, but the downside is that it usually only finds a handful of related sites. In this case, MailChimp, Aweber, Campaign Monitor, and three others.

For the rest of this article, I’ll use Mailchimp as an example of a competitor because it’s likely a brand you already know.

b) Look who’s advertising

Looking for businesses that bid on industry keywords can be a little more reliable than looking at organic traffic overlap. That’s because it tends to surface direct competitors rather than blogs or other sites with different business models.

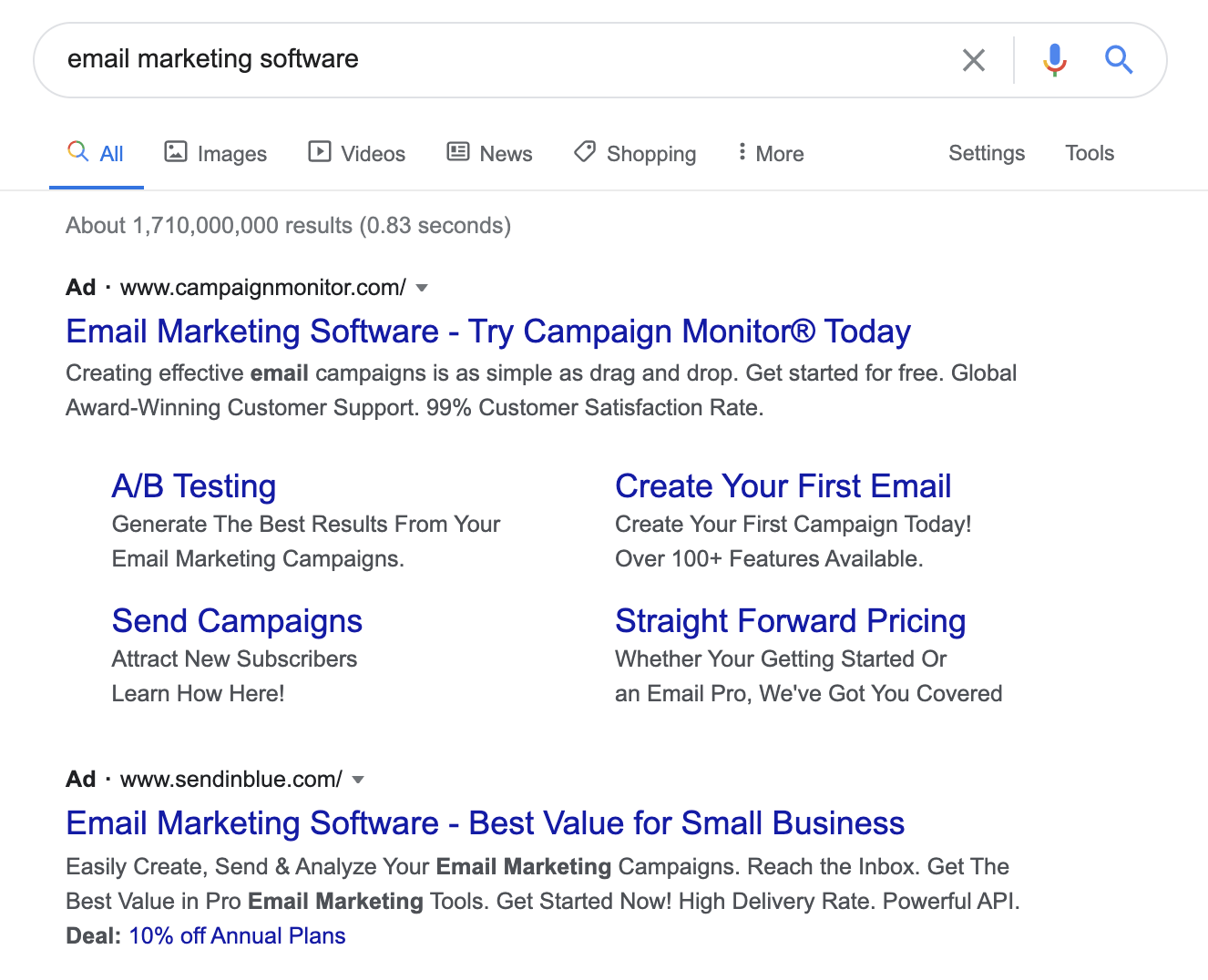

For example, look at the ads for “email marketing software.”

Both of these advertisers are direct competitors to ConvertKit or MailChimp because they sell email marketing software.

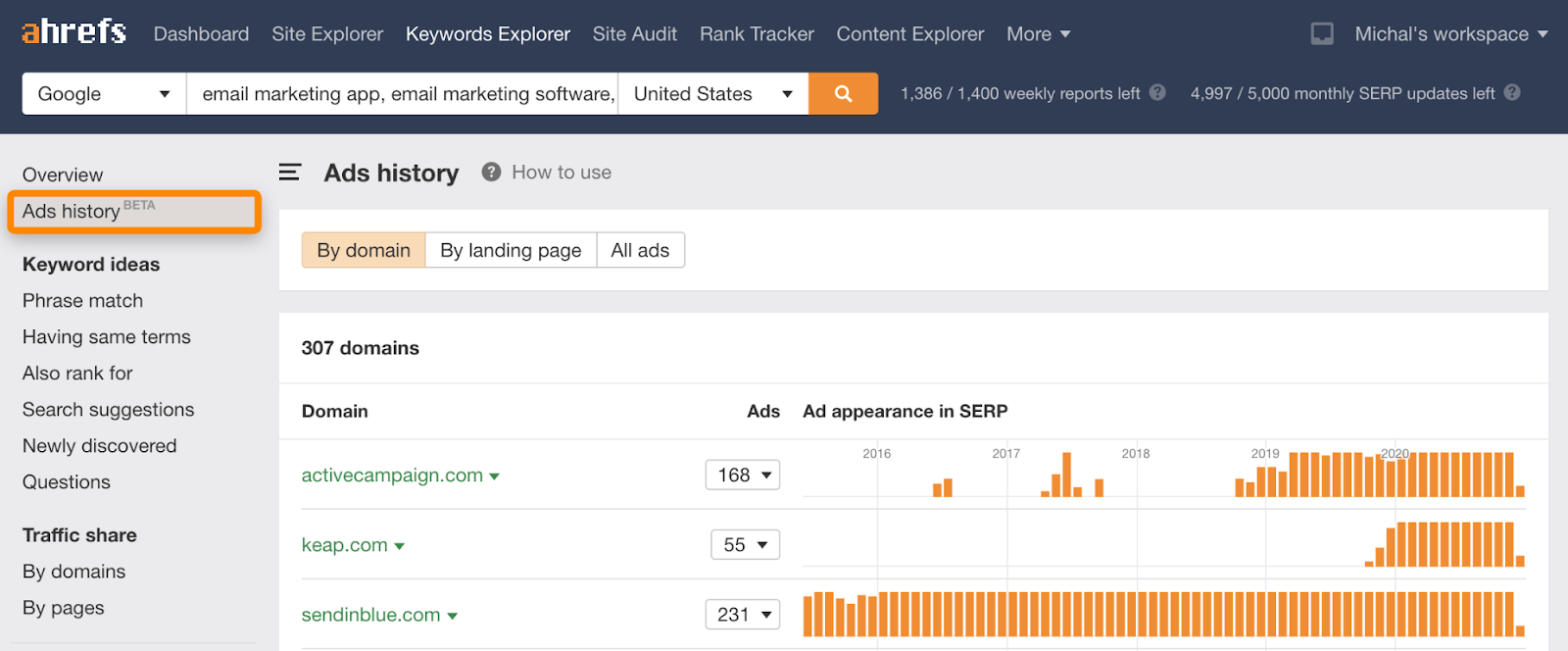

If you want to scale up this approach, use the Ads History report in Ahrefs’ Keywords Explorer to see historical search ads data for relevant keywords. For example, we see that 307 domains have historically paid for ads on keywords like “email marketing app” and “email marketing software.”

c) Look at category listings

Whatever you sell or do, you can bet there’s a website that curates companies that do the same.

Got a software product? Check companies listed in categories on G2 or alternatives.

Own a local business? Check Yelp and its alternatives.

Selling ketchup? There’s a listing for that as well.

This method is fast and straightforward. However, companies listed in a relevant category won’t always be your competitors. You never know how the companies got listed.

Choose 3-5 relevant competitors and add them to the template. You can do this by visiting their websites and making sure that they offer similar products or services to you.

Knowing how a competitor was established and the story behind their growth puts things in context. It’s good to know what you’re up against in terms of size, backing, and finance.

Check for the following data:

- Year founded

- Are there any venture capital investors?

- Which companies did they acquire?

- Number of employees

- Number of customers

- Revenue

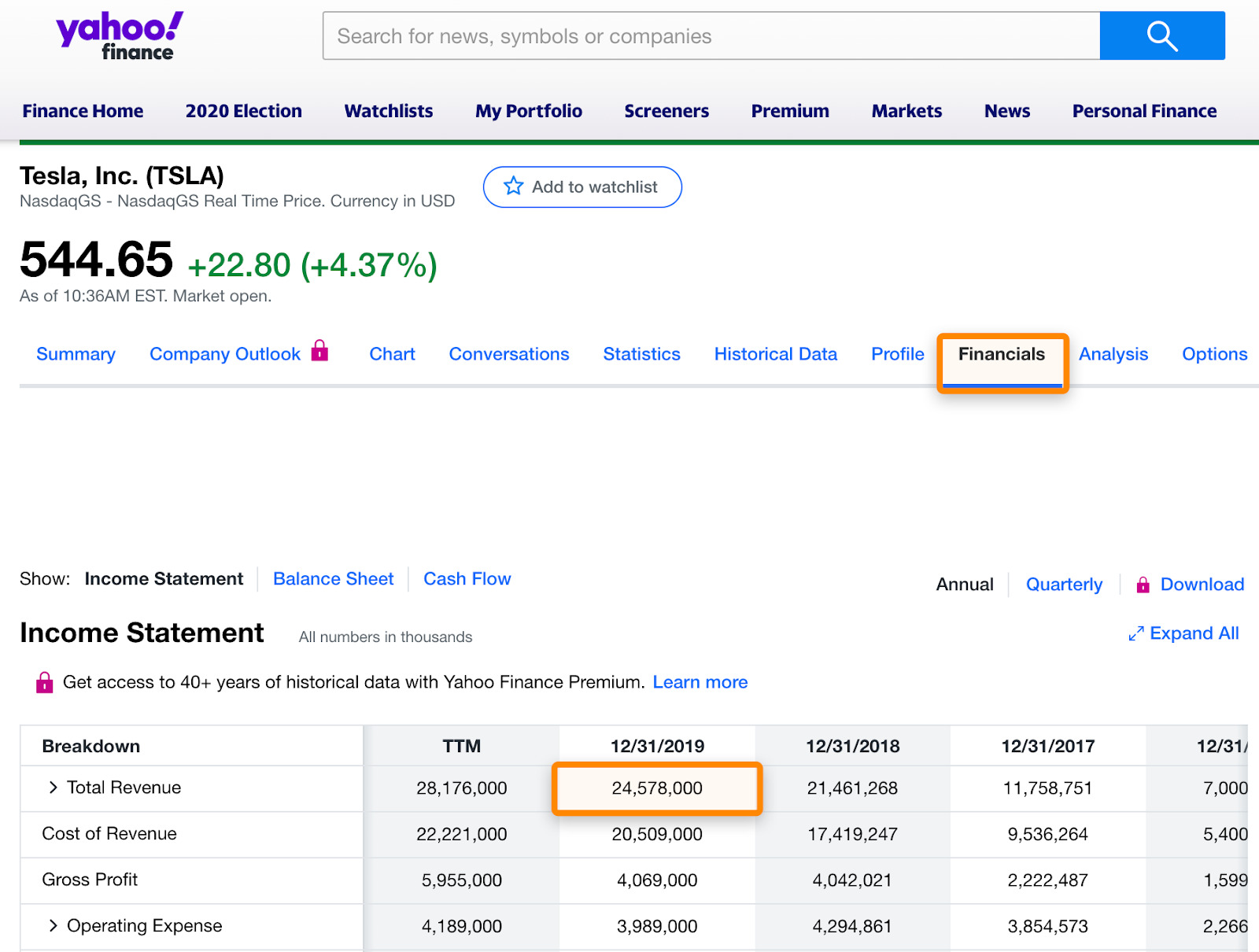

You’ll find answers to the first three data points on company overview websites like Crunchbase or Yahoo Finance. The latter also provides income statements of publicly traded companies where you can find last year’s revenue.

If the competitor is a private company, you can still find the information. Just Google it. C-level interviews often contain information about revenue, along with insights into their strategy, challenges, most valuable segments, and much more.

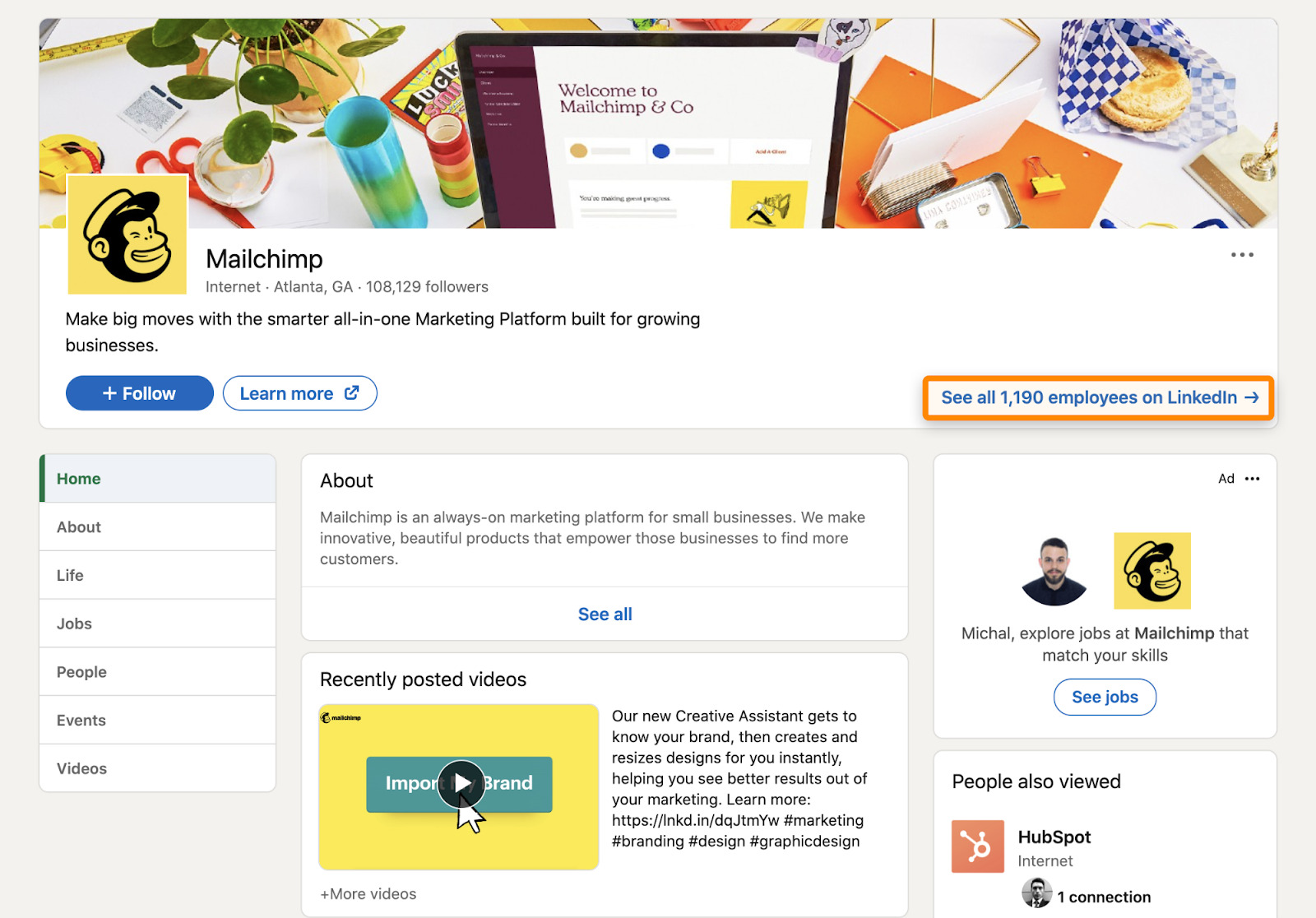

Lastly, you can find the number of people they employ on LinkedIn.

All of this tells you what you’re up against in terms of resources and how much of your target market the competitor owns.

Mailchimp is clearly a long-established industry giant:

| Founded | 2001 |

|---|---|

| VC? | Bootstrapped |

| Acquired companies? | 5 companies (email software, design/template tool, ecom CMS, ecom API platform, business-oriented publisher) |

| # of employees (LinkedIn) | 1,190 |

| # of customers | 1M+ (2019) |

| Revenue | $700M+ (2019) |

But that doesn’t mean you can’t compete with them.

Understanding what your competitors offer and how the market reacts is essential to create a competitive advantage. Of course, this doesn’t mean you should copy anything from them. Your product development should be guided by what the market demands.

This is what you need to know here:

Features and solutions

Try your competitors’ products for yourself and note down their features. There’s no right or wrong way to approach this. Listing all the features and solutions of Mailchimp would take a whole spreadsheet on its own, so it’s better to write down a high-level overview.

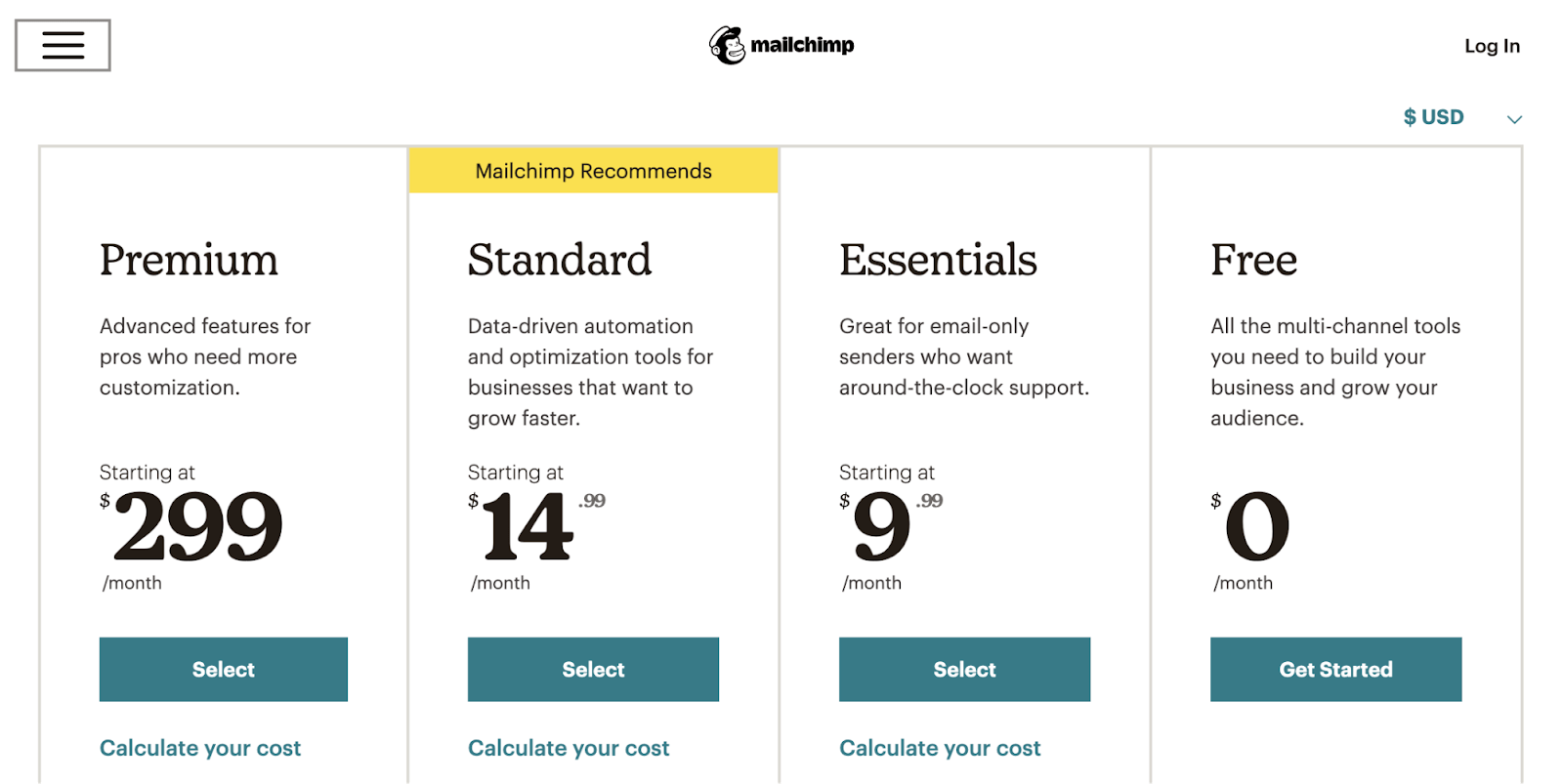

Pricing

In most cases, this will be easy to fill out. See what the products are selling for and note if there are any discounts.

In the case of some B2B niches, you won’t find a public pricing page as they often rely on custom quotes. You’ll have to do some ghost shopping for multiple use cases and ask their current or former customers.

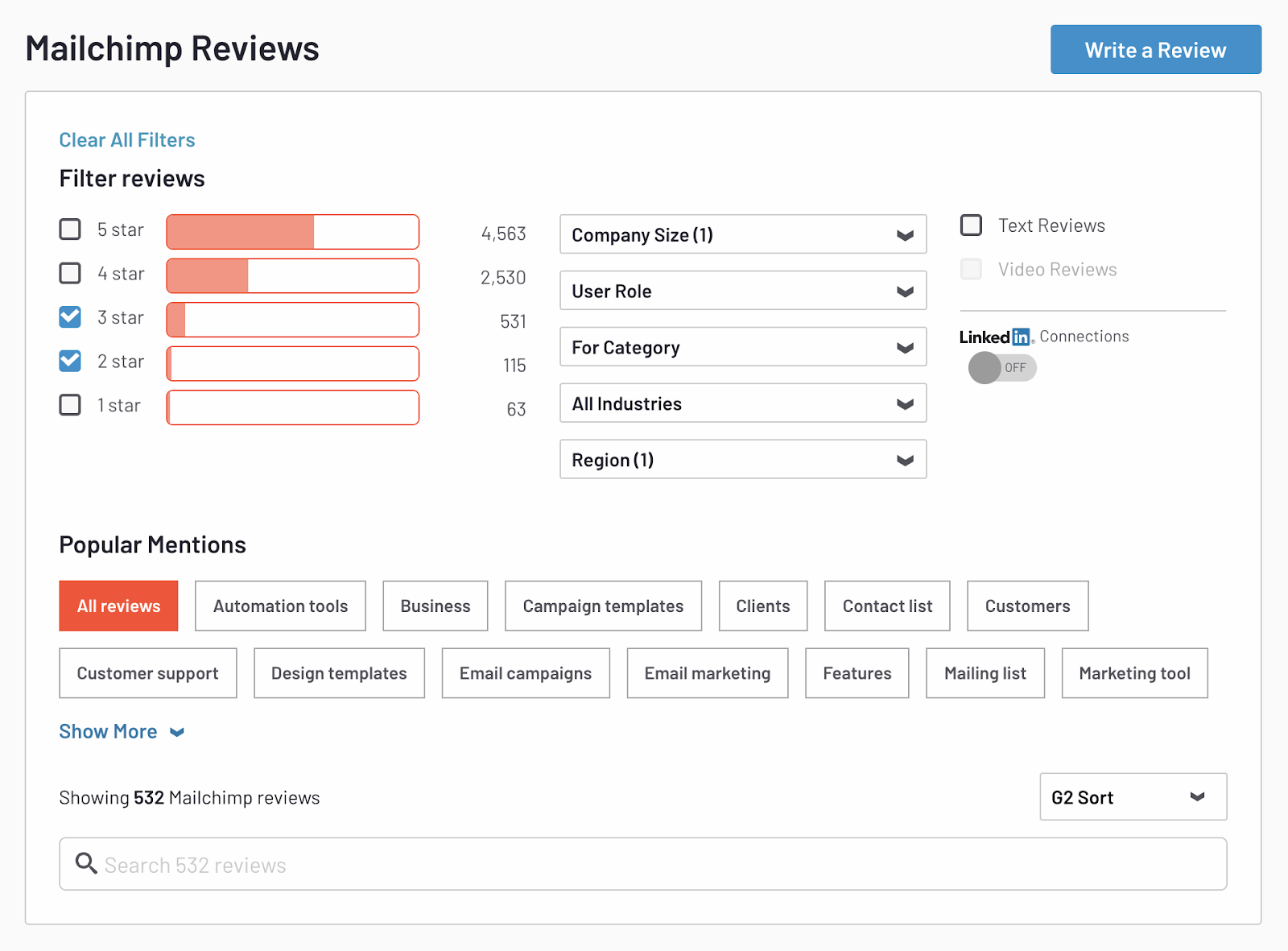

Customer reviews

Being a marketer makes you skeptical about any reviews you read online. Review generation activities are highly biased, but hey, this is also marketing.

For that reason, you’ll want to check reviews that are in the middle. Five-star reviews can often be encouraged by the company, and angry customers mostly write one-star reviews in the heat of the moment. For that reason, it pays to look mainly at 2-4 star reviews for a clearer idea of what people think about your competitors’ product(s) or service(s).

Review platforms offer all sorts of handy filters on top of the review score. This is what the filter options look like on G2:

Strengths and weaknesses

Now that you’ve completed the product overview, it’s time to sum it up. Write down a few strengths and weaknesses based on the product information you’ve gathered so far.

This is what I’ve got for Mailchimp:

| Strengths | It’s likely capable of anything you’d want from such product. |

| Weaknesses | More expensive than alternatives, likely too overwhelming for a beginner. |

Remember the example of cafes vs. restaurants? Even though both sell food and drinks, they don’t compete with one another because their targeting and positioning is different.

This is an important point. You need to know who your competitors are selling to (target segment) and how they want people to perceive their product and brand (positioning). Only then will you be equipped to position yourself to reach and attract the target segment you’re most interested in.

How do you do this?

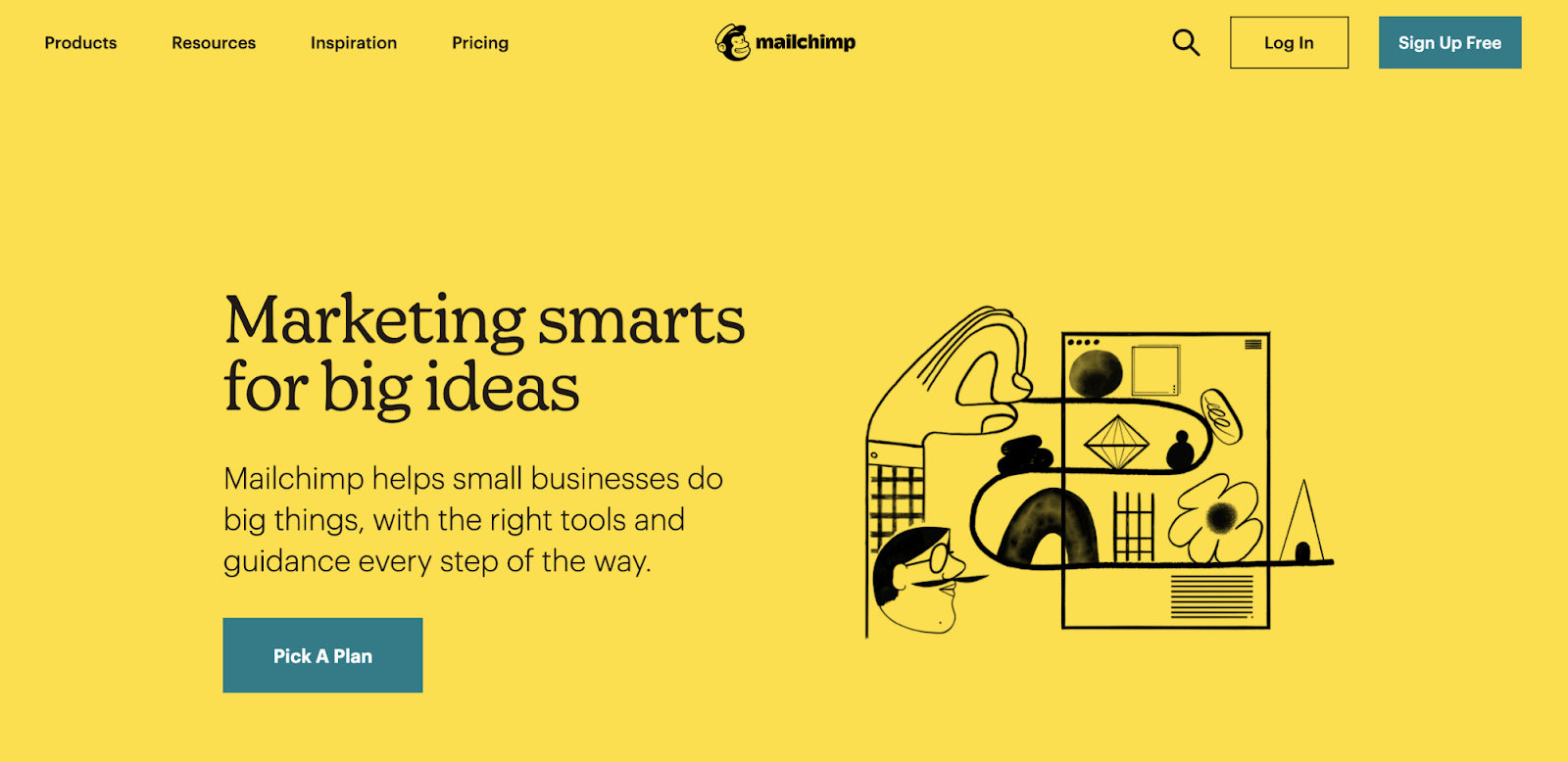

The first stop is your competitor’s homepage:

Just from glancing at MailChimp’s homepage, we know that they provide marketing tools to SMBs. That’s their main segment.

To dig deeper, you can read interviews with their C-suite where they often mention who they cater to. Product and pricing pages can also help, as some companies name their pricing tiers after target segments.

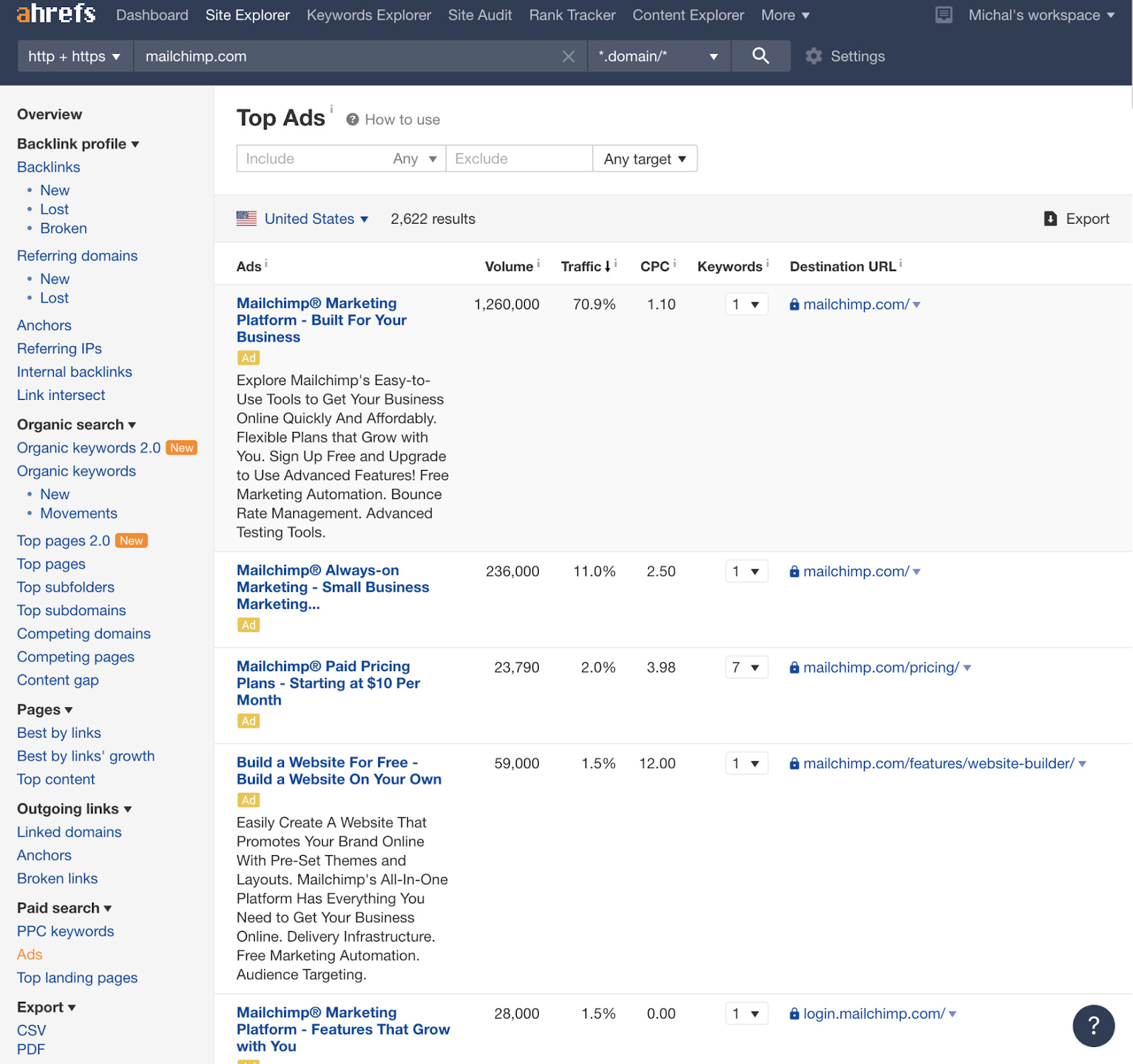

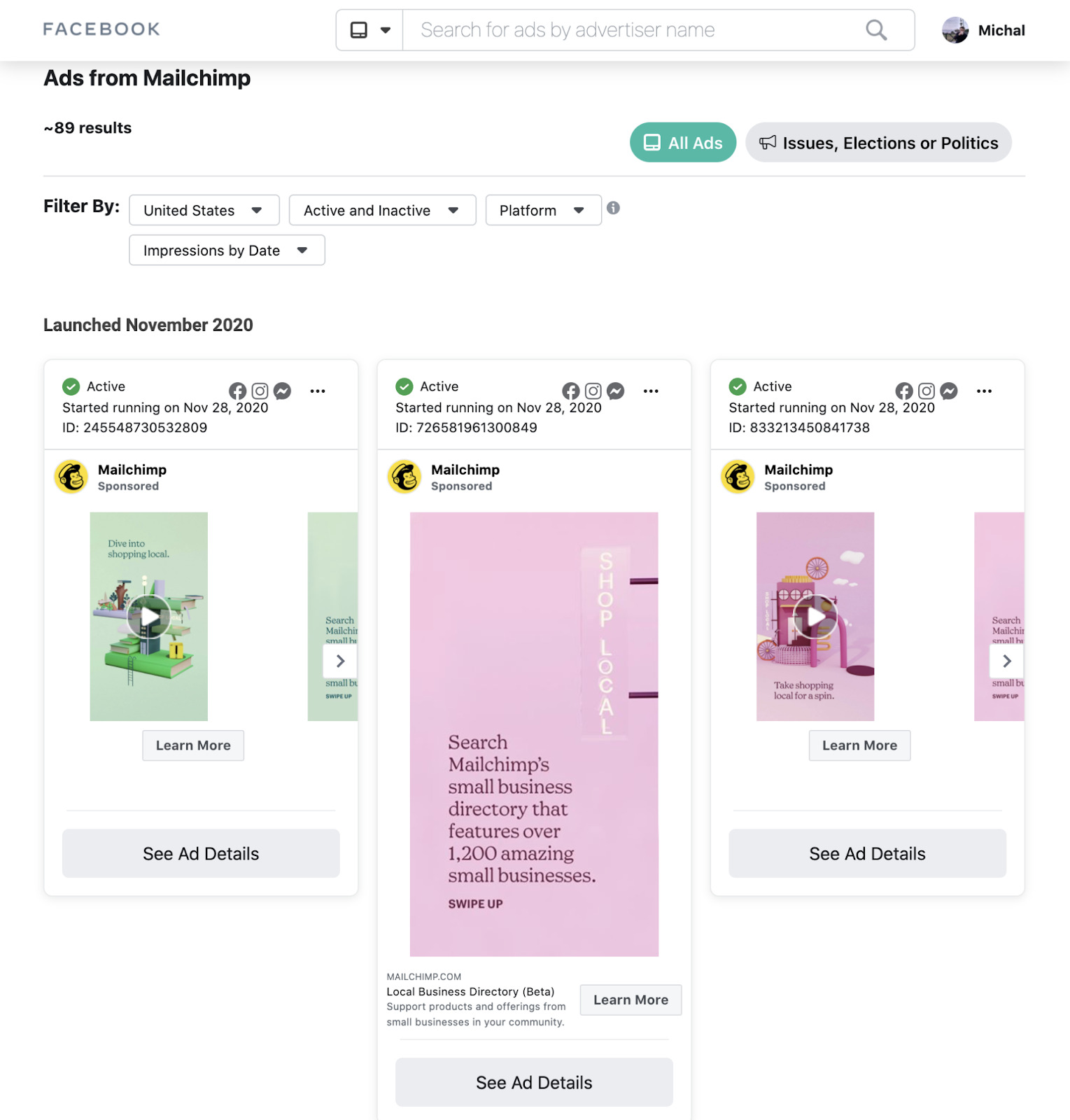

Ads also offer useful insights. They don’t have room for fluff, which makes them a great place to learn about a company’s positioning. To get started, look at their search ads. You can do that by clicking on the Ads report under Paid search tab in Site Explorer.

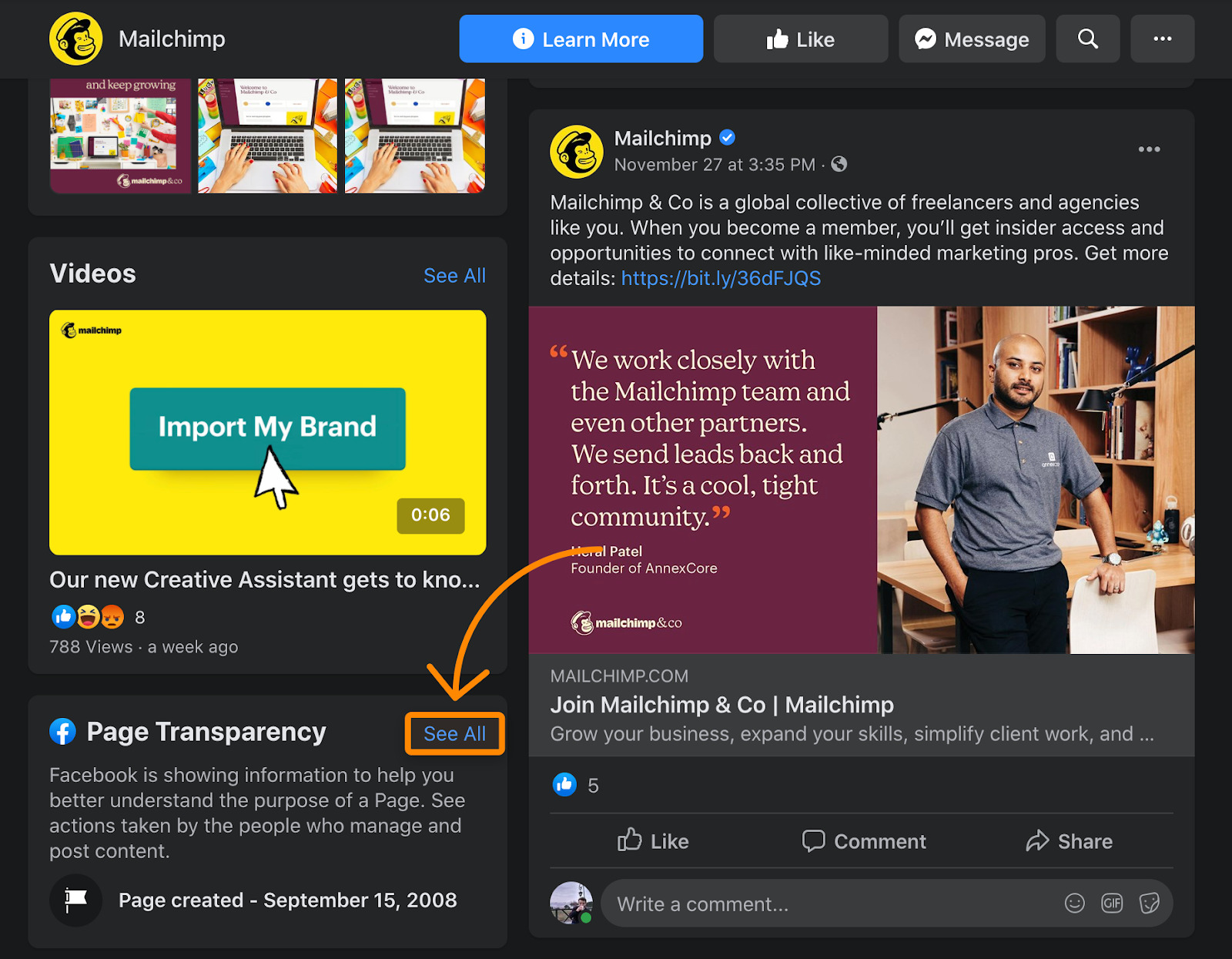

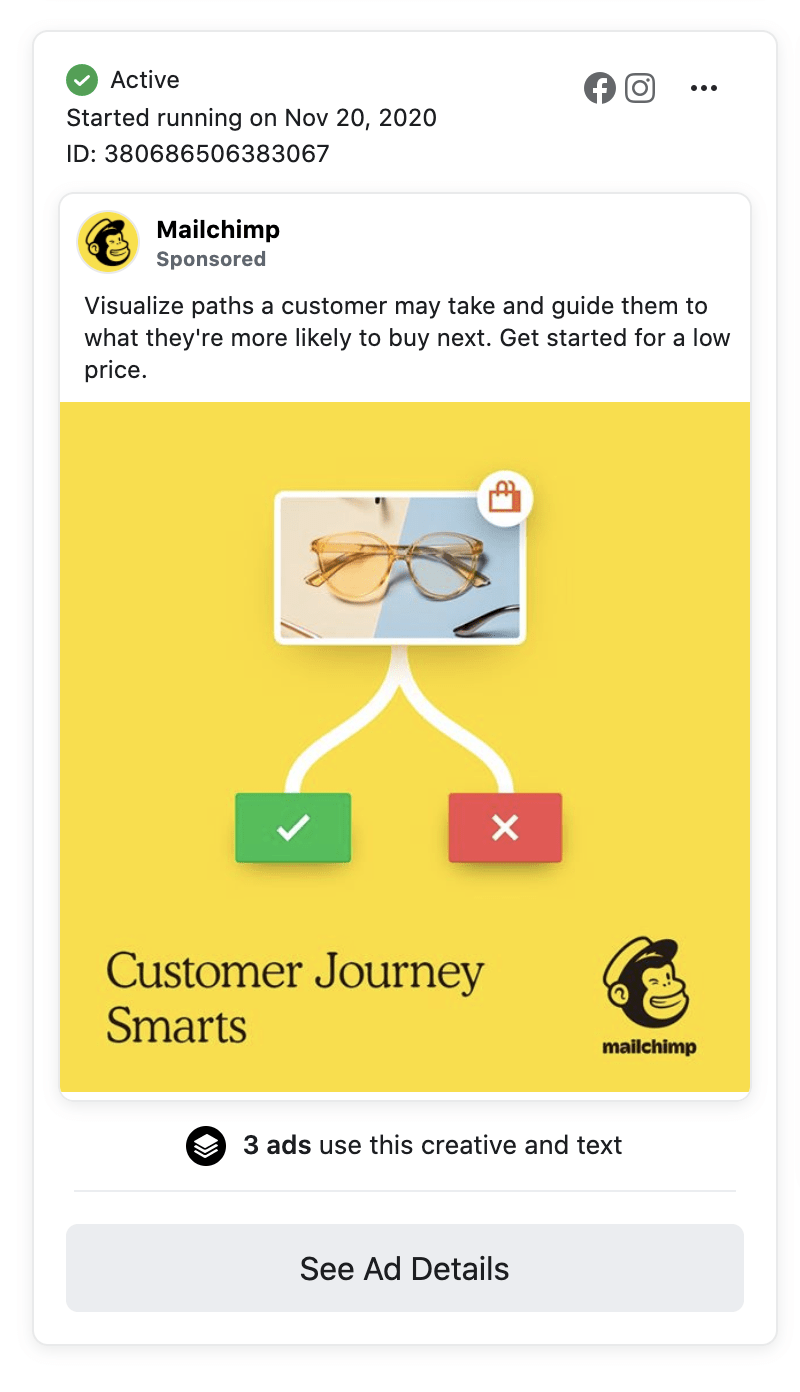

Mass marketing channels like TV ads and billboards are yet another source of insights as their main job is to make the viewer aware of the brand and associate it with certain assets. In the digital world, your second best source is Facebook Ads.

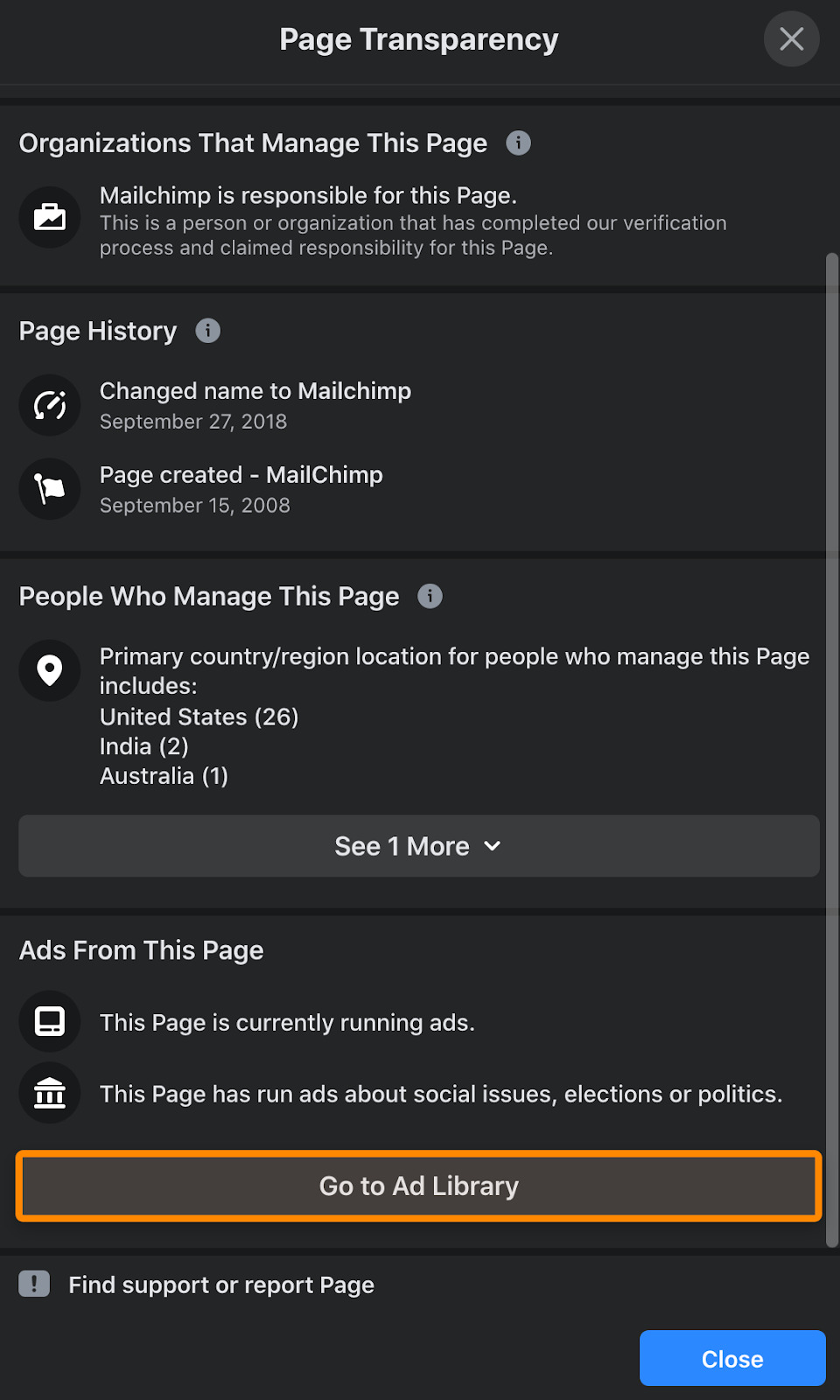

You can see the Facebook ads that any company is running when you visit their page. Just scroll to Page Transparency and click “See All”:

Then click “Go to Ad Library”:

Finally, select a country or apply even more filters to go through their ad variations.

Having gone through the steps above for MailChimp, it’s clear that SMBs are their primary target segment. What’s also interesting is that they’re now positioning themselves as an all-in-one marketing solution—not just an email marketing app. That provides a leverage for my imaginary company.

Distribution is how your competitors are delivering their products or services to customers or clients. It’s the “Place” in the 4 Ps of marketing (marketing mix).

For some companies, distribution is straightforward. Maybe they sell all their products or services direct-to-consumer (DTC) on their website, in retail stores, or door-to-door. This is usually the case with digital products and services.

For others, distribution can be complex. There might be multiple wholesalers and retailers involved, and huge supply chains.

Luckily, there’s no need to go too deep here. You just need a high-level view of how your competitors are distributing their product(s) or service(s) to consumers.

How can you do that?

First, take a look at their websites. Can you buy the product directly from there? If so, they’re a direct-to-consumer (DTC) business. That’s the case for MailChimp.

For some companies, like MailChimp, it’ll be pretty obvious that their website is their only distribution channel. This is the case for most digital products.

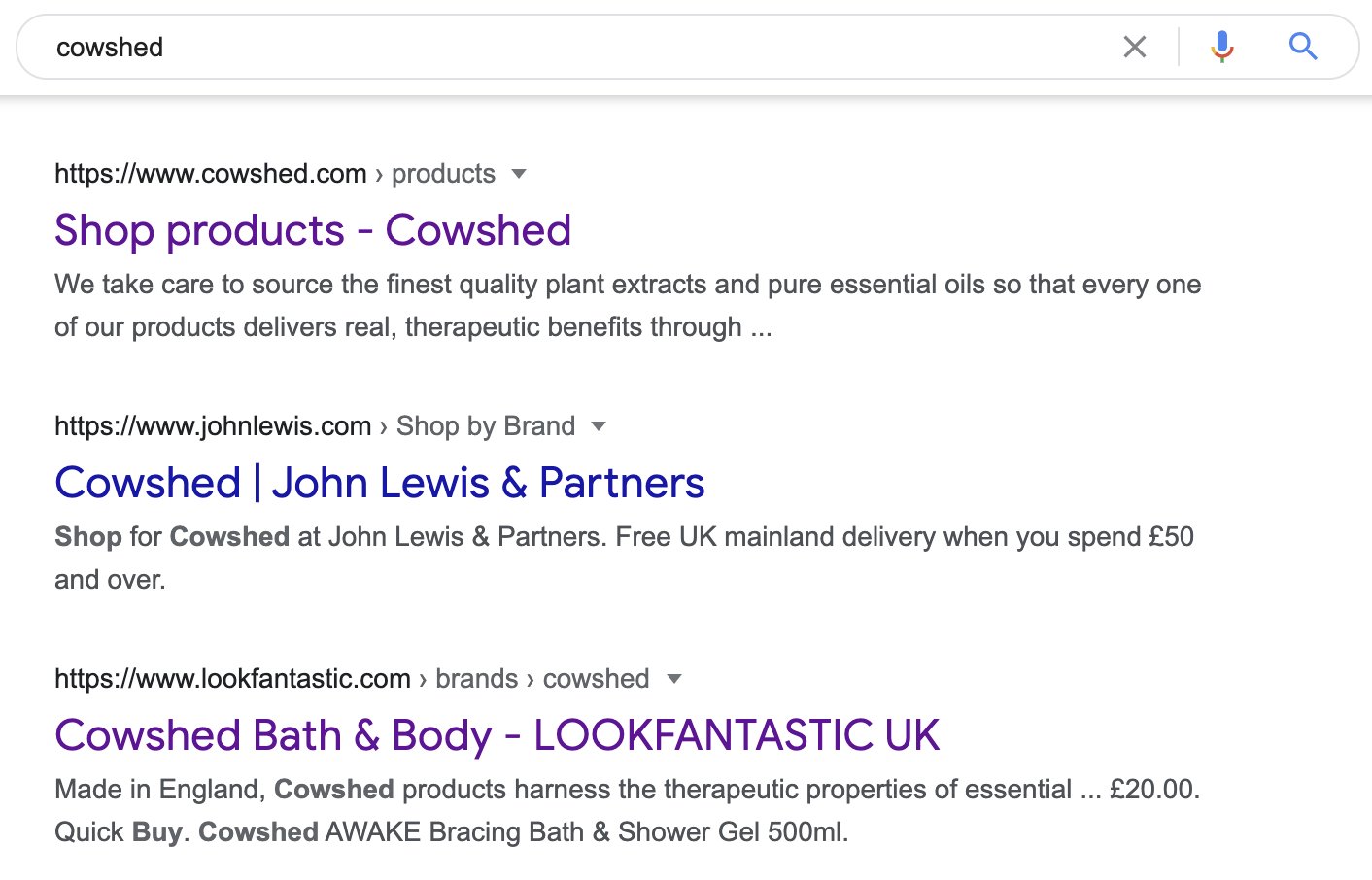

For others, it’s worth running a quick Google search for their product(s) or service(s) to see if you can buy them from other retailers too. This can also tell you more about their positioning and market.

For example, take a cosmetics brand like Cowshed.

It’s clear from the search results that they sell DTC, but you can also get their products from retailers like John Lewis and LookFantastic.com. Not only does that tell you about their distribution, but also their positioning. Both of those are high-end retailers, so it’s clear that they sell premium products.

Your main goal here is to find and list your competitors’ distinctive assets or “brand codes” that people associate with them. These can be:

- Logos

- Brand colors

- Mascots

- Slogans

- Fonts

Or just about anything they use consistently in their communication.

Mailchimp does a great job here. Their logo—a monkey on a yellow background—is quite iconic. The monkey, named Freddie, is also their official mascot and even has its own fanpage. MailChimp consistently uses these distinctive assets in their marketing, as you can see from this Facebook ad:

You win in marketing when people recognize your brand even if you remove your logo. That’s why you should come up with 2-4 distinctive assets on top of your logo.

Our competitive analysis template includes rows to record the channels each competitor dominates and overall communication shortcomings. Unless you’re already in the game, coming up with this information might take a while with a need to use different tools.

Don’t feel pressured to fill out all this information at once, you’ll be updating your competitive analysis with new and better information as time goes on anyway.

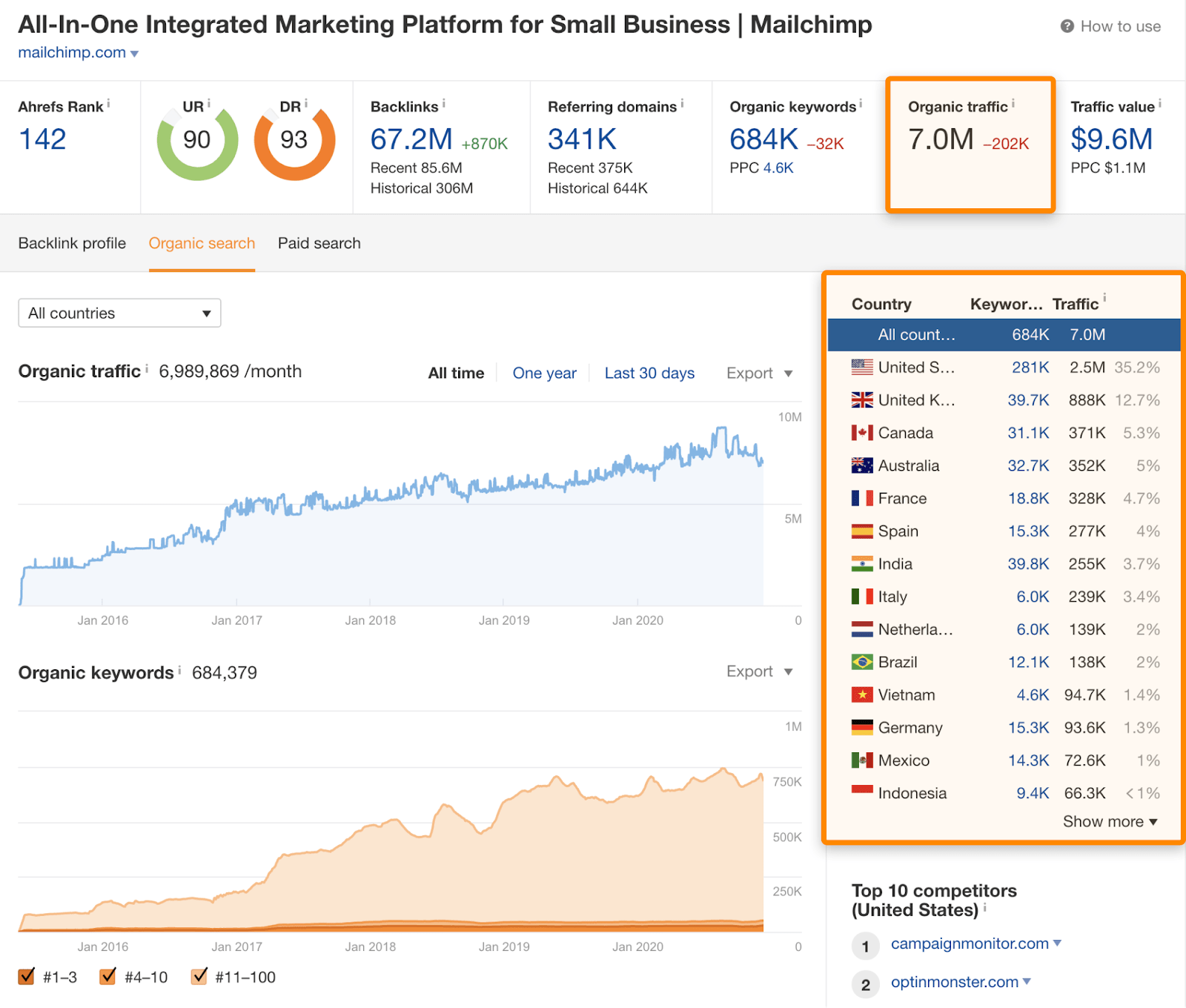

For example, with SEO, you can quickly check your competitors’ estimated organic search traffic in Site Explorer:

But this doesn’t tell the whole story.

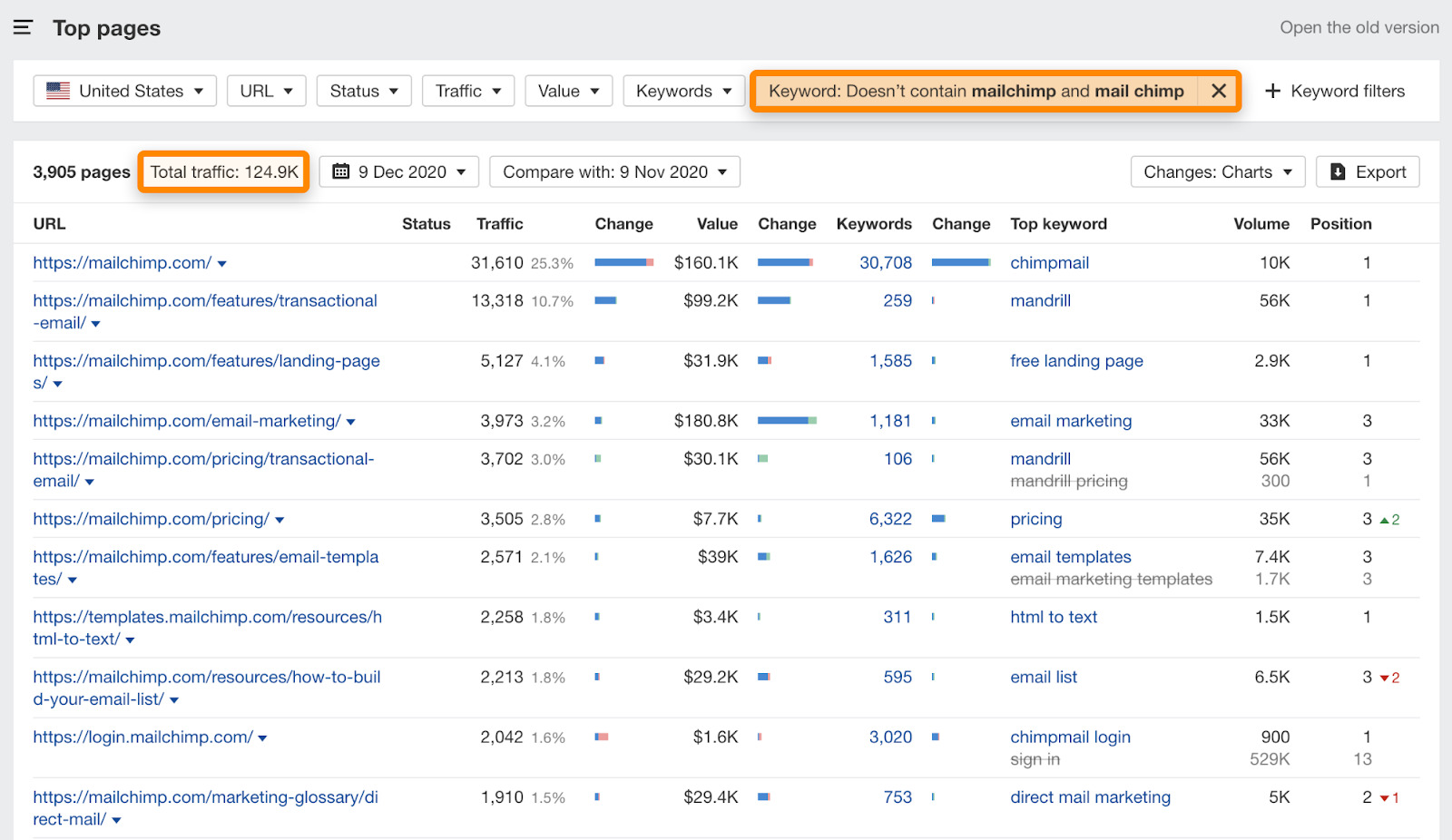

Upon further analysis of Mailchimp’s organic traffic, I came to a conclusion that they have a really strong brand and that the vast majority of their organic traffic comes from branded keywords. If you take a look at the screenshot above, their organic traffic estimation in the US is 2.5M a month. But it drops to 125k a month after excluding most of their branded keywords.

It’s also clear that Mailchimp targets quite a broad audience, so we should only take into account traffic to content that’s relevant to email marketing. The easiest way to do this is with filters in the Top Pages report. For instance, we might choose to exclude traffic from keywords unrelated to email marketing, or include only URLs containing the word ’email.’

However, don’t feel rushed into filling in all this information now. The aim here is to get a high-level view, which means analyzing organic and paid search traffic, organic and paid social media, display ads, YouTube, earned media, newsletters, podcast sponsorships, any form of mass marketing like TV or billboards, and so on.

Your aim here isn’t to create a plan for each and every marketing channel, it’s to use what your competitors are doing to help you set an overall marketing strategy.

If you want to go deeper into the SEO side of things, take a look at our SEO-focused competitive analysis.

The best way to evaluate someone’s product and business is to become their customer. That’s exactly what we’ll be doing here.

Review the whole buying process

Buy their product or service and use it properly. It can mean adding stuff to your online cart, shopping in a brick and mortar store, ordering a service or a combination of everything.

Was the process smooth? Did you encounter any problems or obstacles? Is there something they do especially well?

What are their sales tactics?

Did they try to sell you more products or upgrade to something more expensive? How did they do it? Do they offer discounts? Are they trying to sell you more after you become a customer?

Answers to these questions are invaluable for both marketing and sales teams.

How’s their customer service?

I worked in an industry where having a friendly and knowledgeable live support was a truly unique selling proposition. It contributed to customer satisfaction, retention, and even made undecided prospects convert.

So, come up with a few scenarios and test your competitors’ customer service.

Having used Mailchimp for many years, this is where they have a lot of room for improvement. The support is very limited and sometimes completely unavailable for free tiers, and still rather limited even on paid plans. It’s fair to say that subpar support is the standard with larger organizations.

How’s the onboarding process and customer retention?

This will be irrelevant for some products. If you buy a bottle of ketchup in a store, Heinz isn’t going to contact you to make sure you’re using their product properly, send you recipe ideas, or provide discounts for future purchases.

But it’s important for products like Mailchimp. What does the competitor do to keep customers coming back consistently?

It’s finally time to put all the data together. We’ll conduct an easy SWOT analysis for that. To make sure we’re on the same page, here’s a definition of SWOT analysis:

A SWOT analysis is a strategic overview of your company’s Strengths, Weaknesses, Threats and Opportunities.

Rather than cover tons of theory, let’s keep things simple and take a look at what I came up with for my imaginary email marketing software company:

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Sole focus on email marketing -> simplicity for the end user | Not a well-known brand. | Go after SMBs and bloggers by focusing on what’s important to them when positioning the product. | Going after customers who already use other platforms might be an uphill battle. It takes time getting used to one and they might be tied to using more products at once. |

| Comparable product to competitors for a lower cost. | Considerably lower marketing budget. | Explore the option of increasing email deliverability as one of the features. | |

| Live support available for anyone. | Lacking integrations competitors have. | We have a more flexible team -> opportunity to be the first one on the market to reflect potential upcoming regulatory changes like GDPR. | |

| More personalized communication. | Build great free tools with high search demand. |

To make things even clearer, here’s the formal explanation of what each column should include:

Strengths: advantages of the business or product over competitors

Weaknesses: disadvantages of the business or product relative to competitors

Opportunities: external factors the business can leverage to its advantage

Threats: external factors that can cause problems for the business

A SWOT analysis simply allows you to wrap all the information up in a comprehensible format.

Final thoughts

Competitive analysis is an important component to creating a great marketing strategy. However, it’s not a one-time thing, I’d recommend to come back and refresh it once a year as you, your competitors, and the market evolve over time.

The key is to put your findings into action. Because if you get your market research wrong, it will affect both your marketing strategy and tactics.

Got any questions? Ping me on Twitter.